|

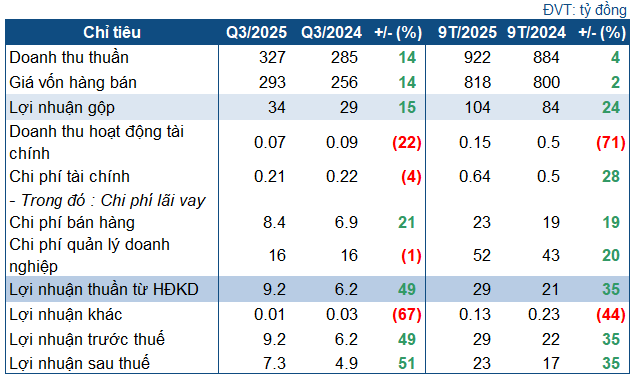

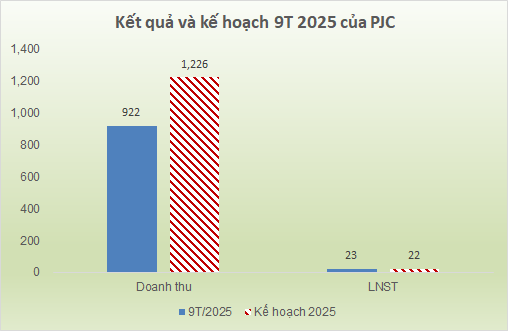

PJC’s Q3/2025 Business Targets

Source: VietstockFinance

|

In Q3, PJC recorded a net revenue of nearly VND 327 billion, a 14% increase year-over-year. The cost of goods sold also rose by 14%, reaching nearly VND 293 billion. After deductions, gross profit reached VND 34 billion, up 15%.

Among other changes, the most notable was a 21% increase in selling expenses, totaling VND 8.4 billion. Ultimately, PJC achieved a net profit of over VND 7.3 billion, a 51% increase. The company attributed this growth primarily to higher sales volumes in petroleum and transportation services in Q3/2025 compared to the same period last year, positively impacting overall business results.

For the first nine months of the year, revenue exceeded VND 922 billion, a 4% increase year-over-year, with after-tax profit surpassing VND 23 billion, up 35%. The company has achieved 75% of its revenue target and exceeded the after-tax profit plan by 5% as assigned by the 2025 Annual General Meeting.

Source: VietstockFinance

|

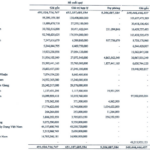

On the balance sheet, as of September 30, 2025, PJC’s total assets reached over VND 255 billion, slightly up from the beginning of the year, with VND 105 billion in current assets (up 27%). Cash holdings surged by 46%, nearing VND 42 billion.

Accounts receivable stood at VND 52 billion, a 35% increase. Inventory reached nearly VND 10 billion, up 16%. Construction in progress decreased sharply by 76% to over VND 33 billion, due to the completion of transportation vehicle investments.

On the liabilities side, total debt was VND 106 billion, up 8.6%, mostly short-term. PJC reported no financial debt (either short-term or long-term).

Transfer of Ownership to Petrolimex

Recently, Petrolimex Petroleum Service Joint Stock Corporation (PTC), PJC’s parent company, registered to sell its entire stake of over 3.74 million PJC shares (equivalent to 51.06% of the charter capital). The purpose of the transfer is to shift securities ownership due to corporate mergers. The transaction is expected to take place from October 27 to November 25.

The recipient of the transfer is identified as Vietnam National Petroleum Group (Petrolimex, HOSE: PLX), as the Group also registered to purchase the same volume and timeframe.

Previously, on October 2, Petrolimex announced the signing of a merger with PTC, a company wholly owned by the Group. PTC will merge into PLX, officially ceasing to exist. Petrolimex will inherit all assets, debts, rights, obligations, and legal interests of PTC, including ownership of PJC.

The merger is part of Petrolimex’s restructuring plan, based on resolutions approved by the Board of Directors and the Extraordinary General Meeting in 2025. The merger will not alter Petrolimex’s key information, including its charter capital (nearly VND 13 trillion), name, address, or senior management. However, Petrolimex may register additional business lines to include activities acquired from PTC. For employees, all PTC staff will be absorbed or reassigned by Petrolimex within the Group.

– 13:55 27/10/2025

Real Estate Firm Surpasses Profit Targets Through Strategic Stock Investments

Fueled by significant gains from stock investments, Nha Da Nang reported a post-tax profit of over 145 billion VND for the first nine months of the year, a 3.5-fold increase compared to the same period last year and far exceeding its annual target.

PDV Stock Set to List on HOSE as Q3 Profits Plummet

Ahead of its listing on HOSE, PVT Logistics (UPCoM: PDV) reported a sharp decline in Q3 profits, attributed to surging borrowing costs and depreciation expenses. The company cited the absence of last year’s one-time revenue as the primary reason, rather than operational inefficiencies.