I. MARKET TRENDS IN WARRANTS

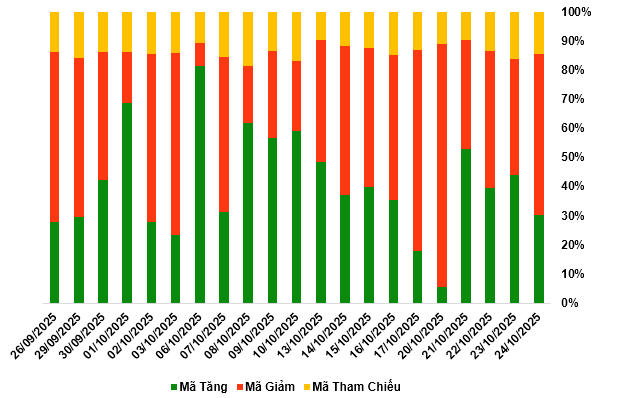

By the close of trading on October 24, 2025, the market saw 77 gainers, 140 decliners, and 37 unchanged securities.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

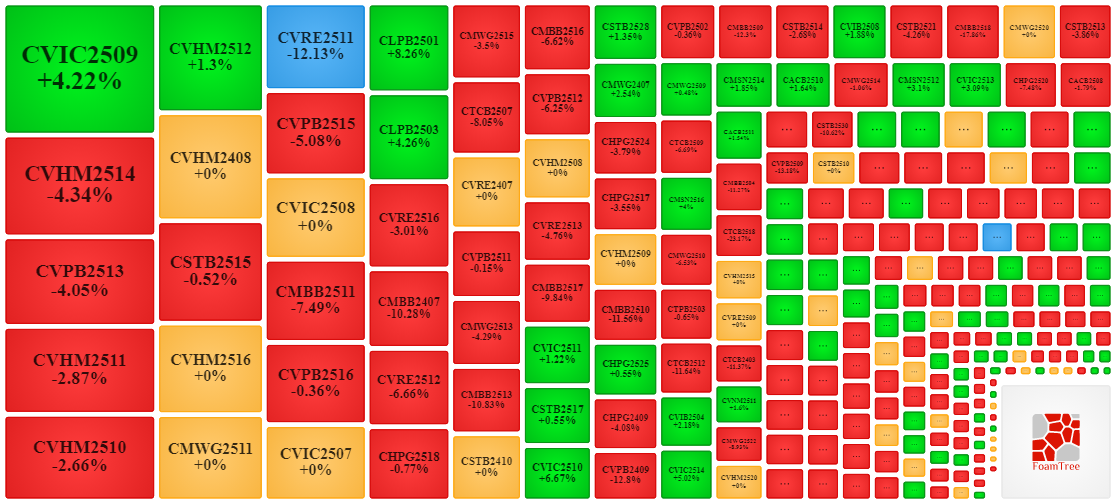

During the October 24, 2025 session, sellers regained control, driving most warrant prices downward. Notable decliners included CVHM2514, CVPB2513, CVHM2511, CVHM2510, and CSTB2515.

Source: VietstockFinance

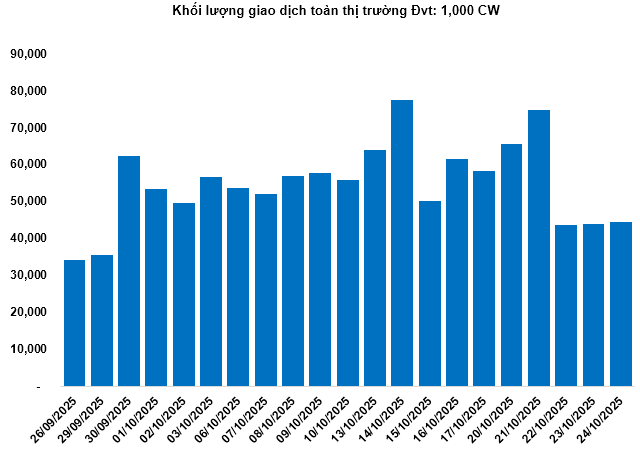

Total market volume on October 24 reached 44.33 million CW, up 0.92%; trading value hit 90.21 billion VND, down 20.91% from October 23. CMBB2518 led in both volume and value, with 2.11 million CW traded, worth 5.37 billion VND.

