A New Milestone for Vietnam’s Stock Market

A New Milestone for Vietnam’s Stock Market

On October 23, in Hanoi, the Vietnam Stock Journalists Club hosted the October Stock Dialogue with the theme “New Money, New Stocks, and Opportunities in Emerging Markets.”

Speaking at the event, Mr. Bui Hoang Hai – Vice Chairman of the State Securities Commission (SSC) emphasized: FTSE Russell’s official upgrade of Vietnam’s stock market to the “secondary emerging” group marks a significant milestone in the 25-year development journey of Vietnam’s stock market.

Mr. Bui Hoang Hai added that following this milestone, the regulatory body and market participants will continue to implement various solutions to enhance the stock market’s contribution to economic growth.

Mr. Bui Hoang Hai – Vice Chairman of the State Securities Commission (SSC) speaking at the event – Photo: VGP/HT

According to Mr. Hai, the Ministry of Finance and SSC have prepared synchronized measures on both the supply and demand sides to maximize the advantages of Vietnam’s upgrade. Following the announcement, many investors, including both active and passive funds, who previously had not focused on Vietnam, have begun to explore the market in depth. Numerous organizations managing capital ranging from hundreds to thousands of billions of VND have shown significant interest in the domestic market.

On the demand side, the regulatory body will continue to improve the investment environment, facilitating foreign investors’ participation in the market. Notable solutions include bilingual information disclosure, ensuring equal access for domestic and foreign investors, and the eventual abolition of the “prefunding” mechanism to minimize exchange rate risks for foreign investors.

On the supply side, the Ministry of Finance and SSC will promote product diversification in the market, including the issuance of Decree 155/2025/NĐ-CP linking IPOs with stock listings to enhance transparency and the scale of public companies.

“One important direction is to encourage foreign-invested enterprises (FIEs) to list on the stock exchange. To date, we have received consensus from relevant ministries and agencies. This is a positive signal, opening up the possibility for FIEs to IPO and list in Vietnam in the near future,” the SSC leader stated.

According to Mr. Bui Hoang Hai, the market upgrade presents a significant opportunity for Vietnam to attract capital from both active and passive investment funds. Many investors who previously had not focused on the Vietnamese market are now proactively engaging with the SSC, including organizations managing hundreds of billions of USD.

Although the upgrade was announced less than two weeks ago, positive signals from foreign capital have begun to emerge. The SSC is actively developing a roadmap to improve institutions, technology, products, and information transparency to maximize the benefits of the upgrade.

Enhancing Market Quality with Multiple Solutions

To effectively leverage the opportunities from the upgrade, the Ministry of Finance and SSC have been implementing a series of solutions on both the supply and demand sides.

Specifically, the SSC continues to facilitate foreign investors by requiring bilingual (English-Vietnamese) information disclosure, ensuring equal access, and eliminating the prefunding requirement, thereby reducing exchange rate risks for investors before transactions.

On the supply side, the Ministry of Finance has issued Decree 245/2025/NĐ-CP amending and supplementing Decree 155/2020/NĐ-CP on the implementation of the Securities Law, linking IPOs with listings to promote greater transparency among public companies.

“Currently, the listing of FIEs on the market has been agreed upon by relevant ministries and agencies, opening up prospects for attracting high-quality products,” the SSC Vice Chairman added.

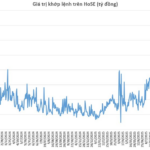

From an infrastructure perspective, Ms. Nguyen Thi Viet Ha – Acting Chairman of the Ho Chi Minh City Stock Exchange (HOSE) emphasized: The upgrade is both an opportunity and a challenge, as it demands higher standards for technology and product quality.

Therefore, HOSE is urgently upgrading its information technology systems and standardizing listing criteria to attract more large, high-tech enterprises to the market.

Mr. Nguyen Anh Phong – Chairman of the Hanoi Stock Exchange (HNX) sharing insights – Photo: VGP/HT

Sharing the same view, Mr. Nguyen Anh Phong – Chairman of the Hanoi Stock Exchange (HNX) noted that HNX is collaborating with the State Treasury to develop technological infrastructure for the bond market, supporting the government in mobilizing resources for economic development. Additionally, HNX will improve the yield curve to reflect market realities, providing investors with a reliable reference tool.

Furthermore, HNX recently launched the VN100 Futures Contract, offering investors additional risk hedging options. Soon, the exchange plans to submit a stock index options product to the SSC, aligning with the development of derivatives from simple to complex, to enhance liquidity and attract more international capital.

“The bond and derivatives markets are expanding their development space, providing investors with more choices and tools to protect their portfolios,” the HNX Chairman observed.

Balancing Capital Sources – A Pillar for Economic Growth

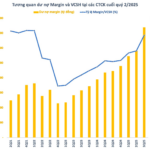

Analyzing the macroeconomy, Dr. Can Van Luc – Chief Economist at BIDV and Member of the National Financial and Monetary Policy Advisory Council highlighted: As of the end of September 2025, the total credit in the economy exceeds deposits by approximately 2 million billion VND. Over seven months, credit grew by 19%, while deposits increased by only 15.5%, indicating significant pressure on banks’ capital sources.

According to Mr. Can Van Luc, the banking system currently accounts for about 50% of the total capital supplied to the economy, while the stock market (equities and bonds) contributes only 14%, creating a significant imbalance. This underscores the need to develop the capital market, aiming to increase its share to 25–27% to reduce the burden on bank credit.

Dr. Can Van Luc – Chief Economist at BIDV, proposing solutions – Photo: VGP/HT

Vietnam’s economic growth target of over 10%/year by 2030 requires an estimated annual investment of approximately 270 billion USD. Given the limited domestic capital, the stock market is seen as an effective mobilization channel, helping to share the burden with the banking system.

The expert also proposed expanding investment funds, particularly open-ended funds, and promoting green investment products. Issuing green bonds for both the government and enterprises will be a necessary step to align with global sustainability trends.

“FTSE Russell’s upgrade is not only good news for the securities industry but also a positive signal for Vietnam’s economy. A developed capital market will reduce pressure on bank credit, diversify mobilization channels, and enhance resilience to global fluctuations,” said Dr. Can Van Luc.

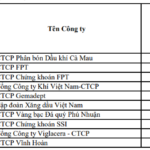

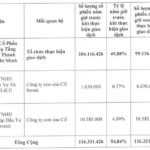

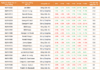

MSN Tops ETF Buy List in Q4 Rally

According to SSI Research, during the Q4/2025 portfolio rebalancing, Masan (HOSE: MSN) is forecasted to rank among the Top 3 stocks with the strongest net buying by ETFs. Additionally, it is expected to enter the Top 10 of the STOXX Vietnam Total Market Liquid Index, a benchmark widely replicated by international investment funds.