Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 903 million shares, equivalent to a value of more than 27.8 trillion VND; the HNX-Index reached over 91.1 million shares, equivalent to a value of more than 2.1 trillion VND.

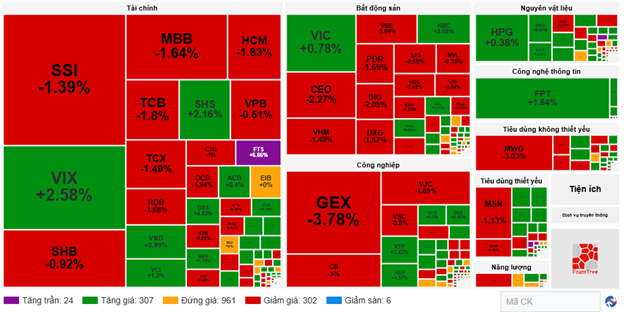

The VN-Index opened the afternoon session on a less favorable note, as the tug-of-war with a bias towards sellers continued, and sudden selling pressure caused the index to plummet sharply towards the end of the session, leaving the VN-Index closing in a rather pessimistic red. In terms of impact, VHM, VIC, TCB, and VPB were the most negatively influential stocks on the VN-Index, contributing to a 14.6-point decline. Conversely, GVR, POW, BVH, and KBC managed to maintain their green status, but their contribution to the overall index was a mere 1.4 points.

| Top 10 stocks impacting the VN-Index on October 27, 2025 (calculated in points) |

Similarly, the HNX-Index exhibited a rather pessimistic trend, with negative influences from stocks such as KSF (-3.3%), CEO (-9.74%), KSV (-3.76%), HUT (-4.17%), and others.

| Top 10 stocks impacting the HNX-Index on October 27, 2025 (calculated in points) |

Real estate was the sector with the most significant decline in the market, at 3.59%, primarily due to stocks plummeting to their floor prices, such as VHM, VRE, CEO, DIG, and other stocks like VIC (-2.28%), KDH (-3.85%), NVL (-3.5%), and TCH (-3.86%). Following closely were the non-essential consumer goods and energy sectors, with declines of 2.25% and 1.91%, respectively. Conversely, the information technology sector maintained its green status, with the strongest market increase of 0.46%, primarily driven by stocks such as FPT (+0.31%), CMG (+1.94%), ELC (+0.71%), and VEC (+14.66%).

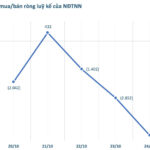

In terms of foreign trading, foreign investors continued to net sell over 1.184 trillion VND on the HOSE floor, concentrated in stocks such as SSI (578.18 billion), MBB (445.75 billion), MWG (89.71 billion), and VCI (86.08 billion). On the HNX floor, foreign investors net sold over 78 billion VND, concentrated in stocks such as CEO (31.34 billion), SHS (26.65 billion), IDC (9.62 billion), and MBS (5.5 billion).

| Foreign net buying and selling trends |

Morning Session: Striving to Regain Balance at the 1,680-Point Threshold

Recovery signals emerged towards the end of the morning session, although they were not enough to help the VN-Index regain its green status. At the mid-session break, the VN-Index was still down by more than 4 points (-0.25%), settling at 1,679.02 points; meanwhile, the HNX-Index reached 268.67 points, up by 0.52%. Market breadth was relatively balanced, with 331 gainers, 308 losers, and 961 unchanged stocks.

Among the top 10 stocks influencing the VN-Index, VHM was the most negatively impactful, deducting 1.55 points from the index. Following closely were TCB, MWG, and MBB, which further dragged the index down by over 2.5 points. Conversely, VIC, GVR, and FPT were the top contributors, adding a combined total of nearly 3 points to the overall index.

| Top 10 stocks impacting the VN-Index in the morning session of October 27, 2025 (calculated in points) |

Divergent trends dominated various sectors. On the gaining side, the information technology and communication services sectors temporarily led the market with increases of 1.73% and 1.25%, respectively, largely thanks to the positive contributions of stocks such as VEC hitting its ceiling, FPT (+1.64%), CMG (+2.84%), ELC (+1.65%); VGI (+0.98%), FOX (+0.62%), VNZ (+2.73%), CTR (+2.75%), and YEG (+2.48%).

Conversely, the energy sector was the temporary laggard, with an adjustment of over 1%, influenced by the corrections of BSR (-2.01%), OIL (-2.75%), VIP (-1.15%), and TMB (-2.04%).

The financial sector was still affected by the adjustments of stocks declining over 1%, such as CTG, TCB, MBB, HDB, TCX, SSI, SSB. However, buying demand began to increase in the securities stock group towards the end of the morning session, notably with VIX (+2.58%), SHS (+2.16%), VCI (+1.2%), ORS (+4.83%), MBS (+1.72%), DSE (+2.65%), and FTS reaching its ceiling.

