ABBank Reports Nearly 10x Profit Growth Year-on-Year

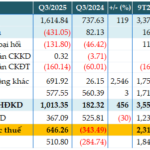

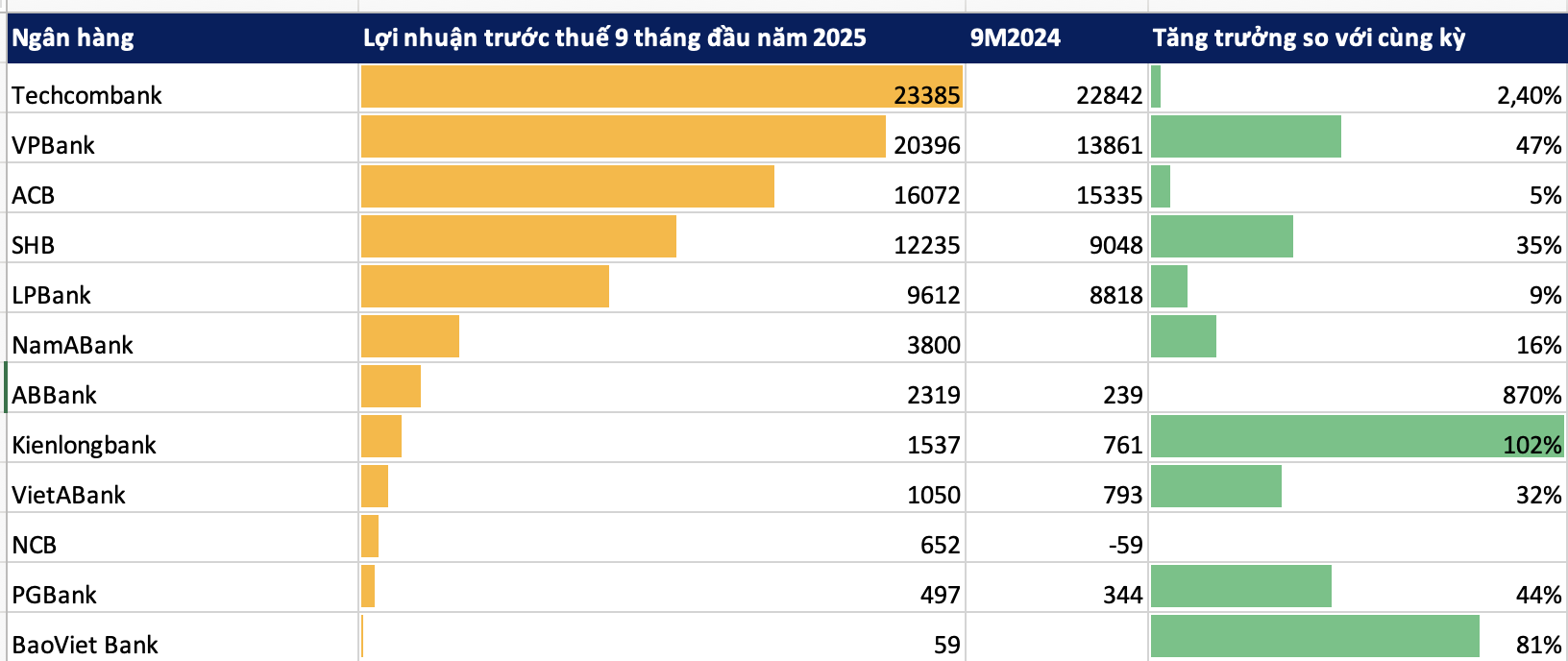

ABBank has released its Q3/2025 financial report, revealing a pre-tax consolidated profit of over 2.3 trillion VND, a 9.7x increase compared to the same period last year, achieving 128% of the 2025 annual profit plan. In Q3 alone, the bank’s pre-tax profit reached over 646 billion VND, a significant improvement from the 343 billion VND loss in Q3 2024.

As of Q3/2025, ABBank’s total assets reached 204.576 trillion VND, a 15.8% increase from the end of 2024. Customer loans stood at 107.573 trillion VND, up 9%, while customer deposits reached 118.712 trillion VND, a nearly 31% increase in the first nine months.

ACB Announces 16.072 Trillion VND Pre-Tax Profit

ACB’s nine-month pre-tax profit for 2025 reached 16.072 trillion VND, a 4.8% increase year-on-year. In Q3/2025 alone, the bank’s pre-tax profit was 5.382 trillion VND, up 11%.

Several business segments saw robust growth, particularly in foreign exchange trading. ACB’s net profit from foreign exchange in the first nine months reached 1.595 trillion VND, a 93% increase year-on-year.

