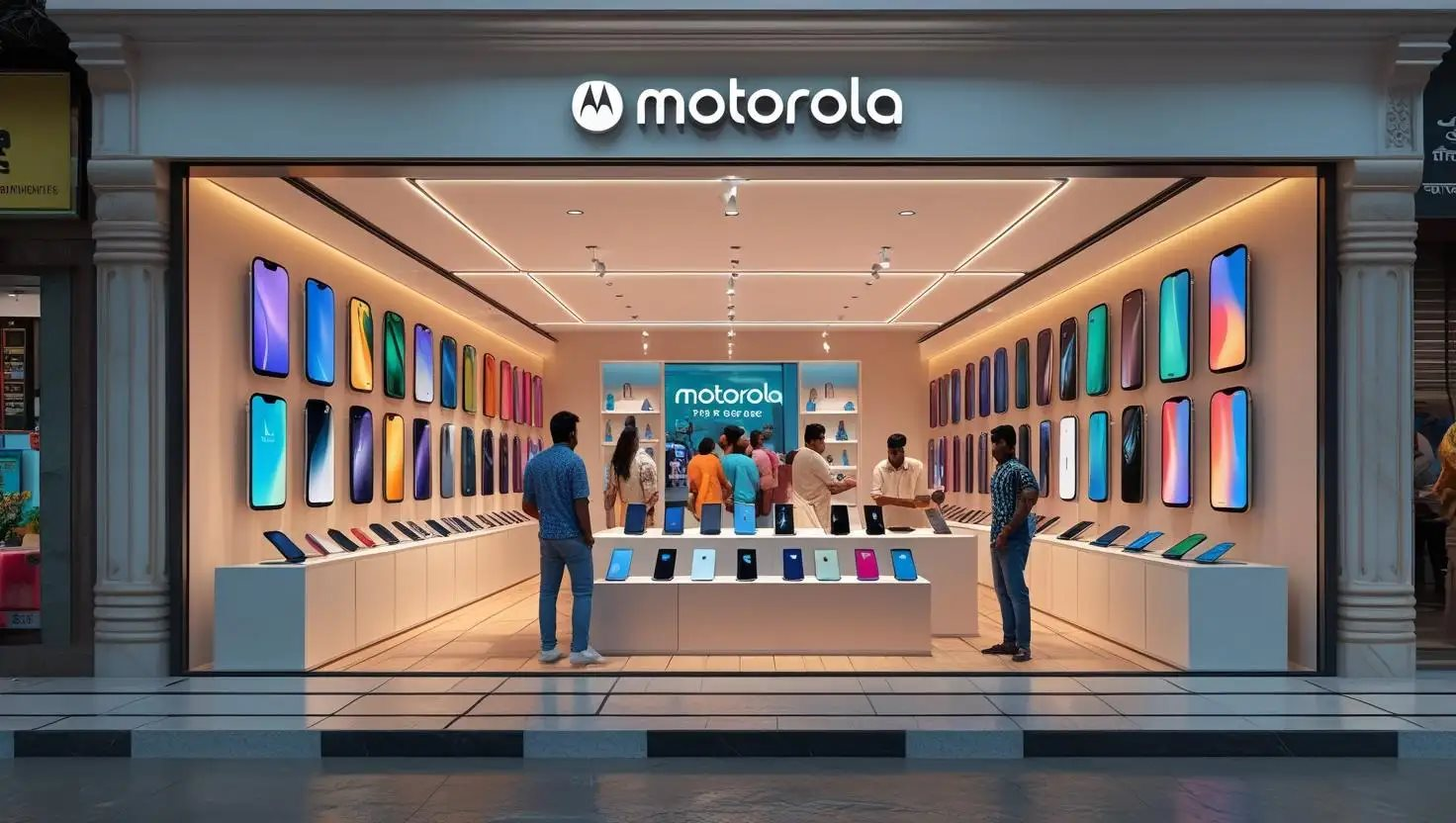

In October 2025, Vietnam’s tech market was met with a surprising announcement: Motorola, a once-iconic phone brand, officially declared its return. For many Vietnamese consumers, Motorola was as beloved as the iPhone in its heyday, symbolizing luxury, innovation, and cutting-edge mobile technology. The satisfying “snap” of the legendary Razr V3 flip phone defined class and style.

