The Q3/2025 financial report of Hanoi Liquor and Beverage Joint Stock Company (Halico, stock code: HNR) reveals a net revenue of over VND 23.6 billion, a 6.1% increase compared to the same period last year. Notably, liquor products account for 91% of the revenue structure.

The cost of goods sold rose by 4.7% year-on-year, while financial activity revenue surged by 25%, reaching VND 1.5 billion, primarily driven by bank deposit interest. As of the end of Q3, Halico holds over VND 135 billion in bank deposits.

After deducting expenses, the company reported a loss of VND 4.3 billion, an improvement from the VND 4.9 billion loss in the same period last year.

For the first nine months of 2025, cumulative net revenue reached VND 87.9 billion, a 10% increase year-on-year, yet the after-tax profit remained negative at VND 3.8 billion (compared to VND 7.4 billion loss in the same period last year).

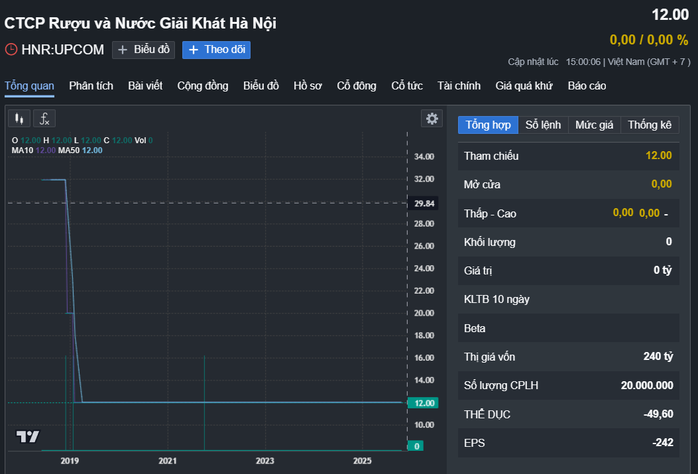

Halico’s stock price has remained stagnant at VND 12,000 for several years. Source: Fireant

This result marks a setback for Halico, which had previously recorded a net profit of nearly VND 700 million in the first six months of 2025—the first semi-annual profit since 2016. However, this profit primarily stemmed from asset liquidation rather than core business operations.

This indicates that the company’s recovery path is still fraught with challenges.

Previously, Halico attributed its losses to rising input material costs. Additionally, alcohol consumption declined due to unfavorable weather conditions and the impact of various government measures aimed at combating the harmful effects of alcohol abuse.

In the stock market, HNR shares have been virtually “frozen” at VND 12,000 per share for over five years, with no trading activity.

The concentrated shareholder structure is believed to be the reason for the stock’s lack of liquidity, with Hanoi Beer-Alcohol-Beverage Joint Stock Corporation (Habeco) holding 54.29% of the charter capital and Streetcar Investment Holding Pte. Ltd (Singapore) owning 45.57%.

Halico, established in 1898 as the Hanoi Distillery, boasts a legacy spanning over 120 years.

The company owns several brands, including Lúa mới, Nếp mới, and Vodka Hà Nội, and produces hand sanitizers and 70% alcohol solutions.

In the 2000s, Halico dominated the northern liquor market and was Vietnam’s largest vodka producer, earning hundreds of billions in profits annually. However, a 2012 smuggling scandal plunged the company into crisis.

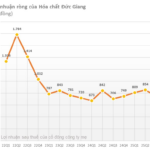

Duc Giang Chemicals Holds Over VND 12,700 Billion in Bank Deposits, Q3/2025 Net Profit Reaches VND 804 Billion

Duc Giang Chemicals reported a net profit of over 804 billion VND in Q3/2025, a 9% increase year-over-year. As of September 30, 2025, the company holds nearly 12,762 billion VND in bank deposits.