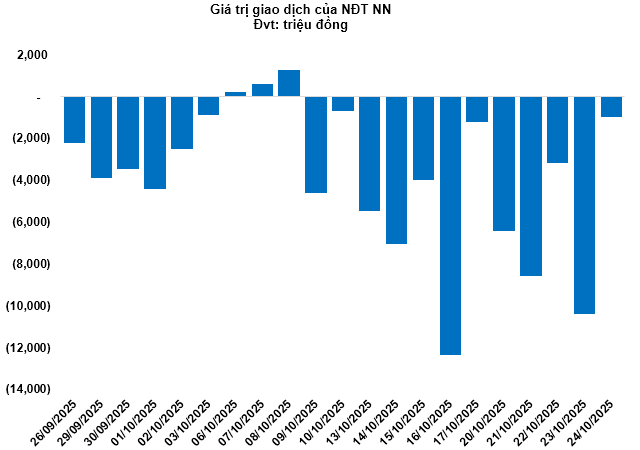

Foreign investors continued net selling on October 24, totaling over 991 million VND. CVHM2517 and CSHB2509 saw the highest net outflows. For the week, foreign net selling exceeded 29.53 billion VND.

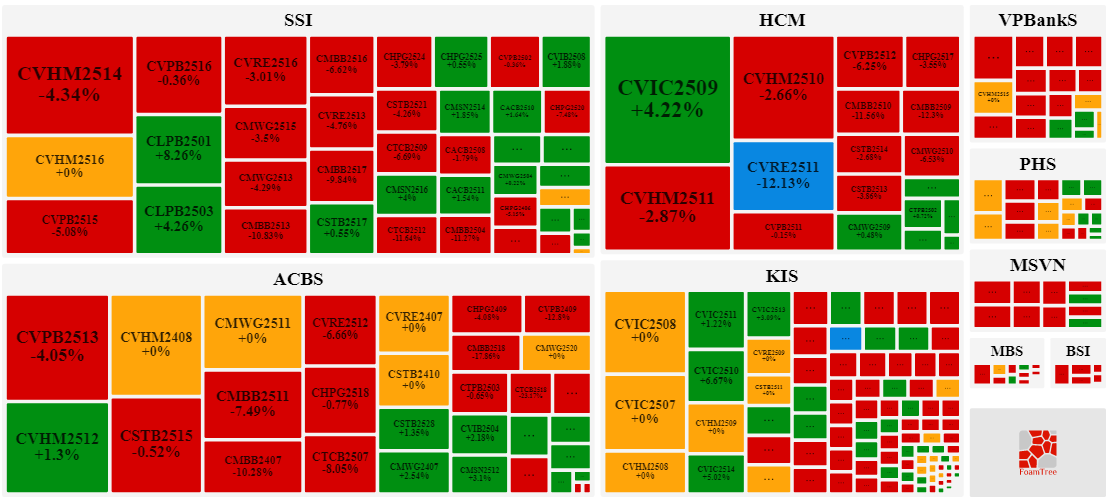

Securities firms SSI, ACBS, HCM, and KIS are the top issuers of warrants in the market.

