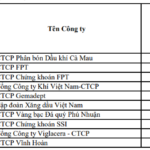

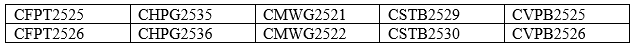

The warrants issued by MSVN are based on five (05) large-cap stocks with high growth potential, including: FPT (FPT Corporation), HPG (Hòa Phát Group Joint Stock Company), MWG (Mobile World Investment Corporation), STB (Saigon Thuong Tin Commercial Joint Stock Bank), and VPB (Vietnam Prosperity Joint Stock Commercial Bank), with maturities ranging from 6 to 9 months.

Each warrant is designed with attractive pricing and parameters, catering to the diverse investment needs of market participants.

Amid the Vietnamese stock market’s sustained positive growth since the beginning of 2025, covered warrants continue to prove their effectiveness as a leveraged financial tool for enhancing profitability.

With their low initial capital requirement and high profit potential, warrants are becoming a strategic choice for many active investors.

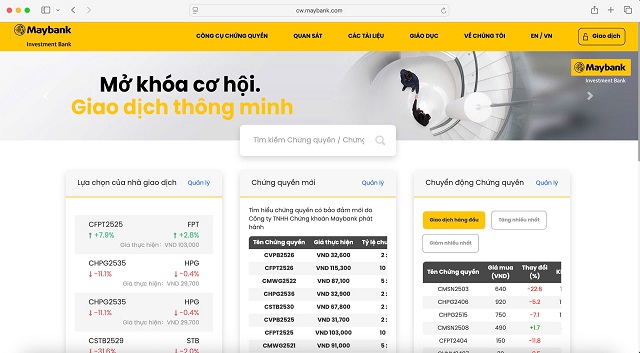

To support investors in trading warrants effectively, MSVN has developed a dedicated online platform (cw.maybank.com) with an intuitive, professional interface. The platform provides comprehensive information on technical specifications, pricing, and comparative analysis. Additionally, MSVN offers training programs, webinars, and in-depth consultations from a team of warrant experts, ensuring continuous support throughout the investment journey.

Dedicated online platform for warrants (cw.maybank.com)

|

Mr. Kim Thiên Quang, CEO of Maybank Securities, stated: “The listing of 10 warrant codes on HOSE marks a strategic milestone in the product development roadmap of MSVN and Maybank IBG in Vietnam. We aim to provide investors with flexible investment options, backed by advanced technology and a team of market experts. Leveraging Maybank IBG’s deep understanding of the Vietnamese market and regional expertise within ASEAN, we strive to be a trusted investment partner for both individual and institutional investors in Vietnam.”

Furthermore, we anticipate heightened investor interest in the stock market as Vietnam is set to be officially upgraded from a frontier market to a secondary emerging market in early September 2026, as announced by FTSE Russell.

This listing also signifies the expansion of Maybank IBG’s warrant business across four countries, including Malaysia, Indonesia, Thailand, and now Vietnam, solidifying the Group’s leadership in the ASEAN derivatives and warrant market.

Mr. Michael Oh-Lau, CEO of Maybank IBG, commented: “The launch of covered warrants in Vietnam underscores Maybank IBG’s commitment to supporting the growth of the ASEAN capital market. We focus on fostering broader market participation, enhancing liquidity, and improving investor education. With our robust network, we continue to collaborate with partners to drive the vibrancy and potential of the ASEAN investment landscape.”

List of warrant codes issued by Maybank Investment Bank (MSVN):

MSVN advises investors to thoroughly understand the characteristics, mechanisms, and potential risks of leveraged financial products before making investment decisions.

For professional and institutional investors, MSVN offers tailored investment advisory services to meet specific needs and objectives.

Detailed product information, procedures, and related documents are available at: https://cw.maybank.com

– 21:35 25/10/2025

Stock Market Week 20-24/10/2025: Challenges Persist

The VN-Index paused its recovery in the final session of the week, failing to offset the sharp decline earlier and closing the week 48 points lower than the previous one. With liquidity yet to show significant improvement and foreign investors maintaining their net selling trend, downward pressure on the index is likely to persist in the near term.

Market Outlook: Heightened Correction Pressures in Stocks for the Week of October 13–17, 2025

The VN-Index tumbled in the final session of the week, capping a week of correction with a decline of over 16 points compared to the previous week. Amidst a sharply polarized market, the weakening of leading stocks coupled with persistent net selling pressure from foreign investors continued to exert significant strain on investor sentiment.