According to a recent Forbes update, as of October 24th, Vietnamese billionaire Pham Nhat Vuong, Chairman of Vingroup (stock code: VIC), boasts a staggering net worth of $20.3 billion, ranking him 118th among the world’s wealthiest individuals.

This marks the first time in history that a Vietnamese national has surpassed the $20 billion threshold. This achievement propels Vuong past numerous global luminaries, bringing him within striking distance of the top 100 richest people on the Forbes list.

To put this into perspective, Vuong’s wealth even surpasses the market capitalization of Vietcombank, Vietnam’s most valuable bank. His assets, as calculated by Forbes, now exceed the market cap of nearly all companies listed on the Vietnamese stock exchange, with the sole exception of Vingroup itself.

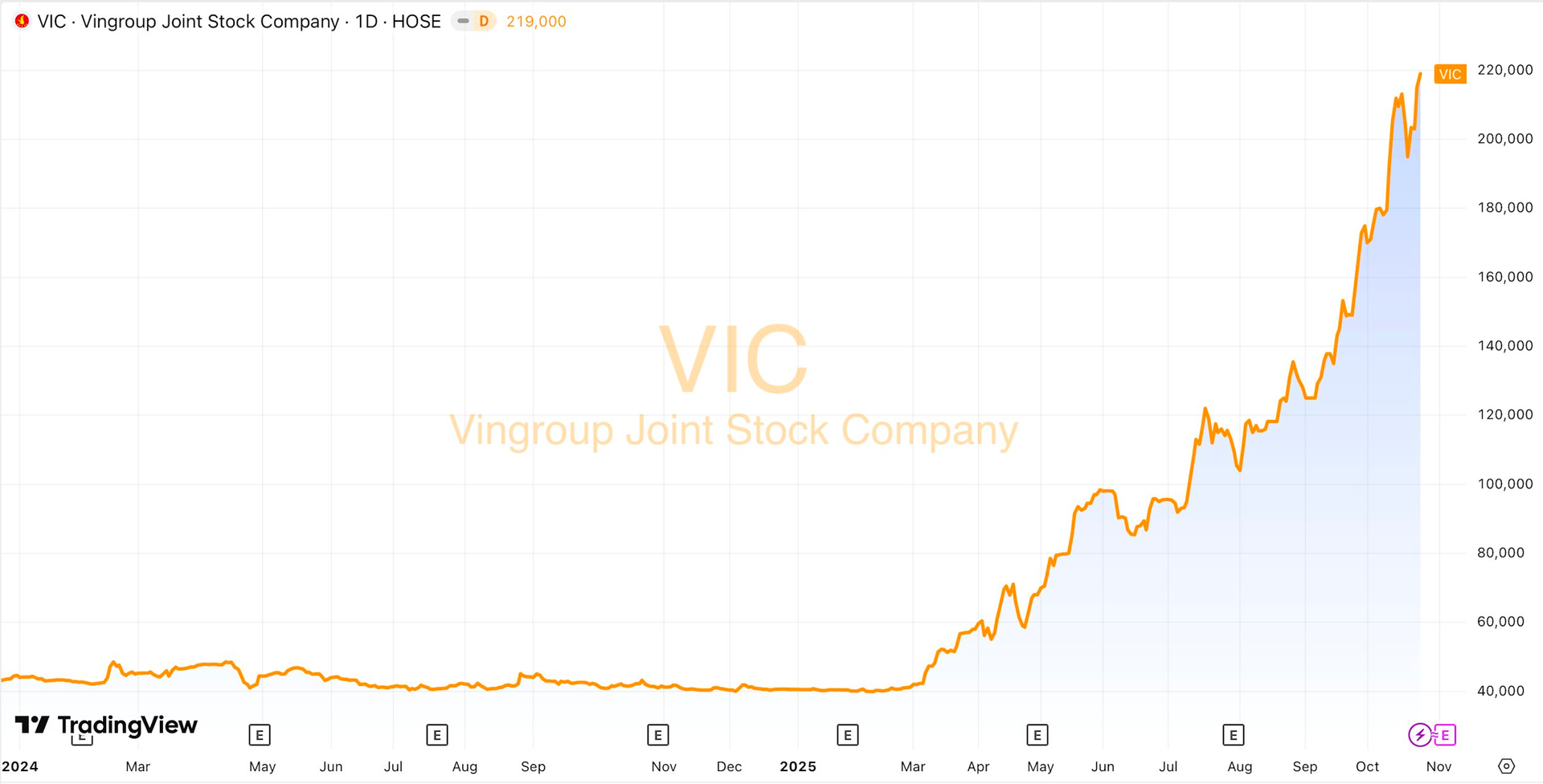

Vuong’s wealth surge is primarily attributed to the meteoric rise of VIC shares. Since the beginning of the year, VIC’s stock price has skyrocketed by 440%, reaching a new peak of VND 219,000 per share. Consequently, Vingroup’s market capitalization has also hit a record high of nearly VND 850 trillion, making it the first Vietnamese company to surpass the VND 600 trillion, VND 700 trillion, and VND 800 trillion milestones.

Beyond his holdings in the Vietnamese stock market, a significant portion of Vuong’s wealth resides in VinFast, a Nasdaq-listed company with a market cap of approximately $7.5 billion. VinFast currently dominates Vietnam’s automotive market and is actively expanding its presence across the region.

Under Vuong’s leadership, Vingroup has pivoted from its real estate focus to a diversified strategy encompassing five key pillars: Technology & Industry, Commerce & Services, Social Philanthropy, Infrastructure, and Green Energy. Vingroup’s subsidiaries, including Vinhomes, Vinpearl, VinFast, VinSpeed, and VinEnergo, are driving this strategic transformation.

In a separate development, Vingroup’s Board of Directors has approved a resolution to issue and offer international bonds on foreign stock exchanges. The company plans to issue up to 1,625 bonds with a face value of $200,000 each, totaling $325 million. These five-year bonds will carry an expected interest rate of 5.5% per annum.

The bonds, denominated in US dollars, will be non-convertible, unsecured, and directly obligate the issuer for repayment. The issuance is slated for Q4 2025, pending regulatory approval. The bonds will be listed on the Vienna Stock Exchange’s Multilateral Trading Facility (MTF) and will not be offered or listed in Vietnam.

Additionally, Vingroup will seek shareholder approval via written consent for a capital increase through the issuance of new shares and other matters within its jurisdiction. The record date is set for October 30th, 2025, with the consent-gathering process expected to commence in November 2025.

Vingroup Awarded 6,300 Hectares of Riverside Land in Congo for Green Urban Development Project

Vingroup is spearheading a transformative initiative by converting over 300,000 gasoline vehicles to electric, while simultaneously establishing an electric bus network and charging infrastructure in Congo.

Vingroup Unveils Plans for 6,300-Hectare Riverside Megacity Project in Congo

The Kinshasa Capital Authority of the Democratic Republic of the Congo and Vietnam’s Vingroup have signed a Memorandum of Understanding (MoU) to collaborate on the research and development of large-scale urban projects and green transportation initiatives in Congo.