I. MARKET TRENDS IN WARRANTS

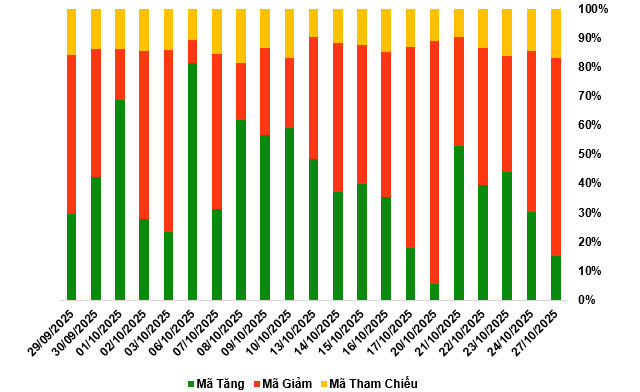

By the close of trading on October 27, 2025, the market recorded 38 gainers, 172 decliners, and 43 unchanged securities.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

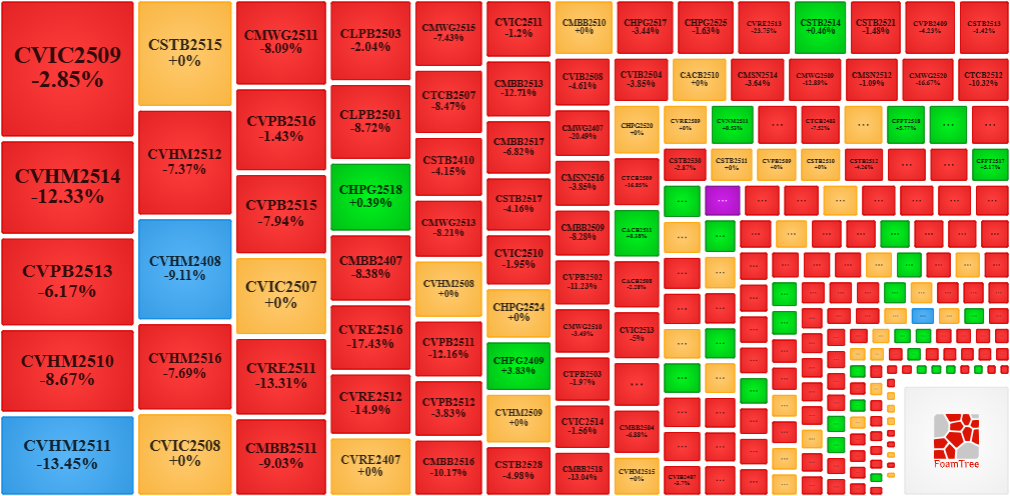

During the October 27, 2025 session, sellers dominated the market, driving down the prices of most warrant codes. Notably, the leading decliners included CVIC2509, CVHM2514, VPB2513, CMWG2511, and CVRE2511.

Source: VietstockFinance

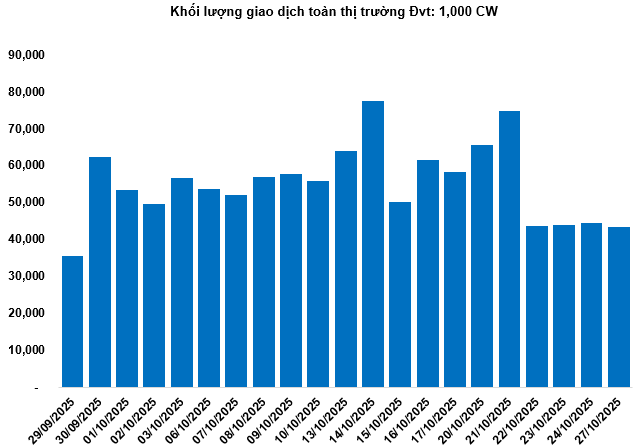

Total market volume on October 27 reached 43.49 million CW, down 1.89%; trading value hit VND 112.95 billion, up 25.2% compared to October 24. CFPT2512 led in volume with 2.65 million CW, while CVHM2514 topped in trading value at VND 10.33 billion.

