The benchmark index significantly narrowed its decline towards the end of the session, with buying interest emerging around the 1,660-point level. VIC remained the primary driver supporting the market, contributing 3.5 points. VIC rose 1.9% to 219,000 VND per share. FPT, VNM, VPL, LPB, and GVR further bolstered the recovery momentum. However, the upward range and influence were limited, insufficient to reverse the main index trend.

Banking and securities stocks universally adjusted, with red dominating the board.

The primary pressure on the VN-Index came from banking and securities stocks. TCB, MBB, VCB, along with VIX and SSI, were among the most negatively traded tickers. SSI dropped 4%, while VIX fell close to the floor price of 6.5%, both being the most actively traded stocks today. SSI led in liquidity with over 2,974 billion VND.

Real estate stocks also faced adjustment pressure, including CII, GEX, VRE, TCH, VHM, HQC, and SCR. Widespread adjustments in high-liquidity, large-cap groups dampened market sentiment. The VN-Index struggled to reclaim its week-opening level, as recovery efforts continually met resistance. The main index fell 2.7% in just one week.

Short-term profit opportunities in the market narrowed, even for investors who “bottom-fished” earlier in the week. Selling pressure persisted in many speculative, high-leverage stocks. Market attention now shifts to the Q2/2025 earnings results of listed companies.

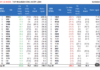

According to FiinTrade data, as of October 20, 160 listed companies representing 9.4% of the total market capitalization had released financial reports or preliminary estimates. Their combined after-tax profit surged 114% year-over-year, outpacing recent quarterly growth trends.

This growth does not yet reflect the overall market picture for Q3, as it was primarily driven by specific sectors, including banking and securities. However, stock performance within these sectors remained lackluster.

At the close, the VN-Index fell 3.88 points (0.23%) to 1,683.18. The HNX-Index gained 0.5 points (0.19%) to 267.28, while the UPCoM-Index dropped 0.17 points (0.15%) to 110.87.

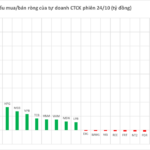

Foreign trading remained a negative factor, with net selling exceeding 1,870 billion VND, concentrated in SSI, MBB, VCI, VIX, and SHS.

Securities Firms Group Sets Record with Over 15 Trillion VND in Profits

The robust wave in the stock market during Q3 2025 has painted a rosy picture for securities companies, delivering a stellar quarter of performance. This surge has even reshuffled the rankings at the top, redefining the profit landscape for the entire sector.

Market Pulse 23/10: Vingroup Once Again “Rescues” the Market

The afternoon session on October 23rd saw the VN-Index continue its volatile trend. At one point, it seemed poised to reclaim the 1,700-point mark, but mounting pressures forced the index to retreat, closing at 1,687 points. Despite the gains, the rally was largely driven by the influence of the Vingroup conglomerate.