Recently, Hanoi Transformer and Electrical Materials Joint Stock Company (stock code: BTH) announced a 250% cash dividend for 2024 (equivalent to VND 25,000 per share). The final registration date is November 7, with the ex-dividend date set for November 6. Payment is scheduled for November 26.

With 25 million outstanding shares, BTH is expected to allocate VND 625 billion for this dividend payment.

During the Annual General Meeting held in late June 2025, shareholders approved a 260% cash dividend plan for 2024. Previously, BTH had paid an interim dividend of 10% in October 2024.

This dividend payout is among the most generous in the industry. Notably, the dividend amount is nearly three times BTH’s charter capital of VND 250 billion.

This move follows BTH’s impressive financial performance in 2024, with a net profit of VND 708 billion—a staggering 6,742 times higher than the VND 105 million recorded in 2023.

This remarkable growth is not attributed to BTH’s traditional core business but to its real estate ventures, particularly the Hoàng Thành Pearl project. This mixed-use development, located at 55 K2 Road, Cầu Diễn Ward, Nam Từ Liêm District, Hanoi, includes residential units, a kindergarten, and green spaces.

For 2025, BTH has adopted a cautious approach, setting a modest revenue target of VND 194 billion and an after-tax profit goal of VND 101 billion.

In Q3 2025, BTH reported a mere VND 5 billion in revenue, a 98% decline from the VND 216 billion recorded in the same period in 2024. Gross profit also plummeted by 98% to nearly VND 3 billion. The sole bright spot was a nearly 60% increase in financial revenue, reaching over VND 12 billion, primarily from idle funds deposited in banks, totaling VND 1,004 billion as of September 2025.

Consequently, pre-tax profit fell by 89% year-on-year to just over VND 13 billion.

According to the company’s explanation, the sharp revenue decline is due to the sale of only one apartment in Q3 2025, compared to 32 apartments and 2 townhouses in the same period last year.

In the first nine months of the year, BTH’s revenue totaled nearly VND 23 billion, with after-tax profit reaching just under VND 32 billion—a 98% and 93% drop, respectively, compared to the same period in 2024. This equates to 12% of the annual revenue target and 32% of the profit goal.

On the stock market, despite broader market volatility, BTH shares surged. Closing the session on October 24, BTH’s stock price climbed over 7% to VND 69,200 per share, marking a historic high.

Vietnam’s Largest Pump Manufacturer Set to Issue 50% Bonus Shares

With a 50% issuance rate, shareholders holding 2 shares will receive an additional 1 new share. The total number of shares expected to be issued exceeds 6.84 million units.

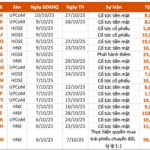

Upcoming Dividend Ex-Dates (Oct 6–10): Highest Cash Dividend at 150%

This week, 14 companies are distributing cash dividends, with rates ranging from a high of 150% to a low of 1.5%.