FPT Corporation (stock code: FPT) recently released its Q3 2025 financial report, showcasing impressive figures.

Specifically, the tech giant recorded a net revenue of nearly VND 17,205 billion, an 8% increase year-over-year, and a post-tax profit of VND 2,901 billion, up by 17%. This marks the second consecutive quarter FPT has set a profit record.

For the first nine months, FPT’s revenue reached VND 49,887 billion, with a post-tax profit of VND 8,237 billion, reflecting a 10% and 19% growth, respectively, compared to the same period last year.

According to FPT, the technology segment (including domestic and international IT services) remains pivotal, contributing 62% of revenue and 45% of pre-tax profit, growing by 10.7% and 13.7%, respectively, year-over-year.

Notably, new contract signings in international IT services reached VND 29,363 billion, a 14.4% increase. FPT solidified its position as a billion-dollar tech company by securing 19 major projects (each over USD 10 million), nearly double the previous year’s figure.

By the end of Q3, FPT achieved 66% of its annual revenue target and 71% of its profit goal.

Financial activities in the first nine months generated nearly VND 2,424 billion for FPT, a 79% increase, with bank deposit interest reaching VND 1,235 billion, accounting for over 51% of total financial income.

On average, FPT earns over VND 4.5 billion daily from bank interest.

As of September 2025, FPT’s cash and cash equivalents totaled nearly VND 10,000 billion, including VND 7,672 billion in regular bank deposits and VND 2,175 billion in short-term deposits (up to 3 months).

Additionally, FPT holds over VND 27,125 billion in term deposits. In total, the corporation has nearly VND 37,000 billion in bank deposits, a 19% increase from the end of 2024.

On the stock market, FPT shares, after a prolonged adjustment period since the year’s start, have rebounded strongly. Currently priced at VND 97,700 per share, they’ve risen nearly 11% in the past week but remain 25% lower than early 2025 levels.

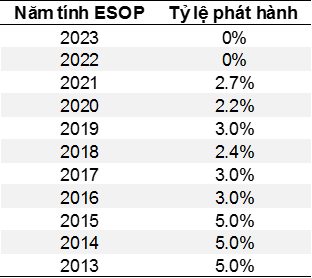

In FPT’s shareholder structure, Chairman Truong Gia Binh is the largest shareholder, holding over 117 million shares, equivalent to 6.89% of the capital.

“Former ‘Steel Fist’ Reports Nearly 100 Billion VND Loss in Q3/2025 Due to Prolonged Shutdowns, Accumulated Losses Exceed 2.1 Trillion VND”

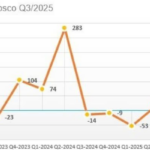

Over the first nine months, net revenue reached VND 2.996 trillion, a slight increase of 0.1% compared to the same period last year. The post-tax loss was VND 38 billion, an improvement from the VND 61 billion loss recorded in the same period last year.

FPT Profits Soar: Earning $1.5 Million Daily

After the first nine months of 2025, FPT reported revenues of VND 49,887 billion and pre-tax profit of VND 9,540 billion, achieving 71% of the annual plan and marking a nearly 18% increase compared to the same period last year. This positive performance is driven by the growth of the Technology and Telecommunications segments, with overseas IT services and the Made-by-FPT ecosystem continuing to expand robustly.