As of September 30, 2025, ACB’s total assets reached 948.549 trillion VND, up 9.8% since the beginning of the year. Customer loans stood at 669.188 trillion VND, a 15.2% increase, while customer deposits reached 571.029 trillion VND, up 6.3%.

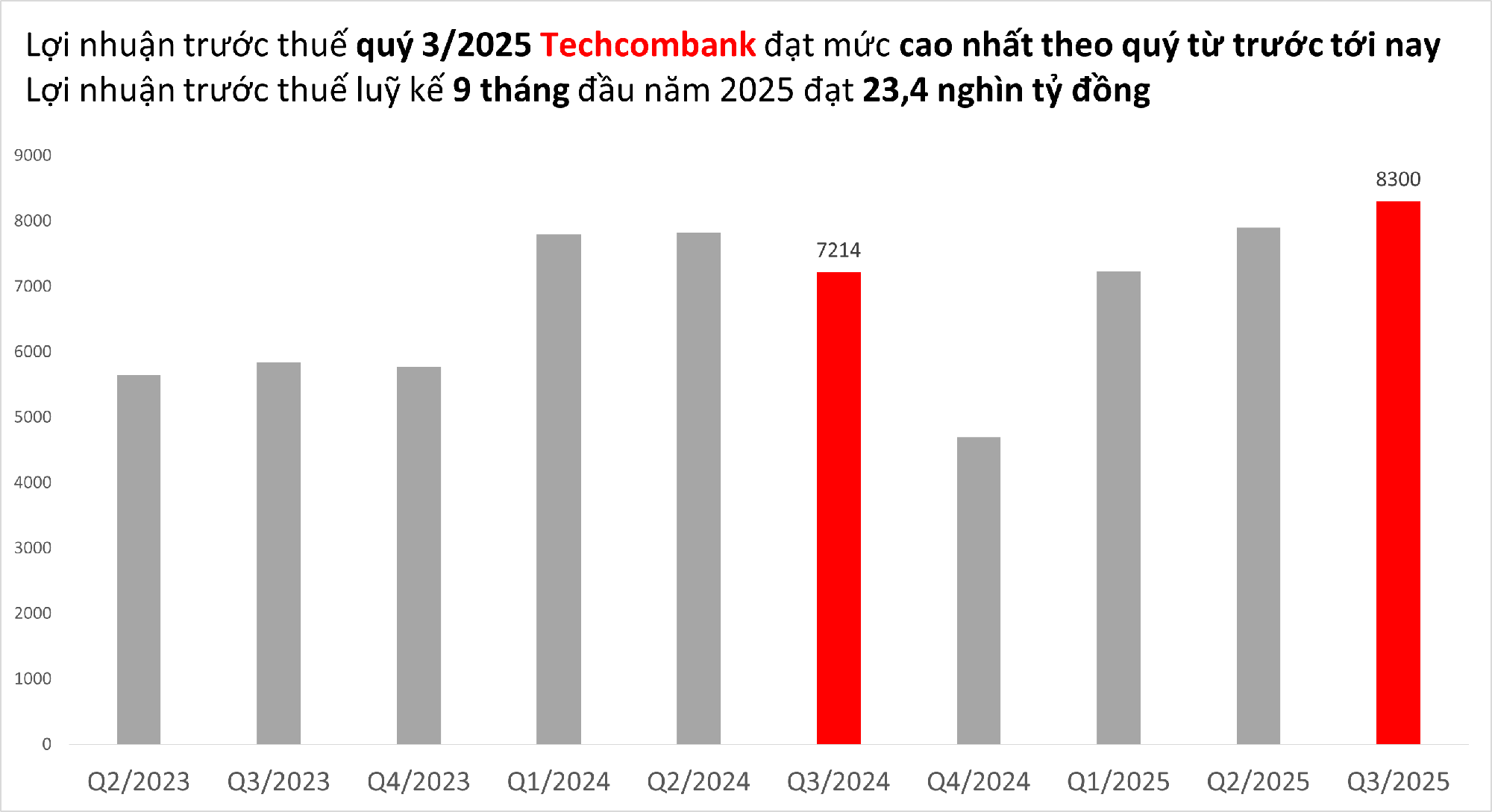

Techcombank Reports 23.4 Trillion VND Pre-Tax Profit

In the first nine months of 2025, Techcombank’s pre-tax profit reached 23.4 trillion VND, a 2.4% increase year-on-year. Q3/2025 pre-tax profit was 8.3 trillion VND, up 14.4%, marking the highest quarterly pre-tax profit in the bank’s history.

