The U.S. Department of the Treasury imposed sanctions on Rosneft (market cap: $50.8 billion) and Lukoil (market cap: $48.98 billion) on Wednesday, citing Moscow’s “lack of serious commitment” to ending the conflict in Ukraine.

The U.S. government set a deadline of November 21 for the cessation of operations, giving companies nearly a month to finalize or terminate existing agreements with Rosneft and Lukoil. Bob McNally, Chairman of Rapidan Energy Group, noted that the move appears designed to avoid immediate market chaos while pressuring Russia.

Rosneft and Lukoil account for roughly half of Russia’s total crude oil exports, exceeding 4 million barrels per day. Since the West imposed a $60 price cap in late 2022, these exports have found stable markets in Asia, according to Vanda Insights data.

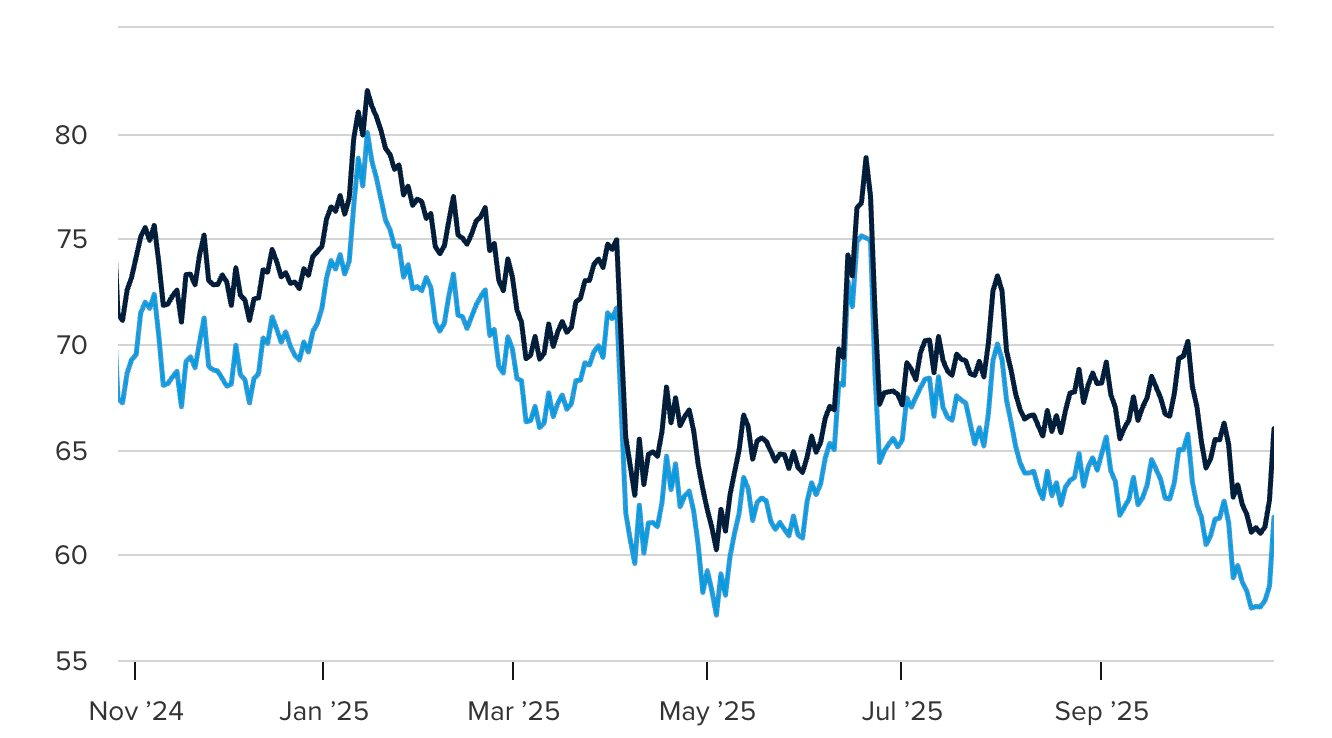

Brent and WTI crude oil prices over the past year.

China imported approximately 2 million barrels per day from Russia in September, while India imported around 1.6 million barrels daily.

“This could be a significant escalation,” said Muyu Xu, Senior Crude Analyst at commodity data firm Kpler. “Trump’s sanctions on Rosneft and Lukoil will substantially impact Russia’s seaborne crude exports, potentially forcing major buyers to scale back—if not halt—purchases in the coming months,” she added.

In India, the sanctions are expected to affect several refineries directly reliant on Russian supplies. State-owned refineries—Indian Oil, Bharat Petroleum, Hindustan Petroleum—and private giants like Reliance Industries, HPCL-Mittal Energy Ltd., and Oil and Natural Gas Corp (ONGC) are among the hardest-hit, per Kpler data.

Rosneft holds a nearly 50% stake in Nayara Energy Ltd., operator of the Vadinar refinery in Gujarat, which may struggle to sell refined products instead of purchasing crude oil.

Reuters reported on October 23 that Indian state refineries are now scrutinizing Russian oil transaction documents to confirm no direct supply ties to Rosneft or Lukoil post-sanctions.

Emma Li, Oil Market Analyst at Vortexa, stated: “India may abandon seaborne shipping agreements, while China’s pipeline oil flows could continue uninterrupted.”

Energy experts warn Chinese refineries will also proceed cautiously. “All state enterprises will avoid Rosneft and Lukoil-linked cargoes,” Xu noted.

According to Vortexa, China National Petroleum Corporation (CNPC) has a pipeline supply agreement with Rosneft but no long-term seaborne crude contracts.

“A complete halt to Russian crude flows is unlikely, but short-term disruptions appear inevitable,” Xu added.

The sanctions force buyers to devise new shipping and payment methods, adding costs and complexity—precisely the U.S. goal: cutting Moscow’s profits without halting exports entirely, McNally explained.

China and India will increasingly rely on U.S. and OPEC supplies, energy experts predict. “OPEC has spare capacity, particularly Saudi Arabia. However, rising demand for non-sanctioned oil globally will push prices higher,” said John Kilduff of Again Capital.

Oil prices surged 5% before moderating post-announcement. Brent crude rose 3.71% to $64.91/barrel on October 24, while U.S. crude gained 3.93% to $60.80.

Vandana Hari, founder of Vanda Insights, noted Middle Eastern crude as the primary alternative for China and India.

These measures differ sharply from the G7’s earlier price cap mechanism, which allowed Russian crude circulation below $60/barrel. “This implies no Russian crude purchases at any price—a total ban,” Kilduff emphasized.

“The bigger question is whether these sanctions will stick… A single Trump-Putin call could reverse everything,” Hari cautioned.

Source: CNBC

Putin Warns: ‘Without Russian Crude, Oil Prices Could Skyrocket to $100 per Barrel’

According to Putin, this price level will not benefit the global economy, particularly European nations already grappling with growth challenges.