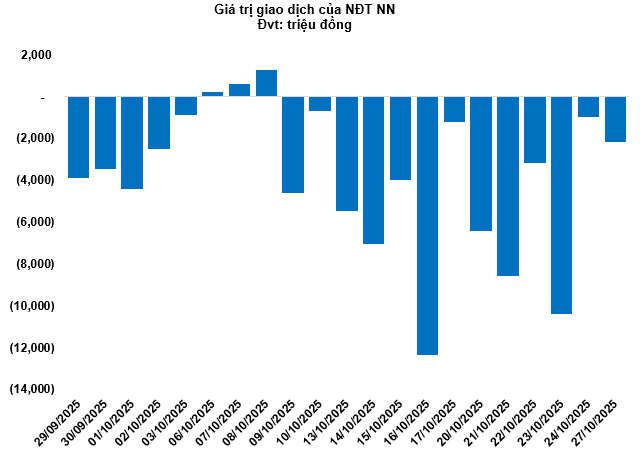

Foreign investors continued net selling on October 27, totaling over VND 2.17 billion. CVHM2522 and CVRE2523 were the most net-sold warrants.

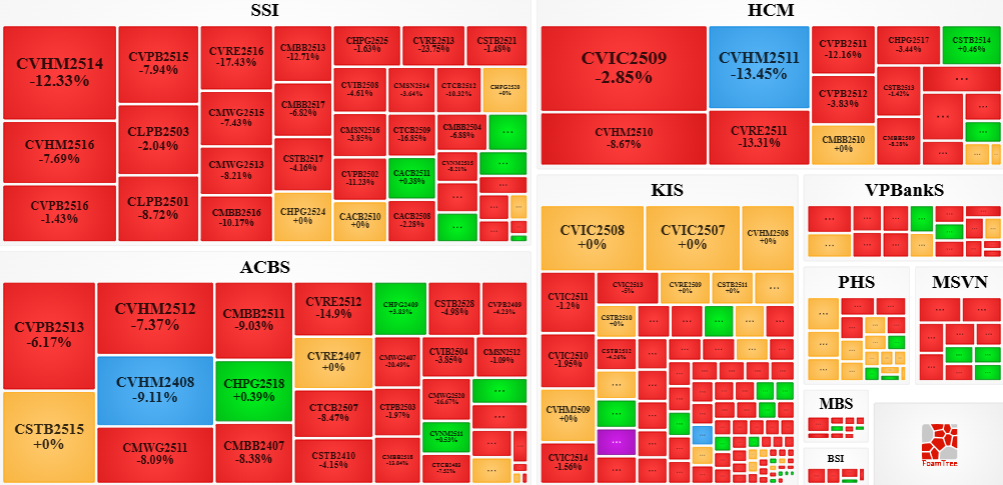

Securities firms SSI, ACBS, KIS, and HCM are currently the leading issuers with the most warrant codes in the market.

Source: VietstockFinance

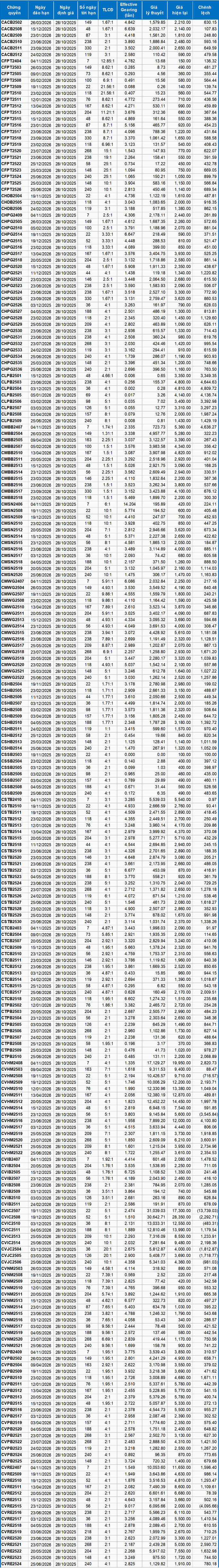

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

Based on the valuation method applicable from October 28, 2025, the fair prices of warrants currently trading in the market are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model have been adjusted to align with the Vietnamese market. Specifically, the risk-free rate (Government Treasury bills) is replaced by the average deposit rate of major banks, adjusted for the respective warrant maturities.

According to the above valuation, CVIC2507 and CVRE2515 are currently the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying securities. Currently, CMSN2406 and CVRE2515 have the highest effective gearing ratios in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:58 October 27, 2025

Construction Stocks See a Week of Inflowing Capital

In the week of October 20-24, cash flow dynamics diverged sharply across the two listed markets. One standout group demonstrated remarkable liquidity growth, with multiple representatives experiencing multi-fold increases in trading volume.

Phuong Phu Pharmaceutical’s Q3 Performance: A Step Back

Amidst declining revenues and rising production costs, Phong Phu Pharmaceutical JSC (HNX: PPP) experienced a downturn in profits during Q3 2025.