As of September 30, 2025, Techcombank’s total assets exceeded 1.13 million trillion VND. Credit growth remained stable at 16.8% year-to-date.

Customer deposits reached 638.5 trillion VND by the end of September, a 24.1% increase since the beginning of the year. The CASA ratio (demand deposits + automatic savings) stood at 42.5%, among the highest in the industry.

Techcombank maintained strong asset quality, with the non-performing loan (NPL) ratio improving from 1.32% to 1.23%. The NPL coverage ratio (LLC) reached 119.1%, marking the eighth consecutive quarter above 100%.

SHB Profit Surges 36%

Sai Gon – Ha Noi Commercial Joint Stock Bank (SHB) announced its nine-month 2025 results, with pre-tax profit reaching 12.307 trillion VND, a 36% increase year-on-year, achieving 85% of the annual plan.

As of September 30, 2025, SHB’s total assets reached 852.695 trillion VND, a 14% increase from the end of 2024. Credit outstanding reached nearly 616.600 trillion VND, up 15% year-to-date.

All capital adequacy ratios exceeded State Bank of Vietnam (SBV) regulations and international standards, with CAR at over 12%, significantly higher than the 8% minimum required by Circular 41/2016/TT-NHNN.

LPBank Reports Over 9.6 Trillion VND Profit

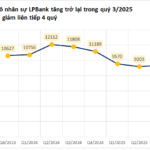

LPBank’s nine-month 2025 financial report shows a pre-tax profit of 9.612 trillion VND, a 9% increase year-on-year. Q3 pre-tax profit was 3.448 trillion VND, up 15.3% quarter-on-quarter and 18.9% year-on-year.

As of September 30, 2025, LPBank’s total assets reached 539.149 trillion VND, an 18.3% increase year-on-year and over 6% since the beginning of the year. Credit outstanding reached 387.898 trillion VND, up 17% year-to-date, while mobilized capital reached 389.638 trillion VND, up 15%.

PGBank Profit Jumps 44%

PGBank recently announced its nine-month 2025 results, with pre-tax profit reaching nearly 497 billion VND, a 44% increase year-on-year.

As of September 30, 2025, PGBank’s total assets reached nearly 79.838 trillion VND, up 9.3% from the end of 2024. Customer loans stood at 44.349 trillion VND, up 7.5%, with an NPL ratio of 2.84% under Circular 31.

Customer deposits reached 44.375 trillion VND, up 2.4%, while deposits from other credit institutions and bond issuances increased significantly.

BAOVIET Bank Profit Skyrockets

In the first nine months of 2025, BAOVIET Bank’s pre-tax profit reached 58.6 billion VND, an 81% increase year-on-year.

As of September 30, 2025, BAOVIET Bank’s total assets exceeded 89.7 trillion VND. Customer loans increased 16.54% year-to-date to over 55.625 trillion VND, while mobilized capital increased 12.34% to 66.743 trillion VND.

Kienlongbank Achieves Record Profit

KienlongBank’s nine-month 2025 consolidated pre-tax profit reached 1.537 trillion VND, double the same period last year, achieving 112% of the annual plan—the highest profit in its 30-year history.

With these results, KienlongBank aims to reach 150% of its 2025 profit plan.

As of September 2025, KienlongBank’s total assets reached 97.716 trillion VND, mobilized capital reached 87.491 trillion VND, and credit outstanding reached 70.922 trillion VND—increases of 5.5 trillion, 7.3 trillion, and 9.4 trillion VND, respectively, since the beginning of the year.

Asset quality remained strong, with the NPL ratio controlled below 2% and NPL coverage consistently above 80% for three consecutive quarters.

NCB Exceeds All 2025 Business Targets

National Citizen Bank (NCB) reported strong Q3/2025 performance, with after-tax profit reaching nearly 190 billion VND. Nine-month after-tax profit reached over 652 billion VND, a significant improvement from the 65 billion VND loss in Q3/2024 and 59 billion VND loss in the first nine months of 2024.

NCB exceeded its 2025 annual plan after just nine months. Total assets as of September 30, 2025, reached over 154.1 trillion VND, up 30% from the end of 2024 and 14% above the annual plan. Mobilized capital reached nearly 119.326 trillion VND, and customer loans exceeded 94.956 trillion VND, up 24% and 33%, respectively, from the end of 2024, and 1% and 3% above the annual plan.