After years of seeming obscurity, operating only in the US and Europe, the company now aims to reclaim a market crowded with giants like Samsung, iPhone, and Chinese brands. This raises questions about Motorola’s strategy. Is this a well-calculated offensive or a reckless gamble?

Why is Motorola “risking” a return to Vietnam?

Motorola isn’t returning as a weakened brand seeking survival. Instead, after years of restructuring under Lenovo, it’s stronger than ever: profitable, growing robustly, and strategically focused. Previously, Motorola withdrew from unprofitable markets and cut loss-making premium segments to stabilize finances. Its past exit from Vietnam was part of this strategic retrenchment.

By 2018-2019, Motorola stabilized and began cautiously expanding, re-entering strategic markets like Japan and the Middle East. Now, after nearly a decade, it aims to “double its business size in three to four years,” targeting high-growth markets.

The 2025 Vietnam return is a key initiative, not an experiment, aimed at capturing share in one of Southeast Asia’s fastest-growing digital economies. Recent financials show a 27% YoY growth and 43% revenue increase, with strong performance across Europe, India, and Japan.

In the Americas, Motorola remains a powerhouse, holding 20% share in Latin America and ranking third in North America behind Apple and Samsung. This provides stable revenue and brand credibility. Lenovo’s support is key, offering financial backing for R&D and marketing without short-term pressure.

Serving Diverse Segments

Motorola’s spearhead is the revived Razr line, targeting the foldable phone segment. Its three-tier strategy (Razr 2025, Razr Plus, Razr Ultra) democratizes foldable tech, challenging Samsung’s single high-priced Z Flip model.

The Razr Ultra, with Snapdragon 8 Elite, 16GB RAM, and 50MP cameras, competes directly with Samsung. Premium materials (leather, Alcantara, wood) and partnerships with Pantone and Bose elevate it to a fashion accessory, crucial for style-conscious Vietnamese consumers.

The Edge series (e.g., Edge 60 Pro) targets the mid-range with flagship features at accessible prices, competing with Samsung’s A-series and Xiaomi. The Moto G series offers budget options with unique features like stylus support.

Opportunities in Vietnam

Vietnam’s smartphone market, valued at $6.71 billion in 2024 and projected to reach $11.5 billion by 2030, is ripe for challengers. The premium segment, growing from 5% to 12% market share, is Motorola’s focus.

More Than Just a Name

Motorola’s legacy gives it a head start in brand recognition and trust, reducing marketing costs. Its return is a calculated strategy, leveraging strength, timing, and a diverse product lineup. However, breaking Apple and Samsung’s dominance remains a significant challenge.

Comprehensive Joint Statement: Vietnam-U.S. Agreement on Reciprocal, Fair, and Balanced Trade

The United States of America (USA) and the Socialist Republic of Vietnam (Vietnam) have reached a consensus on the Framework for a Reciprocal, Fair, and Balanced Trade Agreement. This agreement aims to strengthen bilateral economic ties, fostering enhanced market access for each country’s exports. Building upon the longstanding economic relationship between the two nations, the Reciprocal, Fair, and Balanced Trade Agreement will expand upon existing foundations, including the U.S.-Vietnam Bilateral Trade Agreement signed in 2000 and effective since 2001.

Money Laundering Through Illicit Bank Account and Business Transactions

High-tech criminals engaging in money laundering are becoming increasingly dangerous, sophisticated, and complex, making the need for robust anti-money laundering (AML) measures in the digital economy a critical challenge for nations worldwide, including Vietnam. As Vietnam’s economy becomes more open and interconnected, the urgency to enhance risk identification and mitigation in AML efforts has never been more pressing.