|

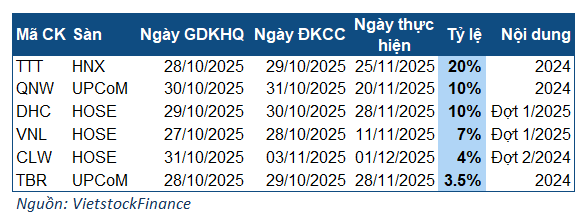

Businesses Finalizing Cash Dividend Rights from October 27-31, 2025

|

The business with the highest dividend payout ratio next week (20%) is TTT, a tourism industry enterprise. With nearly 4.6 million outstanding shares, TTT is expected to allocate approximately 9 billion VND for the 2024 dividend payment. The ex-dividend date is October 28, with the payout scheduled for November 25, 2025.

This marks the fifth consecutive year that the company has maintained a 20% payout ratio and the 12th consecutive year of implementing a cash dividend policy. During 2018-2019, TTT distributed dividends at a peak rate of 30%. Since 2020, the company adjusted the ratio to 20% and has maintained it despite profit fluctuations. Specifically, in 2020-2021, TTT‘s profits declined significantly due to the COVID-19 pandemic, but from 2022-2024, business results recovered, with profits consistently exceeding 20 billion VND annually.

Next are QNW and DHC, both finalizing a 10% dividend payout (1,000 VND per share). The ex-dividend dates are October 30 and 29, respectively, with payout dates on November 20 and 28, 2025.

With 20 million outstanding shares, QNW will allocate approximately 20 billion VND for dividend payments, the highest amount to date, amid record-breaking revenue and profit in 2024. Meanwhile, DHC, with nearly 96.6 million outstanding shares, is expected to allocate around 96.6 billion VND for shareholder dividends.

For stock dividends, next week is quite active with five businesses finalizing rights: TPB, STK, BSR, LCG, and NJC. The highest ratios are from STK and BSR, at 45% (100 shares receive 45 new shares) and 30% (100 shares receive 30 new shares), respectively. The ex-dividend dates are October 30 and 29.

– 13:58 October 26, 2025

Unified Stance from Ministry of Construction, Vingroup, Vinhomes, Masan, and Techcombank on Personal Income Tax for Dividends and Stock Bonuses

The Ministry of Finance has clarified that when dividends are distributed to investors in the form of securities, withholding personal income tax at the time of deduction is appropriate.