Wall Street Securities has announced plans to divest its entire stake of over 2.14 million shares in HAF, representing 14.76% of the company’s charter capital, between October 29 and November 27. Following the transaction, WSS will reduce its ownership to 0% and cease to be a shareholder of HAF. A related individual, Mr. Nguyễn Viết Thắng, serves as a member of HAF‘s Supervisory Board and as Deputy General Director of WSS, though he holds no shares in HAF.

Investment currently at a 22% loss

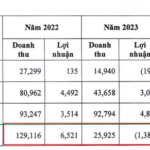

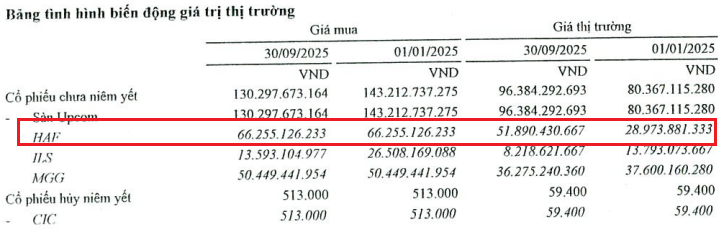

According to the Q3/2025 financial report, as of September 30, 2025, WSS‘s investment in HAF had an original value of nearly VND 66.3 billion, while its market value stood at approximately VND 52 billion, resulting in a temporary loss of about 22%. Compared to the beginning of the year, the market value of this investment has improved by 79%, indicating that the current loss is significantly lower than in early 2025.

Wall Street Securities’ investment in HAF as of Q3/2025 shows a 22% temporary loss

|

However, based on HAF‘s closing price of VND 22,800 per share on October 24, the divestment by WSS is expected to be valued at around VND 49 billion, approximately 26% lower than the original investment value at the end of Q3/2025.

On the UPCoM market, HAF shares have seen a downward trend over the past week, dropping nearly 10%. Nevertheless, over the past year, the stock has surged by nearly 73%, despite low liquidity, averaging less than 1,000 shares per session. Since mid-July 2025, HAF had peaked above VND 28,000 per share, its highest level in nearly two years, before correcting nearly 20% to its current price range.

| Price movement of HAF shares over the past year |

Additionally, HAF remains under warning since April 2024 due to the auditor’s qualified opinion for three consecutive years, based on the 2023 audited financial report. As of June 30, 2025, the company reported accumulated losses of nearly VND 91 billion, continuing a five-year losing streak from 2020 to 2024, with an additional net loss of VND 4 billion in the first half of 2025.

| Business results of HAF from 2019 to 1H2025 |

– 09:26 25/10/2025

Unveiling the Mystery: VNPT Offers Debt-Free Enterprise at 60% Premium to Market Value

VNPT has announced a public auction of TTN shares at a price significantly higher than the current market value. This move comes amidst VNTT’s robust six-month business performance and its strategic dominance within the Becamex ecosystem.

Construction Firm Poised for 230% Profit Surge After Securing $1.1 Billion in Contracts

With a projected surge in financial profits, Vietcap forecasts VCG’s after-tax profit to reach VND 3,700 billion in 2025, marking a remarkable 236% growth compared to the same period last year.