Illustrative image

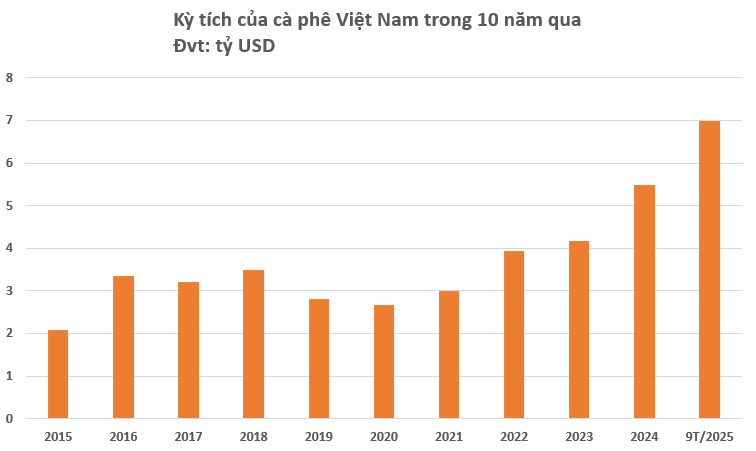

Vietnamese coffee exports are making waves, achieving a record-breaking $8.4 billion in the 2024-2025 season, a 60% surge from the previous year. From January to September 2025, Vietnam exported over 1.2 million tons, earning $7 billion, marking an 11% volume increase and a 62% value rise year-on-year. These figures not only signify a remarkable achievement but also bring joy to local farmers.

Why is Vietnamese Coffee Booming?

Vietnam ranks as the world’s second-largest coffee exporter, following Brazil, contributing 15-18% of global exports. It leads in Robusta coffee supply, competing with Brazil, Indonesia, Colombia, and Honduras. Brazil dominates in volume and variety, while Colombia is renowned for high-quality Arabica.

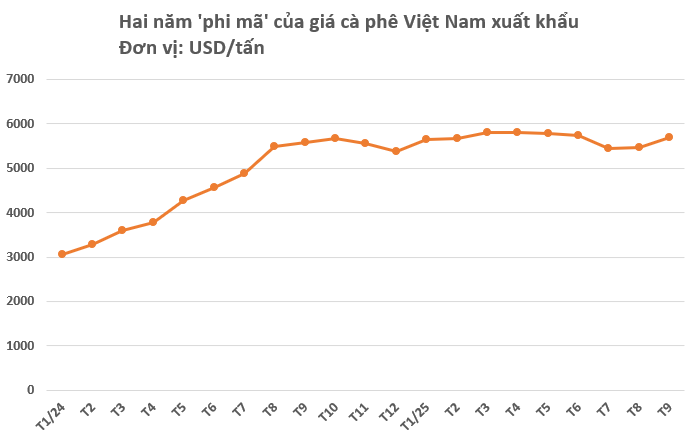

The surge in coffee prices, both domestically and internationally, drives this growth. Prices peaked in March and May 2025, reaching over $5.80/kg domestically and historic highs on global exchanges. Currently, prices stabilize around $5.00/kg, $0.18 higher than the previous season.

The Vietnam Coffee and Cocoa Association (Vicofa) attributes this to global supply constraints due to prolonged droughts in key producing nations like Brazil and Vietnam. Brazilian farmers have sold 85% of their harvest and are holding back further sales. Meanwhile, demand in Europe, the U.S., and Asia is rising significantly.

Over nine months, export prices averaged $5,600/ton, up 45% year-on-year, reflecting Vietnam’s strong global competitiveness amid market volatility.

Extreme weather and unstable trade policies in major producing countries have made Vietnamese Robusta a preferred choice for importers, thanks to its stable supply, competitive pricing, and improving quality.

Beyond Supply and Demand

Vietnam’s 2024-2025 coffee success stems not only from global supply shortages but also from its focus on quality, value, and brand enhancement. Vietnam is emerging as a global coffee processing hub, with major corporations investing in advanced technology. It remains the world’s top Robusta exporter, favored by roasters for blends and instant coffee production.

Vietnamese Arabica is also gaining recognition in specialty markets, rivaling Brazilian varieties. This dual focus allows Vietnam to cater to both mass and premium markets, appealing to diverse international tastes.

Vicofa projects 2025 exports at 1.5 million tons, valued at $8 billion, a historic high. This reinforces Vietnam’s global position and highlights its commitment to quality and brand development.

Vietnam is one of the few major exporters complying with the EU’s Deforestation Regulation (EUDR), expanding access to the world’s largest coffee market. The industry is also shifting toward deep processing, increasing value-added and reducing reliance on raw exports.

How Long Will Prices Rise?

In October 2025, Robusta prices in London rose over 5%, while Arabica in New York saw modest gains. Brazilian Arabica prices fell due to expected high yields, pressuring the market. Vietnam benefits from high global prices and stable domestic production.

With record earnings, deep processing strategies, product diversification, and sustainability commitments, Vietnamese coffee is solidifying its global position, aiming for quality and sustainable growth in the coming years.

Experts predict domestic prices may remain high or adjust slightly until the new harvest. However, a sharp drop in global prices could challenge this trend.

Vietnam’s 2025-2026 coffee output is expected to rise 10%, driven by favorable weather and sustained high prices, encouraging farmers to invest in better yields.

Vietnam’s Exports to Cambodia Surge by Over 300%, Cementing Position as Second-Largest Global Supplier

Vietnam’s nut exports have soared to an all-time high, surpassing the entire year’s target for 2024. This remarkable achievement highlights the country’s growing prominence in the global nut market.