Limited access to international brokers, insufficient English disclosures, and the absence of a central counterparty clearing house (CCP) are significant barriers that could hinder Vietnam from attracting the foreign capital its market eagerly anticipates.

“Beyond the top 30 stocks, it’s challenging to invest $50 million in a single equity. The market lacks the necessary depth,” noted Pon Van Compernolle of Maybank Securities Thailand.

Vietnam’s stock market currently lists around 1,600 stocks, but the majority of market capitalization is concentrated in traditional “old economy” sectors like finance and real estate. Outside the leading stocks, large investment funds struggle to find diverse opportunities.

“Liquidity is the biggest issue… you can only buy bank stocks in large volumes,” Compernolle added. He currently oversees the establishment of Maybank’s private equity fund focused on ASEAN equities.

In contrast, he pointed out that in Thailand, funds can allocate capital across 100 to 150 different stocks. Compernolle previously managed the RVC Emerging Asia Fund at Ross & Van Compernolle, focusing on listed ASEAN equities.

Lack of non-financial IPOs

Vietnam has also seen few new listings since the COVID-19 pandemic. Recent IPOs have primarily come from securities companies, limiting portfolio diversification opportunities.

“I hope to see more non-financial companies go public in Vietnam,” shared David Xu, Chief Investment Officer at Aumento Capital Management. The Hong Kong-based fund manager has allocated 10% of its $100 million assets under management to Vietnam.

Xu also emphasized that limited English disclosures are a major hurdle for increased investment. MSCI, a leading index provider and FTSE Russell competitor, has long cited insufficient English transparency as a key reason Vietnam remains classified as a Frontier Market.

“The top 50 listed companies typically have English-speaking management and professional investor relations teams, enabling effective market communication. Beyond this group, significant improvement is needed,” Xu observed.

He also noted the scarcity of foreign brokerages in Vietnam, complicating communication with local brokers and companies. This situation creates challenges for foreign institutional investors conducting research.

Market access barriers to overcome

FTSE has also highlighted the limited access of global brokers to Vietnam’s market. The index provider stated that upgrading Vietnam to Secondary Emerging Market status (effective September 2026) remains contingent on an interim review in March 2026 “to assess whether sufficient progress has been made in facilitating global broker access.”

Vietnam has established a framework allowing foreign investors to trade through brokers acting as settlement guarantors. This measure provides a short-term non-prefunding solution, eliminating the previous requirement for foreign investors to deposit funds before placing orders.

“This model is temporarily suitable for the current scale of foreign participation,” Compernolle commented. “But to increase the scale tenfold, Vietnam needs standards adopted by developed markets.”

An internationally compliant central counterparty clearing system (CCP) – crucial for the non-prefunding mechanism’s efficiency and safety – may not be operational until early 2027.

This timeline was outlined in a decree and roadmap released by the Vietnamese government in September, aimed at enhancing stock market accessibility through key reforms. These include raising foreign ownership limits, modernizing payment and clearing systems, simplifying IPO processes, and ensuring fair treatment for foreign investors.

Domestic investors – a safety net for the market

The silver lining is Vietnam’s robust domestic investor base. Market liquidity is primarily driven by local retail investors, accounting for 80 to 90% of total trading value.

Christina McGuire, founder and CIO of London-based Elephant Asset Management, views this as a significant strength, though she encourages greater participation from domestic institutions.

In contrast, foreign investors in the Philippines typically account for 30 to 40% of total trading value. McGuire believes high foreign participation negatively impacts market stability.

“High foreign ownership always carries risks. As seen in other ASEAN markets, when foreign investors withdraw without domestic support, markets face severe challenges,” she stressed.

The Philippine stock index has fallen over 7.6% year-to-date, with net foreign outflows exceeding $700 million. Similarly, Thailand’s SET index has dropped around 7%, with net foreign selling surpassing $3 billion, according to Bloomberg data.

Despite foreign investors net-selling over $4 billion in Vietnamese equities during the same period – one of Asia’s largest outflows – the VN-Index has shown remarkable resilience, rising approximately 30% year-to-date, leading ASEAN in performance.

“Liquidity in a market of Vietnam’s size is critical. Without it, you risk losing everything,” McGuire emphasized.