Source: VietstockFinance

Source: VietstockFinance

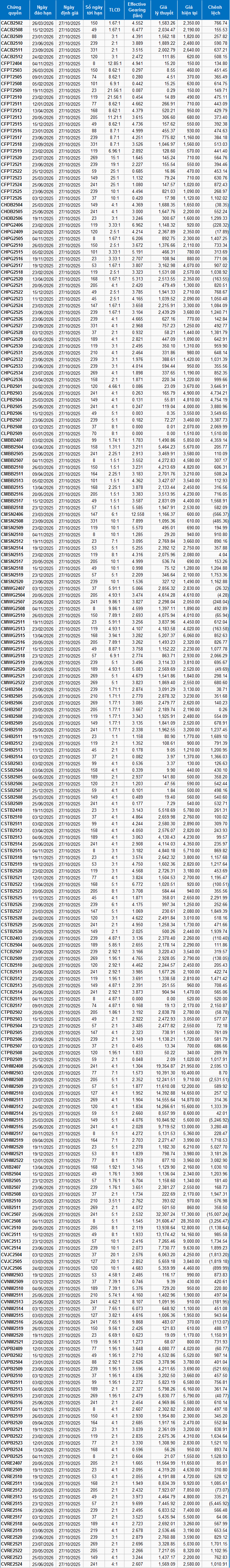

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

Using a valuation method effective from October 27, 2025, the fair prices of traded warrants are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, adjusted for warrant maturities.

According to this valuation, CVIC2507 and CVRE2515 are the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying securities. Currently, CMSN2406 and CVNM2516 have the highest effective gearing in the market.

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 17:58 October 26, 2025

Real Estate Stocks Witness Massive Sell-Off

REE Land has successfully offloaded 55,000 SGR shares of Saigon Real Estate Corporation, part of its previously registered 3 million shares for sale. This transaction follows a series of substantial share disposals by REE Land in recent times.

Market Pulse 24/10: Foreign Investors Net Sell Financial Stocks, VN-Index Closes in the Red

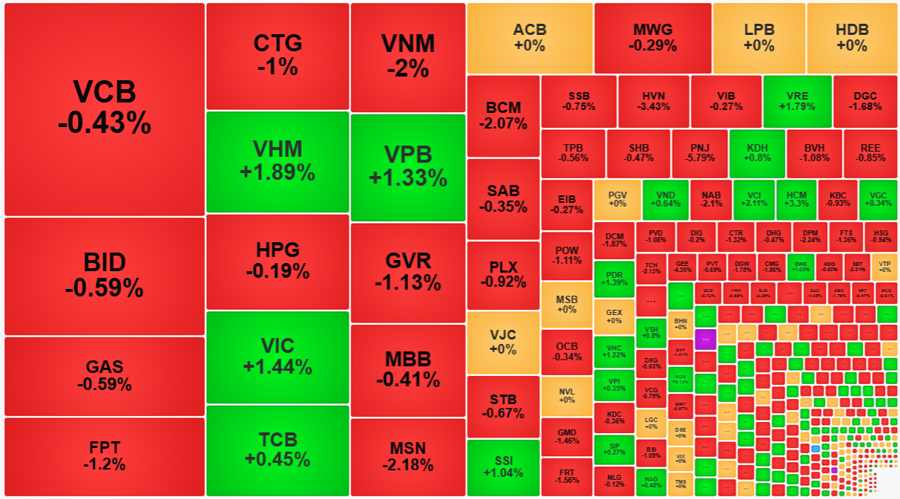

At the close of trading, the VN-Index dipped 3.88 points (-0.23%), settling at 1,683.18 points, while the HNX-Index edged up 0.5 points (+0.19%) to 267.28 points. Market breadth favored decliners, with 416 stocks closing lower compared to 291 gainers. Similarly, the VN30 basket saw red dominate, with 15 decliners, 12 advancers, and 3 unchanged stocks.

Stock Market Week 20-24/10/2025: Challenges Persist

The VN-Index paused its recovery in the final session of the week, failing to offset the sharp decline earlier and closing the week 48 points lower than the previous one. With liquidity yet to show significant improvement and foreign investors maintaining their net selling trend, downward pressure on the index is likely to persist in the near term.