Vietjet Aviation Joint Stock Company (Vietjet, Stock Code: VJC) has officially notified the Hanoi Stock Exchange (HNX) regarding the early redemption of its entire bond issuance.

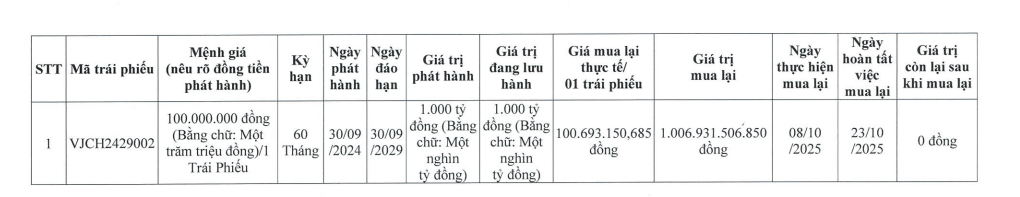

The bond series, VJCH2429002, with a face value of VND 100 million per bond and a total issuance value of VND 1,000 billion, was initially issued on September 30, 2024, with a 60-month term. The original maturity date was set for September 30, 2029.

The company successfully repurchased the entire bond series between October 8 and October 23, 2025, at a total redemption value of approximately VND 1,007 billion (equivalent to nearly VND 100.7 million per bond).

Thus, Vietjet has fully settled the VJCH2429002 bond series just over a year after its issuance.

Source: HNX

Previously, Vietjet had communicated to HNX and the bondholders of VJCH2429002 regarding the early bond repurchase plan.

The company intends to fund this repurchase using proceeds from the issuance of the VJC12503 bond series (issued in September 2025).

According to the issuance announcement, this is a standard corporate bond, non-convertible, unsecured, and without warrants.

The purpose of the issuance is to cover operational expenses, including fuel costs, port fees, flight operations, technical maintenance, insurance, aircraft deposit payments (PDP), and other related expenses.

The interest rate for the first four interest periods is set at 11% per annum. For subsequent periods, the rate will be the reference rate plus a 4% margin, with a minimum floor of 11% per annum.

In other developments, Vietjet’s Board of Directors issued Resolution No. 64-25/VJCHĐQT-NQ on October 22, 2025, approving a plan to issue shares for dividend payments and capital increase.

The company plans to issue over 118.3 million shares as dividends, with a rights ratio of 100:20 (shareholders holding 100 shares will receive 20 new shares). The dividend shares will be unrestricted for transfer.

The issuance will be funded by undistributed after-tax profits, as per the audited consolidated financial report for 2024.

The issuance is expected to take place between Q4/2025 and Q1/2026, with the exact timing determined by the Board of Directors following written confirmation from the State Securities Commission upon receipt of all required issuance documents, in compliance with legal regulations.

The total capital increase from this issuance is projected to exceed VND 1,183 billion, which will be utilized to meet the requirements for business expansion, enhance financial capacity, improve market competitiveness, strengthen bidding capabilities, and ensure compliance with liquidity regulations.

If the issuance proceeds as planned, Vietjet’s chartered capital is expected to increase from VND 5,916 billion to over VND 7,099 billion.

Galaxy Cinema Operator Surprises with Profit in H1 2025, Yet Accumulated Losses Exceed VND 1.2 Trillion

Galaxy Entertainment and Education JSC (Galaxy EE) reported profits in the first half of 2025. However, it remains uncertain whether this signals a true “revival” for the Galaxy cinema chain, given the company’s accumulated losses exceeding 1.2 trillion VND.

Soaring High with VJC: The Aviation Industry’s Rising Star (Part 2)

Despite lingering challenges that require attention in the coming period, Vietjet Aviation Joint Stock Company (HOSE: VJC) continues to captivate the investment community with its strong appeal. According to valuation model results, VJC’s stock price remains attractive for long-term investment opportunities.