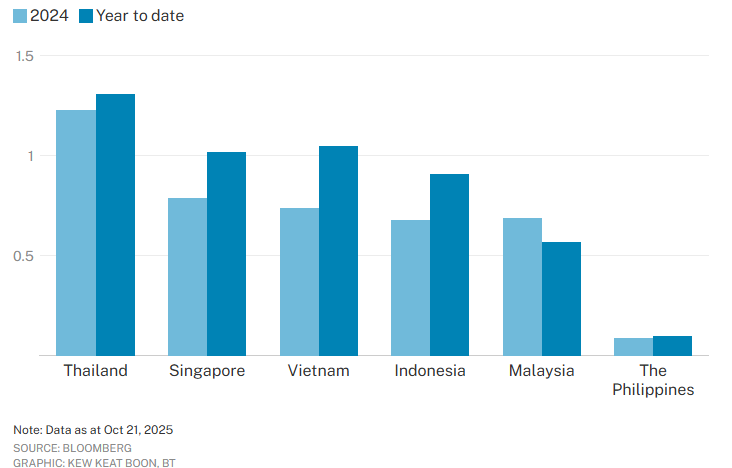

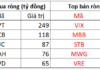

Thailand, classified by FTSE as an Advanced Emerging Market, maintains an average daily trading value of around $1.3 billion year-to-date, leading Southeast Asia. Vietnam follows closely with over $1 billion, on par with advanced markets like Singapore, and outperforming emerging markets such as Indonesia and Malaysia.

Meanwhile, the Philippine stock market remains smaller and less liquid compared to other ASEAN-6 economies, with average daily trading value of just around $100 million.

Vietnamese equities among ASEAN’s most actively traded

Average daily trading value by market (in billions USD)

When will global capital flow in?

Dang Thanh Tung, Director of Business Operations at Dragon Capital, predicts Vietnam’s weight in FTSE’s Emerging Market indices could range from 0.3% to 0.5%. This would attract at least $500 million to $600 million in passive inflows.

Additionally, active fund inflows are expected to range from $2.5 billion to $7.5 billion, with some potentially arriving before Vietnam’s official upgrade in 2026.

“Given Vietnam’s compelling growth story, many active investors may allocate a higher weight to Vietnam than FTSE’s assigned weight,” Tung noted. “They may see this as an undervalued opportunity, potentially pushing active inflows toward the higher end of the forecast range.”

Some funds have already begun exploring opportunities in Vietnam. From October 13 to 16, Elephant Asset Management, with $300 million in AUM, and Aumento Capital Management were among 20 global fund managers – representing over $1 trillion in total assets – participating in a fact-finding trip to Vietnam. Organized by Maybank Securities Vietnam, the trip aimed to connect investors with local companies following the market upgrade announcement.

However, fund managers stated they would only buy when valuations and risk-return profiles of specific companies are truly attractive.

“Currently, market conditions are slightly unfavorable for Vietnam due to relatively high valuations compared to the region. However, this will self-correct over time,” McGuire observed.

Compernolle agreed, noting that all positive news in recent years has been priced into stocks, with the VN-Index reaching record highs in mid-October. This has led to relatively high valuations and caution among foreign investors.

After a prolonged rally, the VN-Index plunged 5.47% on Monday (October 20), marking the second-largest percentage drop this year. Notably, foreign investors turned net buyers the following day, purchasing around $92 million in stocks on October 21 – the largest single-day net buying this year.

Compernolle views the FTSE upgrade as a significant signal to the international investment community that Vietnam has genuinely opened its capital market and business environment. “We will now monitor how quickly Vietnam achieves its next goal: an MSCI upgrade to Emerging Market status,” he concluded.

Vu Hao (According to Business Times)

– 15:16 24/10/2025

Record-Breaking Brokerage Revenue in Vietnam’s Securities Sector, Yet Several Firms Face Four-Year Decline

As the market expands, most brokerage firms have capitalized on the opportunity to boost their brokerage revenue. However, some have yet to secure their share of this growing pie.

Top Global Funds with Trillions in Assets Eye Vietnamese Stock Market Post-Upgrade

Following the announcement of Vietnam’s market upgrade, there has been a significant surge in interest from both passive and active fund investors who previously had not focused on the country. Many are now actively seeking to explore opportunities within the Vietnamese market.