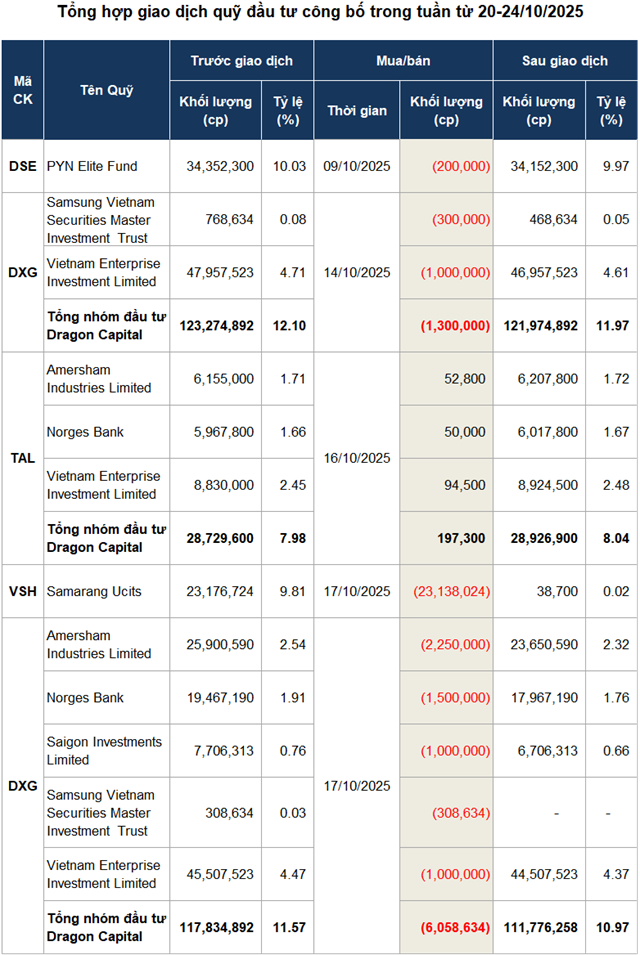

The spotlight is on Dragon Capital, which has been aggressively selling shares of DXG (Dat Xanh Group). Specifically, the foreign fund sold 1.3 million shares of DXG on October 14th and an additional 6.06 million shares on October 17th, reducing its ownership stake in the company from 12.1% to 10.97%, equivalent to 111.8 million shares.

Based on the closing prices of the two sessions, the transaction brought Dragon Capital nearly VND 164 billion.

| DXG Stock Performance Over the Past 5 Years |

Dragon Capital successfully offloaded a significant amount of DXG shares at a high price of VND 22,600 per share on October 17th, just before the stock plummeted by 12% in the following two sessions (October 20th-21st). This decline was attributed to the market’s correction after a prolonged rally since April 2025.

Similarly, Samarang Ucits, another foreign fund, executed a substantial divestment from VSH (Vinh Son – Song Hinh Hydropower). The fund sold over 23 million shares on October 17th, reducing its ownership from 9.81% to a mere 0.02%, equivalent to 38,700 shares, effectively ceasing to be a major shareholder.

In the same session, the trading volume of VSH matched the number of shares sold by Samarang Ucits, including 22.6 million shares traded via agreement at VND 903 billion and nearly 598,000 shares traded via order matching at approximately VND 26 billion. The total value of the divestment was estimated at nearly VND 930 billion.

| VSH Stock Performance from 2024 to October 24th, 2025 |

On the market, VSH shares hit the ceiling price during the foreign fund’s divestment session, closing at VND 45,550 per share. However, this was still 15% lower than the peak of VND 52,300 per share reached on March 13th.

| TAL Stock Performance from 2024 to October 24th, 2025 |

In contrast, Dragon Capital demonstrated selective buying activity. On October 16th, the fund purchased 197,300 shares of TAL (Taseco Real Estate Investment Corporation), increasing its ownership from 7.98% to 8.04%, equivalent to over 28.9 million shares.

This move came shortly after the fund bought 450,000 shares of TAL on October 8th and quickly sold 705,000 shares on October 13th, netting approximately VND 12 billion from these two transactions.

Source: VietstockFinance

|

– 07:28 October 26th, 2025

Market Pulse 23/10: Vingroup Once Again “Rescues” the Market

The afternoon session on October 23rd saw the VN-Index continue its volatile trend. At one point, it seemed poised to reclaim the 1,700-point mark, but mounting pressures forced the index to retreat, closing at 1,687 points. Despite the gains, the rally was largely driven by the influence of the Vingroup conglomerate.

How Do Investors Fare After a Memorable Stock Market Session?

Today (October 22nd), shares purchased at the market bottom during the VN-Index’s record 94-point plunge on October 20th have been credited to investor accounts and are now eligible for trading. However, hopes of quick profits through short-term trading have largely been unfulfilled for the majority.

Do Investors Profit or Lose When ‘Bottom Fishing’ in a Stock Market Plunge?

Today (October 22nd), shares purchased at the market bottom during the VN-Index’s record 94-point plunge on October 20th have been credited to investor accounts and are now eligible for trading. However, hopes of quick profits through short-term trading have largely been unfulfilled for the majority.