Tien Phong Securities Corporation (Stock Code: TPS) recently announced the Board of Directors’ Resolution detailing the allocation of funds raised from a private placement of shares.

According to the private placement plan and the fund utilization strategy approved by the Annual General Meeting of Shareholders in February 2025, the proceeds from this issuance are expected to reach nearly VND 3,600 billion. These funds will be allocated to enhance the company’s capital for various business operations.

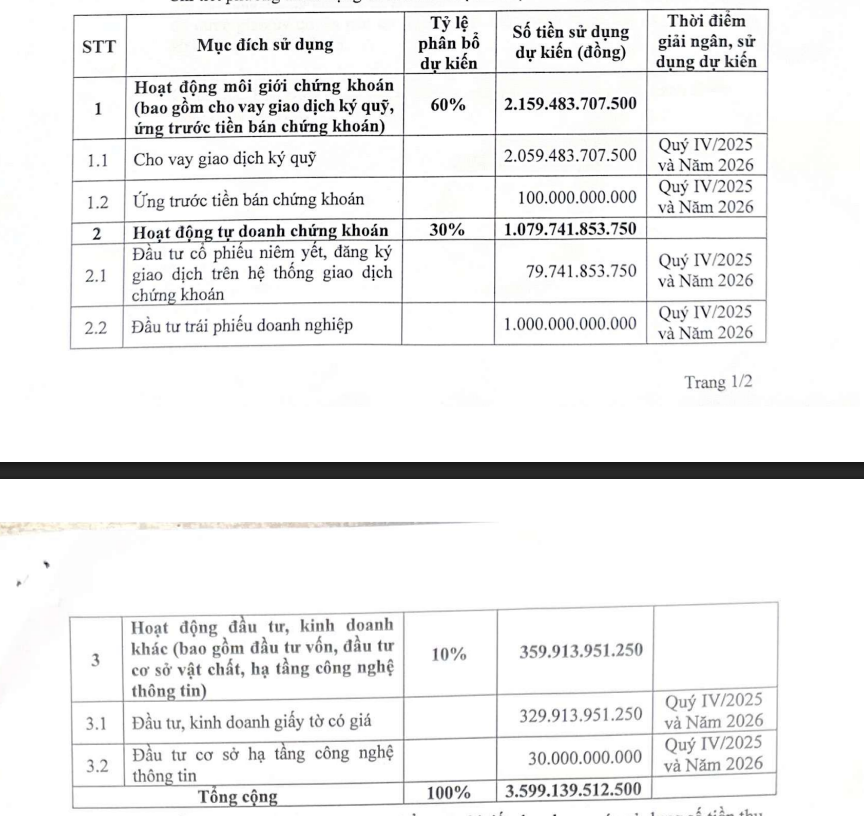

Specifically, TPS plans to allocate 60% of the funds (approximately VND 2,159 billion) to securities brokerage activities, 30% (nearly VND 1,080 billion) to proprietary trading, and the remaining 10% (approximately VND 360 billion) to other investment and business activities.

The detailed allocation of funds from the share issuance is as follows:

Source: TPS

In related news, Tien Phong Commercial Joint Stock Bank (TPBank, Stock Code: TPB) has received approval from the State Bank of Vietnam (SBV) to acquire shares in TPS, making it a subsidiary of TPBank. The maximum investment amount is over VND 3,599 billion, equivalent to a 51% stake in TPS. This decision was approved by TPBank’s Annual General Meeting of Shareholders in Resolution No. 02/2025/NQ-TPB on September 11, 2025, and further endorsed by the Board of Directors in Resolutions No. 44/2025/NQ-TPB.HĐQT on September 15, 2025, and No. 47/2025/NQ-TPB.HĐQT on October 13, 2025.

As per the previously announced private placement resolution, TPS will issue 287.9 million shares to TPBank, the sole investor, at a price of VND 12,500 per share, aiming to raise nearly VND 3,600 billion.

Upon completion of the issuance, Tien Phong Securities will increase its outstanding shares from approximately 334 million to 623.93 million, raising its charter capital to VND 6,239.3 billion.

Concurrently, TPBank’s ownership in TPS will rise from 30.2 million shares (9.01% of charter capital) to 318.2 million shares, representing a 51% stake in TPS.

Central Bank Injects Massive VND Liquidity into Banking System, Nearly 1/4 in 91-Day Term

Previously, OMO tenders primarily focused on maturities ranging from 7 to 28 days, meaning the SBV’s liquidity support to the banking system was short-term (under one month). However, with the 91-day tenor, these loans will not mature until late January 2026.