According to the Customs Department, in the first nine months of this year, Vietnam’s imports from the United States reached over $13.6 billion, marking a 23% increase compared to the same period last year, equivalent to an additional $2.5 billion.

The most notable products include computers, electronic goods, and components. During this period, Vietnam spent more than $4 billion, a 24% year-on-year increase, on importing these items from the U.S. This category represents the largest segment of imports from the U.S., reflecting a surge in technology upgrades, component replacements, and capacity expansions across sectors like electronics, telecommunications, and medical equipment.

Other machinery, equipment, tools, and spare parts reached $915.3 million, up 14.6%; raw plastic materials hit $854.9 million, a 46% increase. These figures indicate stable, even expanding demand in packaging, technical plastics, and auxiliary industries as businesses prepare for the year-end peak season and 2026 orders.

Notably, following Vietnam’s memorandum of understanding with the U.S., agricultural imports from the U.S. have surged. Vietnam spent over $1.1 billion on 650,000 tons of cotton from the U.S., an 84.2% increase, making it Vietnam’s largest cotton supplier. Soybean imports from the U.S. totaled $301 million, 2.5 times more than last year, while fruits and vegetables reached $413 million, up 35.8%, reflecting steady demand in the mid- to high-end urban and processed food segments.

U.S. fruit imports to Vietnam show a strong upward trend.

A representative from a high-end food distributor in Hanoi revealed that the share of U.S. products in the company’s import structure rose from 28% to 40% in just nine months. Apples, grapes, cherries, and red-fleshed oranges from the U.S. have seen steady growth since the beginning of the year, while frozen beef and chicken sales increased by 25–30%, with mid- to high-end customers favoring U.S. products.

USA Foods Import Trading Company reported a 30% year-on-year increase in U.S. imports over the past nine months. With reduced import tariffs, many businesses are shifting their sourcing to the U.S. market.

Speaking with Tiền Phong, economist Lê Đăng Doanh noted that the significant rise in U.S. goods entering Vietnam is a positive development and aligns with expectations to narrow the trade deficit between the two countries. According to Doanh, U.S. goods in Vietnam primarily focus on two key areas: high-quality agricultural products and consumer goods, and raw materials for manufacturing. In both categories, U.S. products offer clear advantages in safety standards, quality consistency, and traceability.

Particularly, pricing has become more competitive as tariffs continue to decrease, with many items now at 0%. “The recent surge in U.S. agricultural imports is no coincidence—it’s a direct result of lower taxes, more reasonable prices, and Vietnamese businesses quickly adapting their supply chains,” Doanh emphasized.

Doanh added that the greatest growth potential in the coming period lies in high-tech sectors, such as semiconductors and LNG, which are in high demand in Vietnam but require more time for businesses to deeply understand the U.S. supply chain and build long-term trust.

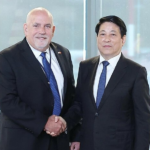

Vietnamese President Luong Cuong’s U.S. Visit: Costco Eyes $1B in Vietnamese Imports, Boeing Delivers Aircraft, Paving the Way for Vietnam’s Supply Chain Expansion

On the morning of September 21st (local time) in Seattle, as part of his official visit to the United States, President Luong Cuong held significant meetings with leaders of two leading American corporations, Costco and Boeing.

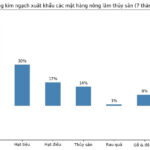

What Agricultural Product Has Shown the Most Impressive Export Performance Over the Last Seven Months?

The agriculture, forestry, and fisheries sector has witnessed robust growth in the first seven months of the year, with key commodities experiencing significant volume and value surges. Notably, coffee remains the powerhouse, attaining unprecedented export turnover fueled by soaring export prices.