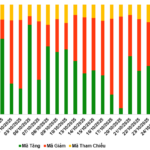

Vietnam’s stock market (VNIndex) demonstrated a positive trajectory throughout the first ten months of 2025, characterized by three distinct phases of volatility.

Initially, from the beginning of 2025 until President Donald Trump’s announcement of tariffs (with an initial rate of 46% on Vietnam), the VNIndex experienced steady growth. This was fueled by macroeconomic policies and positive earnings outlooks for listed companies.

The second phase saw a downturn as the VNIndex declined for four consecutive sessions (April 3rd – April 9th) following the tariff announcement. However, a temporary suspension of tariffs led to a strong rebound until mid-August, supported by the Vingroup stock group.

In the final phase, after a period of sideways movement, the index surged past the 1,700-point mark, driven by FTSE Russell’s upgrade of Vietnam’s stock market classification. Despite a 5.47% drop to 1,636.43 points on October 20th, the VNIndex remained nearly 37% higher than its 2024 year-end value.

Despite the significant gains, experts believe the VNIndex still has substantial upside potential.

Long-Term Growth Prospects

Speaking at the recent “Investor Day: Investing Successfully in the New Era” event, Mr. Le Anh Tuan, CEO of Dragon Capital, highlighted several factors supporting the stock market: a targeted GDP growth rate of over 10% for 2026-2030, a forward P/E ratio of 15-16 times for the VNIndex, and a projected 20% increase in listed companies’ earnings for 2026.

“1,700 points won’t be the VNIndex’s final destination,” Mr. Tuan asserted. He further noted that while J.P. Morgan’s reports on Vietnam’s stock market are typically neutral, their latest analysis expresses optimism, forecasting the VNIndex to reach 2,000-2,200 points within the next 12 months.

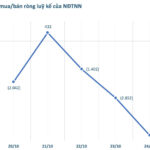

However, a persistent concern for domestic investors is the significant net selling by foreign investors, totaling 113.67 trillion VND since the beginning of the year. Mr. Le Anh Tuan advises investors to focus on moderate foreign capital inflows, as foreign transactions only account for 10-15% of the market. He believes foreign selling pressure is nearing exhaustion.

“In the short term, as index funds tracking FTSE Russell invest, we expect 1-1.5 billion USD to flow back into Vietnam’s stock market within the next year,” Mr. Tuan added.

The Dragon Capital CEO emphasizes that investors shouldn’t expect the upgrade to automatically attract foreign capital. Investments will be driven by factors like valuation, earnings growth, and a stable macroeconomic environment.

Experts also highlight the government’s commitment, through the Ministry of Finance and the State Securities Commission, to develop a transparent and sustainable stock market as a crucial factor in attracting investment.

Regulatory bodies have implemented two key initiatives: the Market Upgrade Plan and the Investor Restructuring and Securities Investment Fund Development Plan. These, along with various decrees and circulars, outline short-term and long-term strategies aimed at creating a transparent, sustainable, and internationally recognized Vietnamese stock market.

The Best Time to Invest is Now

The strong market performance in 2025 has left many individual investors, especially newcomers, wondering about the optimal entry point.

Mr. Vo Nguyen Khoa Tuan, Senior Business Director at Dragon Capital Vietnam, advises a gradual investment approach, starting immediately. “Predicting short-term market fluctuations is extremely difficult,” he says.

While short-term factors like foreign selling and profit-taking pressure exist, Mr. Vo Nguyen Khoa Tuan urges individual investors to focus on long-term fundamentals: macroeconomic stability, corporate earnings prospects, and reasonable valuations. These factors provide a solid foundation for long-term investment strategies.

He believes the stock market remains an attractive investment option for the next few years, with a positive and optimistic outlook.

Several experts suggest that for new investors, particularly those with limited time for research, a simple and effective strategy is to invest regularly in mutual funds. This allows investors to delegate investment decisions to professional fund managers who invest in stocks and bonds on their behalf.

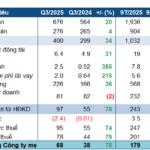

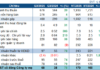

Current fund performance in the market

Regular monthly investments eliminate the need to time the market and reduce FOMO (fear of missing out). This disciplined approach promotes long-term wealth accumulation.

The future looks bright for mutual fund investment. On September 12, 2025, the Ministry of Finance issued Decision No. 3168/QD-BTC, approving the Investor Restructuring and Securities Investment Fund Development Plan.

This plan includes measures to encourage fund development, such as tax incentives for long-term mutual fund investors.

Foreign Blockades Unleash Massive Sell-Off: Net Outflow of VND 4.7 Trillion in Week 20-24/10, Contrasting Billion-Dollar Bluechip Buy-In

The record-breaking session on October 21st surprisingly saw net buying from foreign investors, but selling pressure swiftly returned with intensity in the subsequent trading days.

Revitalizing the Stock Market: The Urge for Fresh Listings and New Capital

Following FTSE Russell’s upgrade of Vietnam from frontier to secondary emerging market status, the immediate priority is to enhance both the quantity and quality of securities listed on the Vietnamese stock market. This strategic move will alleviate capital dependency on banks and significantly contribute to achieving the ambitious double-digit growth targets set for the 2026-2030 economic period.