Source: VietstockFinance

|

Foreign investors continued their net selling trend, with a value of over 1.1 trillion VND across all three floors. Selling pressure was concentrated heavily on two stocks, SSI and MBB, with values of 341.44 billion and 215.46 billion, respectively. Meanwhile, leading the net buying list was FPT, with a value of 115.06 billion VND, far surpassing other stocks.

| Top 10 stocks with the strongest foreign net buying and selling in the morning session of October 27, 2025 |

10:30 AM: Selling Pressure Re-emerges, Indices Universally Reverse Course

Hesitation resurfaced, causing the main indices to gradually narrow their early gains and turn negative. As of 10:30 AM, the VN-Index dropped by more than 6 points, trading around 1,676 points, while the HNX-Index fluctuated around its reference level.

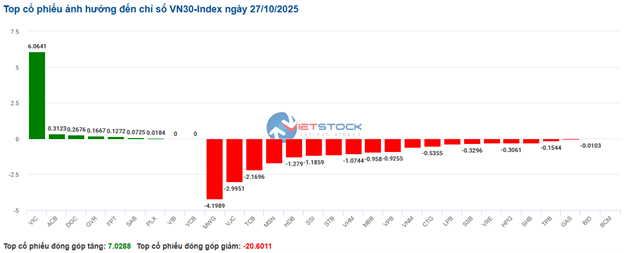

Stocks in the VN30 basket faced strong selling pressure, deducting over 20 points from the overall index. Notably, MWG, VJC, TCB, and MSN had negative impacts of 4.20 points, 3 points, 2.17 points, and 1.68 points, respectively. Following were stocks like HDB, SSI, STB, which also recorded declines. Conversely, VIC played a significant role in holding back more than 6 points for the VN30-Index.

Source: VietstockFinance

|

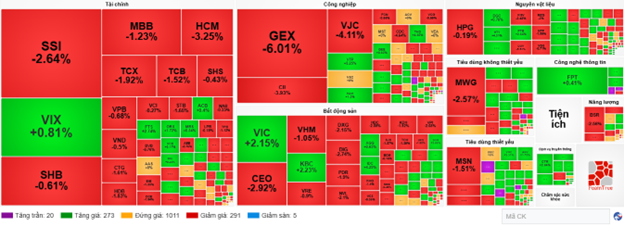

Capital unexpectedly reversed its flow out of the financial and industrial sectors, with declines of 0.9% and 0.54%, respectively, causing most stocks in these sectors to drop sharply. Specifically, SSI fell by 2.78%, HCM by 3.05%, TCB by 1.39%, TCX by 1.92%, GEX by 5.43%, VJC by 3.94%, CII by 3.56%, and others.

Additionally, although the real estate sector still recorded an overall increase of 0.34%, mainly due to the optimistic reverse trend of stocks like VIC (+2.05%), KBC (+2.37%), IDC (+4%), the overwhelming breadth still leaned towards the red, with stocks still under selling pressure such as CEO (-3.25%), VHM (-1.22%), DXG (-2.15%), VRE (-1.03%), and others.

Compared to the beginning of the session, the overall market was in a state of clear polarization, with over 1,000 unchanged stocks, and sellers seemed to have the upper hand as the number of declining stocks continued to rise to 291, while the number of stocks maintaining their green status was 273.

Source: VietstockFinance

|

Market Opening: Positive Start to the Session

At the start of the session on October 27, as of 9:30 AM, the VN-Index rose by more than 7 points, reaching 1,690 points, while the HNX-Index increased by more than 2 points, reaching 270 points.

Green dominated the morning session, with several industrial sector stocks rising positively from the beginning, such as HAH (+2.74%), VTP (+3.17%), and VSC (+2.2%).

Large-cap stocks like VIC, GVR, VCB, and VPB led the index with a combined increase of nearly 5 points. Conversely, VPL, MWG, FPT, and GEX were dragging the market down with a total decrease of over 1.3 points.

Financial stocks showed slight polarization. On the buying side were stocks like VIX (+0.97%), MBS (+0.61%), SHS (+1.3%), while stocks still under selling pressure included TCX (-0.53%), HDB (-1.07%), HCM (-1.42%), and others.

– 15:25 27/10/2025

Expert Insights: Anticipate Market Volatility Before the Next Wave – Seize Opportunities to Target High-Potential Stocks in Q4

Amidst a market undergoing a corrective phase marked by diminished liquidity, reflecting investors’ current cautious sentiment, sectors underpinned by fundamental strengths such as profit growth are poised to catalyze an early resurgence of capital inflows.

Vietstock Weekly 27-31/10/2025: Will Market Volatility Persist?

The VN-Index extended its correction into the second consecutive week, accompanied by trading volumes dipping below the 20-session average. While the decline has somewhat narrowed, a cautious sentiment persists, with demand largely exploratory and lacking the breadth required for a sustained rebound. Against a backdrop where the Stochastic Oscillator has signaled a sell and the MACD is gradually converging with the Signal Line, continued volatility is likely in the near term.

Real Estate Stocks Witness Massive Sell-Off

REE Land has successfully offloaded 55,000 SGR shares of Saigon Real Estate Corporation, part of its previously registered 3 million shares for sale. This transaction follows a series of substantial share disposals by REE Land in recent times.