Last week, the VN-Index dropped by 48.01 points to close at 1,683.18. Average trading volume on the HoSE reached 1,204 million shares per session, an 8% decrease from the previous week, while the trading value stood at VND 37,807 billion per session, down 13% week-on-week. Similarly, the HNX-Index fell by 8.83 points to 267.28.

On the HoSE, foreign investors net-sold 259.3 million shares, with a net value of over VND 4,389 billion. On the HNX, they net-sold 20.2 million shares, valued at nearly VND 518 billion.

On the Upcom market, foreign investors net-sold over 2 million shares, with a net value of nearly VND 21 billion. Overall, during the trading week from October 20-24, foreign investors net-sold 181.4 million shares across the market, totaling over VND 4,928 billion.

Continuous Selling Pressure

REE Land (a subsidiary of REE) recently sold 55,000 shares of Saigonres (SGR) out of the 3 million shares registered earlier. This transaction was executed via order matching, with the remaining shares unsold due to unmet price expectations. Post-transaction, REE Land’s ownership in SGR decreased to 21.84% of the charter capital, equivalent to over 15 million shares.

REE Land continues to offload SGR shares.

Previously, from September 9-15, REE Land successfully sold 2 million SGR shares, reducing its holdings to 15.32 million shares. Notably, REE Land had registered to sell a similar volume of SGR shares from June 27 to July 24 but did not execute any transactions due to unmet price expectations.

REE Land remains the second-largest shareholder in Saigonres, behind the family of Mr. Pham Thu, Chairman of SGR’s Board of Directors. Since the beginning of the year, SGR shares have declined by nearly 42%, while the VN-Index has surged by 35%. This downturn coincides with significant selling by two major shareholders: Mr. Pham Thu and REE Land.

While REE Land has been reducing its stake in Saigonres, Mr. Pham Thu—after acquiring 9.9 million SGR shares from a private placement in May 2025—sold 7 million shares in June and July.

Mr. Dinh Van Hien, a board member of Viconship (VSC), registered to sell 92,187 VSC shares, reducing his ownership to 0.03% of the charter capital. The transaction is expected to take place from October 29 to November 27.

Earlier, on October 1, Mr. Nguyen Duc Dung, another board member of Viconship, sold 217,187 VSC shares, lowering his ownership to 0.16%.

Dragon Capital Sells Additional 6 Million DXG Shares

Dragon Capital group sold an additional 6,058,634 shares of Dat Xanh Group (DXG), reducing its ownership to 10.97% of the charter capital. Specifically, Amersham Industries Limited sold 2.25 million shares, Norges Bank sold 1.5 million shares, Saigon Investments Limited sold 1 million shares, Vietnam Enterprise Investments Limited sold 1 million shares, and Samsung Vietnam Securities Master Investment Trust (Equity) sold 308,634 shares.

Dragon Capital group sold an additional 6,058,634 DXG shares.

Recently, Dragon Capital has been consistently offloading DXG shares. On August 25, they sold 3.9 million shares; on August 29, 3.75 million shares; on September 22, 1.25 million shares; on September 25, 2.2 million shares; and on October 14, 1.3 million shares.

Similarly, several Dat Xanh Group executives have been selling DXG shares. For instance, from August 15-27, Ms. Do Thi Thai, Deputy CEO of DXG, sold 413,300 shares, reducing her ownership to 0.05%. From August 4-26, Mr. Ha Duc Hieu, a board member, sold 6,355,000 shares, lowering his stake to 0.04%. From July 24 to August 19, Mr. Bui Ngoc Duc, CEO of Dat Xanh, sold 744,418 shares, reducing his ownership to 0.09%.

Truong Thanh Group (TTA) approved a plan to issue dividend shares for 2024 at a 5% rate, equivalent to over 8.5 million new shares. The issuance is expected in November-December 2025, pending approval from the State Securities Commission.

Previously, at the 2025 Annual General Meeting, Truong Thanh Group also approved a 5% dividend payout for 2024 in the form of shares.

Technical Analysis Afternoon Session 24/10: Struggling to Break Above Bollinger Bands’ Middle Line

The VN-Index experienced intense volatility, retracing after nearing the Bollinger Bands’ Middle Line. Meanwhile, the HNX-Index extended its decline, forming a candle pattern resembling a Spinning Top.

