Governor of the State Bank of Vietnam, Nguyen Thi Hong, presented the draft Law on Deposit Insurance (amended) to the National Assembly, emphasizing its purpose to fully institutionalize the policies of the Party and the State. This is particularly aligned with the tasks outlined in Conclusion No. 19-KL/TW of the Politburo and the Legislative Program of the 15th National Assembly.

Governor Nguyen Thi Hong presenting the draft Law on Deposit Insurance (amended)

After 12 years of implementation, the 2012 Law on Deposit Insurance has revealed certain challenges that need addressing. The National Assembly’s approval of the amended Law on Credit Institutions on January 18, 2024, necessitates revisions to the Law on Deposit Insurance to ensure legal consistency and enable the Vietnam Deposit Insurance (VDI) to effectively fulfill its new responsibilities.

Additionally, the amended Law aims to institutionalize the Party and State’s policies on enhancing institutions and innovating legal frameworks to support private economic development and the banking sector’s strategies in the new era.

“The core objective of this draft Law is to establish a comprehensive legal framework, strengthening the ‘safety net’ for deposit insurance organizations to better protect depositors’ rights while maintaining the stability of credit institutions and societal security,” stated Governor Nguyen Thi Hong.

The Government’s proposal outlines a principle-based approach: fully institutionalizing Party and State policies, retaining suitable provisions while addressing limitations, ensuring alignment with other laws (such as the Law on Credit Institutions), and drawing on international best practices tailored to Vietnam’s context.

Session in progress

The amended Law, presented by Governor Nguyen Thi Hong, consists of 8 chapters and 42 articles, including 26 amendments, 7 new additions, 4 repeals, and 9 unchanged articles. The focus is on enhancing the role, capacity, and flexibility of the VDI.

Regarding deposit insurance payout limits, the draft Law adds provisions: in special cases, the Governor of the State Bank may set the maximum payout equal to the total insured deposits of a depositor at a participating institution. Payouts during the controlled bankruptcy of a credit institution follow the Law on Credit Institutions.

For insurance premiums, the draft Law empowers the Governor of the State Bank to set flexible premium rates, ensuring stable revenue for the VDI. Specially controlled credit institutions may defer premium payments, with repayment plans integrated into restructuring strategies.

On insurance payouts, the draft Law specifies triggering events: approval of a bankruptcy plan, confirmation of a foreign bank branch’s inability to pay deposits, or suspension of deposit-taking activities for institutions with losses exceeding 100% of equity. Payouts may also occur to maintain systemic stability.

The draft Law allows the VDI to provide special loans to insured institutions under early intervention, special control, or facing bank runs, to support recovery or mandatory transfers. The VDI may decide on loan terms, including secured or unsecured, with or without interest.

Additionally, the VDI may receive zero-interest, unsecured loans from the State Bank if its reserve fund is insufficient. The VDI must plan premium increases to repay such loans.

In systemic crises, the VDI will participate in resolution efforts as per the Law. The Government will determine additional measures.

Phan Van Mai, Chairman of the Economic and Financial Committee, recommended clarifying the VDI’s role in premium calculation and inspection. Enhanced information sharing and coordination among agencies are essential. Conditions for VDI support from the state budget or special loans should be clearly defined, ensuring alignment with budget processes.

The Committee supports the Governor’s authority to set payout limits but calls for guidelines on adjustments to protect depositors. Criteria for exceeding limits and transparent approval processes involving relevant agencies are needed.

Notably, the draft Law emphasizes decentralization, transferring authority from the Government/Prime Minister to the Governor of the State Bank for payout limits, premium rates, and special loans to the VDI. The VDI will inspect participating institutions as directed by the State Bank.

The Economic and Financial Committee views this decentralization as appropriate, enhancing the responsiveness of monetary and deposit insurance policies.

The Committee considers the amended Law on Deposit Insurance a significant step toward strengthening the national financial safety net. While the Government’s proposal enhances the VDI’s role, issues regarding financial mechanisms, legal clarity in inspections, and special cases (e.g., exceeding payout limits, special loans, crisis management) require further National Assembly discussion. Addressing these will ensure the VDI effectively protects depositors and contributes to a healthy credit institution system, meeting public and business expectations.

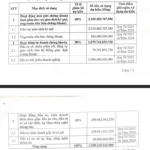

What Will TPS Do with the Anticipated 3.6 Trillion VND from Its Share Offering?

With nearly VND 3.6 trillion raised from its IPO, TPS plans to allocate the funds towards securities brokerage, proprietary trading, and other strategic initiatives.