According to information from the Vietnam National Oil and Gas Group (Petrovietnam – PVN), the corporation is implementing a plan to divest its entire capital contribution in Indochina Green Development Joint Stock Company (GID) and Vietnam Petroleum Trading and Services Joint Stock Company (PVTS).

PVTS, formerly known as Vietnam Petroleum Finance Investment Joint Stock Company (PVFI), began operations in 2007. In 2022, PVFI rebranded to PVTS, marking a significant milestone and initiating a comprehensive restructuring phase. This shift focuses on commerce, financial services, application training, and event organization.

PVTS has a chartered capital of 300 billion VND, with PVN contributing 105 billion VND, equivalent to 35% of the chartered capital at a par value of 10,000 VND per share. The starting auction price is set at 9,200 VND per share.

Indochina Green Development Joint Stock Company, established in 2006, aims to strengthen investment cooperation between Vietnam and Laos, as directed by the Vietnamese Communist Party and Government. Since its inception, the company has invested in two mineral exploration projects: copper and gold mining in IToum village, Phu Vong district, Attapeu province (Attapeu Project), and in Na-luong village, Kham district, Xieng Khouang province, and Vieng Thong district, Houaphanh province (Xieng Khouang Project).

GID has a chartered capital of over 235 billion VND, with PVN contributing 87 billion VND, equivalent to 36.9% of the chartered capital at a par value of 10,000 VND per share. The starting auction price is 19,100 VND per share.

As part of the restructuring plan for Petrovietnam until 2025, approved by the Prime Minister, the group will gradually divest from non-core businesses. This strategic move aims to concentrate resources on core activities such as oil and gas exploration, production, processing, energy, and high-quality technical services.

The divestment will be conducted through public auctions at the Hanoi Stock Exchange (HNX).

FLC Calls Extraordinary General Meeting Following Bamboo Airways Takeover

Amidst FLC’s comprehensive restructuring efforts following an extended period of crisis, these strategic moves are taking place.

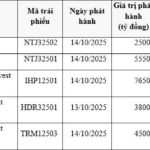

Vinhomes Cổ Loa Project Investor Secures Additional 2.5 Trillion VND in Bond Funding

New Era T&T, the company behind a portion of the Vinhomes Co Loa project, has successfully raised 2.5 trillion VND through the issuance of its NTJ32502 bond series.