Market Pulse 24/10: Foreign Investors Net Sell Financial Stocks, VN-Index Closes in the Red

At the close of trading, the VN-Index dipped 3.88 points (-0.23%), settling at 1,683.18 points, while the HNX-Index edged up 0.5 points (+0.19%) to 267.28 points. Market breadth favored decliners, with 416 stocks closing lower compared to 291 gainers. Similarly, the VN30 basket saw red dominate, with 15 decliners, 12 advancers, and 3 unchanged stocks.

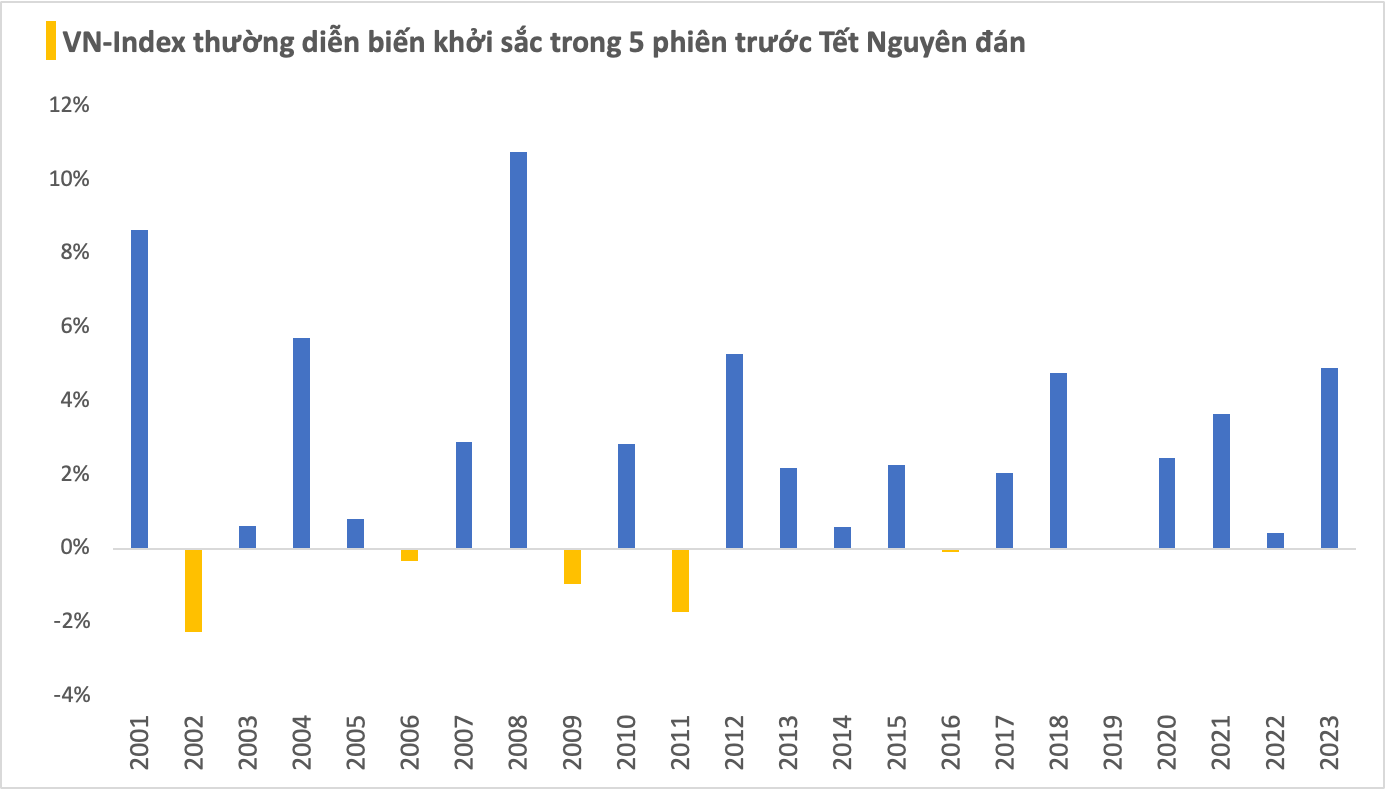

Stock Market Week 20-24/10/2025: Challenges Persist

The VN-Index paused its recovery in the final session of the week, failing to offset the sharp decline earlier and closing the week 48 points lower than the previous one. With liquidity yet to show significant improvement and foreign investors maintaining their net selling trend, downward pressure on the index is likely to persist in the near term.

Short-Term Stock Market Declines: What You Need to Know

The stock market’s growth prospects remain robust, fueled by strong domestic investor inflows and improving corporate earnings.