Recently, Binh Thuan Agricultural Services Joint Stock Company (Bitagco, Stock Code: ABS) released its Q3/2025 Financial Report, highlighting several notable figures.

During the period, the company recorded net revenue of over 30 billion VND, a 70.3% decrease compared to the 101 billion VND in the same period of 2024.

Cost of goods sold decreased by 71.6% to 28.1 billion VND, resulting in a gross profit of 1.87 billion VND, a slight increase from the 1.6 billion VND in the previous year.

However, gross profit was insufficient to cover financial, selling, and administrative expenses, leading to a net loss from operations of nearly 1.4 billion VND, compared to a profit of 296 million VND in the same period last year.

Thanks to other income of over 3 billion VND, Bitagco reported an after-tax profit of nearly 1.7 billion VND, approximately six times higher, or a 541% increase, compared to the 325 million VND profit in Q3/2024.

Illustrative image

Explaining the variance in Q3/2025 results compared to Q3/2024, Bitagco attributed the revenue decline to the impact of the Russia-Ukraine and Middle East conflicts, leading to economic recession, business challenges, reduced crop areas, and decreased investment by farmers. This resulted in lower demand for fertilizers and fuel, affecting the company’s sales in these sectors.

The significant increase in Q3/2025 profit compared to the same period in 2024 was primarily due to penalties collected from contract violations by customers.

For the first nine months of 2025, net revenue reached 131 billion VND, a 58% decrease compared to the same period in 2024. After-tax profit was negative at 293 million VND, while the same period last year saw a profit of over 7.1 billion VND.

As of September 30, 2025, the company’s total assets stood at nearly 708 billion VND, a 29% decrease from the beginning of the year.

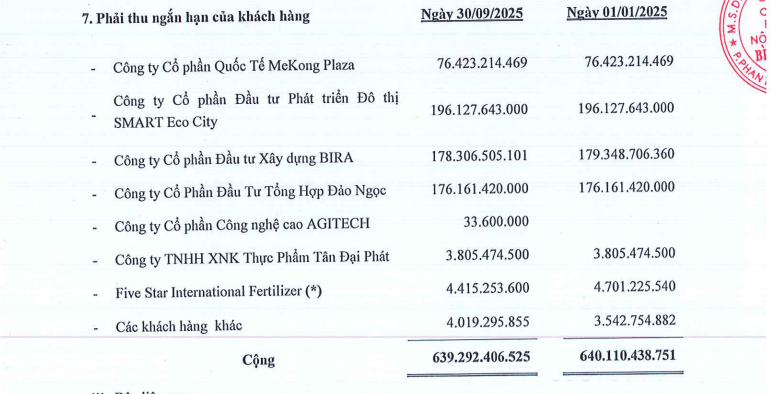

Short-term receivables from customers totaled over 639 billion VND, including: Smart Eco City Urban Development Investment JSC (196 billion VND); Bira Construction Investment JSC (178 billion VND); Bao Ngoc General Investment JSC (176 billion VND); MeKong Plaza International JSC;…

Source: Q3/2025 Financial Report of Bitagco

Notably, as of the end of Q3/2025, Bitagco’s provision for hard-to-recover short-term receivables reached nearly 312 billion VND, compared to only 22 billion VND at the beginning of the year. According to the financial report, Bitagco is provisioning for bad debts from several companies, including: Bira Construction Investment (nearly 61 billion VND); Smart Eco City Investment JSC (over 97 billion VND); Dao Ngoc General Investment JSC (over 83 billion VND);…

The Q3/2025 Financial Report of Bitagco also recorded short-term receivables of over 301 billion VND from Five Star International Group JSC, including 297.8 billion VND from an investment cooperation contract.

Among the aforementioned companies, Smart Eco City Urban Development Investment JSC has significant ties to Mr. Tran Van Muoi, Chairman of Bitagco’s Board of Directors.

Smart Eco City Urban Development Investment JSC was established in July 2018, primarily engaged in real estate business.

At the time of establishment, its charter capital was 990 billion VND, with founding shareholders including: Mr. Tran Van Muoi (69%); Mr. Mai Quoc Hung (5%); Mr. Tran Quoc Toan (9%); Ms. Bui Thi Khanh Huong (2%); and Mr. Tran Xuan Nam (15%).

Mr. Tran Xuan Nam (born in 1971) serves as the General Director and legal representative of the company.

Mr. Tran Van Muoi, Chairman of Bitagco’s Board of Directors, is also known as the Chairman of Five Star Group. Five Star Group’s website lists Bitagco as a member company of the group. Therefore, it is understandable that Bitagco has numerous transactions with Mr. Tran Van Muoi’s group.

As of September 30, 2025, Chairman Tran Van Muoi holds 10 million shares, equivalent to 12.5% of Bitagco’s capital.

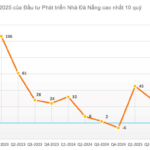

Company Profits Surge 36-Fold After Cashing in on Vinhomes Shares

This marks the highest result achieved in the past 10 quarters, surpassing all records since Q2 2023.

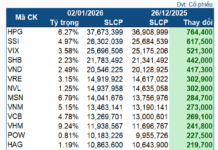

Mobile World Group (MWG) Reports Record-Breaking Q3 Profit of Nearly VND 1.8 Trillion, Surpassing Annual Plan in Just 9 Months

Over the first nine months, The Gioi Di Dong (Mobile World) achieved an accumulated after-tax profit of VND 4,989 billion, a remarkable 73% surge compared to the same period in 2024, surpassing its full-year target.