Illustrative Image

Reliance Industries Ltd., India’s largest private conglomerate, has significantly ramped up its crude oil purchases from the Middle East and the United States following Washington’s sanctions on two major Russian oil producers. This move comes amid growing concerns over potential global supply disruptions.

According to trade sources, Reliance has acquired various crude grades, including Saudi Arabia’s Khafji, Iraq’s Basrah Medium, Qatar’s Al-Shaheen, and the U.S. West Texas Intermediate (WTI). These shipments are scheduled for delivery in December or January.

Reliance, the largest importer of Russian crude oil in India this year, primarily through long-term contracts with Rosneft PJSC—one of the sanctioned entities—has traditionally sourced oil from the Middle East. However, traders note that the company’s recent buying spree has been unusually aggressive, particularly after the U.S. sanctions took effect.

In total, Reliance is reported to have purchased at least 10 million barrels of oil in the spot market this month, with the majority originating from the Middle East. Notably, most of these transactions occurred after the U.S. announced its sanctions. A Reliance spokesperson has not yet commented on the matter.

Beyond Reliance, other Indian refineries are actively seeking alternative supplies from the Middle East, the U.S., and Brazil. This shift has driven up prices for grades like Oman on October 24, widening the spot premium for Dubai benchmark crude. Internationally, Brent crude prices have surged by over 5%.

Analysts predict a significant decline in Russian crude flows to major Indian refineries as sanctions against Rosneft and Lukoil PJSC take hold. Except for Nayara Energy Ltd., which has Rosneft as a stakeholder, most Indian refiners are adjusting their import strategies. Some Chinese firms have also paused Russian oil purchases to assess the impact of U.S. sanctions.

Reliance’s pivot to Middle Eastern and U.S. supplies underscores the Asian oil market’s rapid adaptability to geopolitical shifts, highlighting the region’s growing role in stabilizing global supply chains.

Source: ET

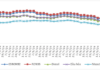

E5 RON92 Gasoline Price Rises by 6 Dong per Liter

At 3:00 PM on October 2nd, the Ministries of Industry and Trade and Finance jointly announced an increase in fuel prices, ranging from 6 to 380 VND per liter or kilogram, depending on the specific fuel type.