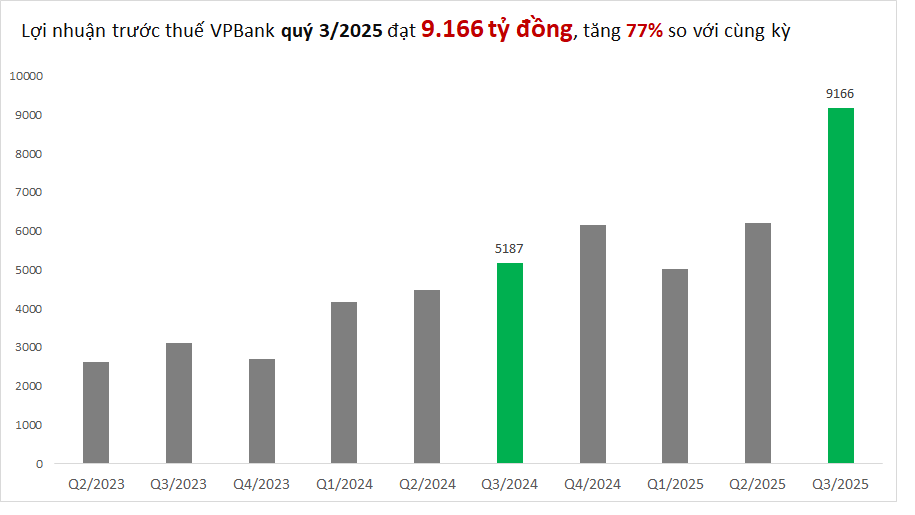

VPBank Reports 20.4 Trillion VND Profit in Nine Months

Vietnam Prosperity Joint Stock Commercial Bank (VPBank) announced its nine-month 2025 results, with consolidated pre-tax profit reaching 20.396 trillion VND, a 47.1% increase year-on-year. Q3/2025 profit reached 9.166 trillion VND, up 76.7%, the highest in the last 15 quarters. Nine-month profit exceeded the full-year 2024 results and achieved 81% of the 2025 annual plan.

As of September 2025, VPBank’s consolidated total assets surpassed the shareholders’ meeting target, reaching 1.18 million trillion VND, up 27.5% year-to-date. Standalone total assets exceeded 1.1 million trillion VND.

Consolidated credit outstanding reached nearly 912 trillion VND, up 28.4%, driven by both the parent bank and subsidiaries. Standalone credit stood at 813 trillion VND.

As of Q3/2025, the consolidated NPL ratio under Circular 31 was tightly controlled below 3%, while the standalone NPL ratio improved to 2.23%.

VietABank Profit Rises 32%

Viet A Commercial Joint Stock Bank (VietABank) announced its Q3/2025 consolidated financial report, with pre-tax profit reaching 336 billion VND, up 46% year-on-year. Nine-month pre-tax profit reached 1.050 trillion VND, a 32% increase.

As of September 30, 2025, VietABank’s consolidated total assets reached 134.614 trillion VND, up 12.3% year-to-date. Customer loans stood at 85.811 trillion VND, up 8.4%, while customer deposits reached 97.984 trillion VND, up 8.5%.

Nam A Bank Assets Double

Nam A Commercial Joint Stock Bank (Nam A Bank) reported nine-month 2025 pre-tax profit of over 3.8 trillion VND, up nearly 520 billion VND year-on-year (16%), achieving 77% of the annual plan. Total assets as of September 30, 2025, reached over 377 trillion VND, an increase of over 132 trillion VND since the beginning of the year.

Deposits from economic organizations and individuals increased by over 35 trillion VND, up 20% year-to-date. Credit outstanding increased by over 30 trillion VND, up 17.88%, while bond investments increased by nearly 14 trillion VND.

The NPL ratio decreased to 2.53% (pre-CIC) and 2.73% (post-CIC) from 2.85% in June 2025. The NPL coverage ratio (LLR) increased sharply from 39% in June to nearly 46% in September. The liquidity reserve ratio reached nearly 20%, double the SBV’s minimum requirement.

Ms. Ngo Thu Ha, CEO of SHB, Honored as “Outstanding Vietnamese Female Entrepreneur – Golden Rose” 2025

SHB’s CEO, Ngo Thu Ha, has been honored with the prestigious “Outstanding Vietnamese Female Entrepreneur – Golden Rose” award for 2025 by the Vietnam Chamber of Commerce and Industry (VCCI). This esteemed recognition celebrates exceptional female leaders who have achieved remarkable business success and made significant contributions to the nation’s economic and social development.

ACB Q3/2025: Sustained Growth Momentum, Among Industry’s Lowest NPL Ratios

ACB’s Q3 2025 business results solidify its position as a leading private bank renowned for exceptional risk management and robust asset quality. Consistently maintaining one of the lowest non-performing loan ratios in the industry for years, ACB demonstrates its unwavering commitment to financial stability and sustainable growth.