At the 2026 Business Forum “New Growth Spaces: Opportunities and Strategies” held on the morning of October 22, experts discussed the gold market and silver investment channels.

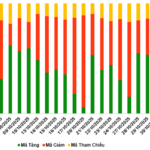

According to expert Ngo Tri Long, gold prices rise due to global trends, geopolitical instability, and economic fluctuations. Gold serves as a safe-haven asset, and many central banks have been actively purchasing it. The domestic gold price premium over global gold prices is excessively high, currently ranging from 10% to 11%.

Mr. Long suggested that to narrow the gap between domestic and global gold prices, Decree 24 should be replaced with a new one. Decree 232 now reflects a market-oriented management approach. However, supply and demand remain mismatched, leading to a fragmented market.

Vo Tri Thanh, a member of the National Financial and Monetary Policy Advisory Council and the session moderator, highlighted gold’s significance for investment, storage, and trading due to its high liquidity. Silver prices have also reached historic highs, outpacing gold. Despite its name, silver’s value is undeniable. What drives silver’s surge, and is it sustainable?

Dr. Vo Tri Thanh – Member of the National Financial and Monetary Policy Advisory Council.

Market expert Chu Phuong noted that silver prices have surged dramatically, with annual profit margins surpassing those of gold. Like gold, silver hit a record high of $50/ounce, briefly reaching $56 before a sharp decline on October 21.

“Several factors drive silver’s rise. First, silver is essential for green technologies like solar panels, electric vehicles, and batteries. Countries like the U.S., China, and Vietnam are embracing green tech, creating real demand for silver.

Second, like gold, silver is priced in USD. When the dollar weakens, USD-denominated commodities like silver tend to rise. The USD is currently at its lowest since late 2022, making silver cheaper in other currencies,” Ms. Phuong explained.

She added that cyclical investments often see rapid price increases when commodities surpass historical highs. At $50/ounce, market sentiment intensifies, driving prices higher. When silver exceeded this threshold, the London market faced shortages, while U.S. inventories remained high due to strategic stockpiling and proposed silver taxes.

Technically, investors once followed the “buy at support, sell at resistance” strategy. At $50/ounce, major U.S. institutions short-sold silver, expecting a decline. However, when prices rose further, short sellers were forced to buy back at higher prices, fueling a FOMO-driven rally.

“From October 13–17, global gold ETFs bought 59 tons of gold, driving prices upward. Silver ETFs followed suit, purchasing nearly 100 tons, exacerbating shortages and investor enthusiasm,” Ms. Phuong added.

“Avoid Borrowing for Gold or Silver Investments”

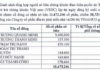

Huynh Minh Tuan, founder of FIDT and Vice Chairman of APG Securities, shared that FIDT allocates 5–10% of its portfolio to precious metals like gold and silver.

Historically, silver has been used in jewelry, though less prominently than gold. With limited gold supplies, silver may gain traction. During Donald Trump’s presidency, gold and silver prices moved in tandem, making silver a viable defensive asset.

“Physical silver has gained attention with a 64% year-to-date increase. Companies like Phu Quy Gold and Sacombank now offer silver storage products, with Phu Quy partnering with Bao Tin Minh Chau for silver bars and coins,” Mr. Tuan noted.

Ngo Tri Long emphasized, “Gold never loses value—only changes hands. Allocate investments wisely. If I had $100, I’d invest $70 in gold and $30 in silver. Never borrow to invest.”

Vietnam and South Africa Aim for Strategic Partnership, Expanding Economic Cooperation in the New Era

The Vietnam-South Africa Business Forum, held in Hanoi on the afternoon of October 24th, marks a significant milestone in bilateral cooperation. As both nations strive to elevate their relationship to a Strategic Partnership, this event underscores a shared commitment to expanding economic connectivity between Asia and Africa.

Today’s Crypto Market, October 21: Another Enterprise Enters the Digital Asset Arena

Digital currency investors are forecasting a potential drop in Bitcoin’s value, predicting it could fall to $100,000 or even $95,000 if buying momentum fails to strengthen.