Double Delight for Investors

Vietjet is set to issue a total of 118.3 million shares, with an expected par value issuance of over 1.183 trillion VND.

The issuance is scheduled for Q4/2025 or Q1/2026, pending regulatory approvals.

Post-issuance, Vietjet’s chartered capital is projected to exceed 7,000 billion VND, with consolidated equity surpassing 24,000 billion VND. The additional capital will bolster the company’s long-term financial strength.

A 20% dividend payout is a “double delight” for investors and shareholders. Alongside attractive dividends, VJC shares are poised for significant appreciation, driven by recent net foreign buying. As of October 23, VJC closed at 184,000 VND per share.

Vietjet’s market capitalization stood at 109,000 billion VND on October 23.

Solid Foundation for Growth

VJC’s share value stems from Vietjet’s robust operational growth since the year’s start and its promising outlook. New aircraft orders, modern fleet expansion, and significant investments in aviation infrastructure underscore this momentum.

Demonstrating sustainable growth, Vietjet has added an A330 wide-body aircraft to its fleet, bringing the total, including Vietjet Thailand and Vietjet Qazaqstan, to 130 aircraft. This expansion ensures readiness to meet surging year-end travel and trade demands.

Vietjet’s new A330 wide-body aircraft ensures seamless service for increased year-end travel and trade demands.

Vietjet has commenced construction of its Aircraft Maintenance Technical Center at Long Thanh International Airport. This project, among 80 initiatives celebrating the 80th anniversary of the August Revolution and National Day (September 2, 1945 – 2025), marks a pivotal milestone for Vietjet and Vietnam’s aviation sector.

The Long Thanh Aircraft Maintenance Technical Center signifies a major leap for Vietjet and Vietnam’s aviation industry.

As a pioneer in sustainable aviation fuel (SAF), Vietjet has partnered with Petrolimex Aviation to pilot SAF usage, a critical step in the industry’s green transition.

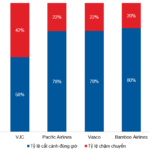

Vietjet now self-manages ground services at Noi Bai and Tan Son Nhat International Airports, enhancing service quality and achieving industry-leading on-time performance in September 2025.

These proactive initiatives, coupled with an extensive Asia-Pacific network, position Vietjet for global expansion into Europe and the Americas. By attracting top talent and delivering world-class services, Vietjet is set for continued robust growth, as analysts predict.

Soaring High with VJC: The Aviation Industry’s Rising Star (Part 2)

Despite lingering challenges that require attention in the coming period, Vietjet Aviation Joint Stock Company (HOSE: VJC) continues to captivate the investment community with its strong appeal. According to valuation model results, VJC’s stock price remains attractive for long-term investment opportunities.