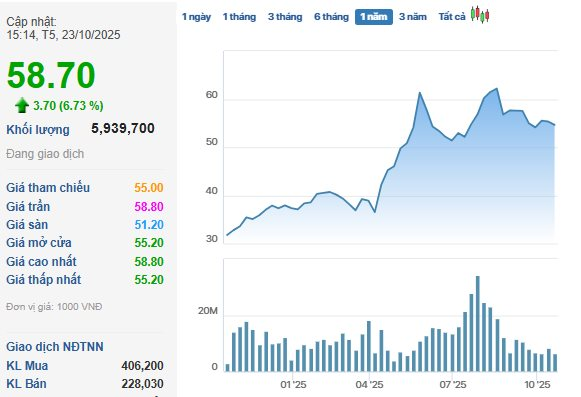

The stock code HAH of Hai An Transport and Stevedoring JSC witnessed a remarkable surge, skyrocketing 6.73% to 58.00 VND per share. Buoyant demand propelled its trading volume to nearly 6 million units on October 23rd, a significant uptick compared to recent averages.

This acceleration followed the announcement of an extraordinary shareholder meeting scheduled for November 12th, 2025. Hai An plans to propose adjustments to its 2025 consolidated revenue and profit targets. The meeting is expected to convene in December 2025.

HAH is renowned for owning Vietnam’s largest container ship fleet, comprising 17 vessels with a total capacity of 28,000 TEU, accounting for 68% of the country’s total container ship capacity. According to Alphaliner, a French maritime services company, HAH ranks among the world’s top 100 container ship operators.

Additionally, HAH owns Hai An Port in northern Vietnam, handling an average of over 300,000 TEU annually. Maritime transport has been the primary growth driver for HAH in recent years, with average revenue growth of around 80% per annum.

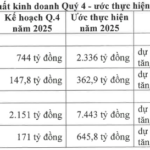

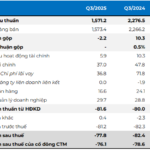

The company has yet to release its Q3 2025 financial results. In the first half of 2025, Hai An reported revenue of 2,443 billion VND, a 48% increase year-on-year, with parent company net profit reaching 595 billion VND, up 248% year-on-year.

For 2025, HAH targets a total operating volume of nearly 1.46 million TEU, a 9% increase from 2024. Ship operations are expected to contribute the most with 689,000 TEU, followed by port operations with 588,000 TEU, and depot operations with 178,000 TEU.

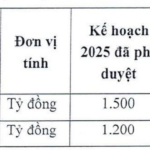

Consequently, HAH has set a 2025 business plan targeting total revenue of 4,556 billion VND and consolidated net profit of 865 billion VND, representing 13% and 8% growth, respectively, compared to 2024. The proposed 2025 dividend is 10% in cash and 10% in shares, totaling approximately 348 billion VND.

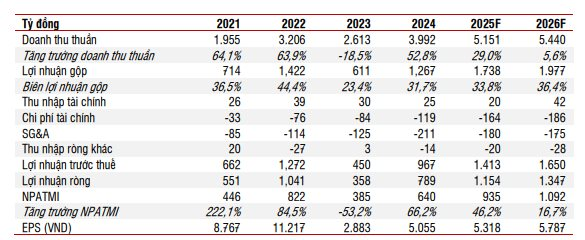

According to VNDirect, HAH’s 2025 performance is expected to remain stable, driven by fleet expansion and favorable charter rates. Most charter contracts are secured until the end of 2025, with some extending into the second half of 2026, ensuring a steady revenue stream. VNDirect anticipates the Haian Mind vessel to renew its contract for 6 months at approximately $32,000 per day.

In port operations and inland transportation, volumes are projected to remain robust, supported by domestic GDP growth. VNDirect maintains its 2025 revenue forecast for HAH at 4,633 billion VND, driven by fleet expansion plans and improved profit margins due to favorable charter rates. Net profit is expected to reach 887 billion VND, a 27% increase year-on-year.

SSI Research also highlights HAH’s advantageous position to capitalize on high feeder vessel charter rates amid a market shortage. The company’s fleet is projected to double to approximately 57,600 TEU through acquisitions and joint ventures with VSC, directly addressing the regional feeder vessel scarcity.

HAH maintains a balanced strategy between self-operated vessels and chartering to major shipping lines, ensuring operational efficiency and revenue optimization. Furthermore, recent bond conversions have enhanced the company’s financial health, reducing leverage and increasing capital allocation flexibility. Total CAPEX remains focused on port and fleet expansion projects, strengthening long-term operational capacity and scale.

SSI forecasts HAH’s 2025 net revenue at 5,151 billion VND (+29% year-on-year) and net profit at 1,154 billion VND (+46.2%), driven by stable charter demand and fleet expansion.

For 2026, revenue is estimated at 5,440 billion VND (+5.6%), with net profit reaching 1,347 billion VND (+16.7%). While profit margins may slightly decline as feeder vessel charter rates normalize, they are expected to remain above historical averages.

Phú Tài Aims to Surpass 2025 Profit Target by Over 35%

The Board of Directors of Phu Tai Corporation (HOSE: PTB) has approved the estimated consolidated business results for the first nine months of 2025, reporting a revenue of VND 5,292 billion and pre-tax profit of nearly VND 475 billion. This represents a 15% increase in revenue and a 36% surge in pre-tax profit compared to the same period last year.

Hải An Logistics to Issue Nearly 2.5 Million ESOP Shares

Hải An Port Services (HAH) is set to launch an ambitious Employee Stock Ownership Plan (ESOP), offering approximately 2.5 million shares to its employees at a price of 10,000 VND per share. This represents an astonishing 81% discount compared to the current market price of HAH shares, providing employees with a unique opportunity to invest in the company’s future at an exceptionally favorable rate.

Surprising Common Ground: Two Brokerages Double Their 2025 Profit Targets

Several brokerage firms have unveiled ambitious plans for the second half of 2025, signaling a shift towards more aggressive growth strategies.

The Masterplan for Sun Group’s Luxurious Urban Development in Hanoi: Unveiling a Visionary 200-Hectare Project with a Massive 15,000 Billion VND Investment.

The exclusive Me Linh Urban Area is conveniently located next to the Ring Road 4 and just 8 km from Noi Bai International Airport. What sets this development apart is its dedication to green spaces and cultural attractions, with 65% of the land allocated for stunning landscapes, a state-of-the-art exhibition center, and a unique flower museum.