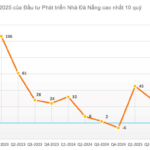

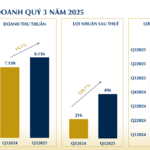

According to the consolidated financial report for Q3/2025, Danang Housing Development Investment Corporation (stock code: NDN, HNX) recorded a total revenue of nearly VND 106 billion and a post-tax profit of approximately VND 71 billion, marking a 2.1-fold and nearly 36-fold increase year-over-year, respectively.

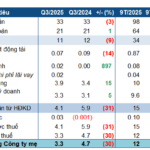

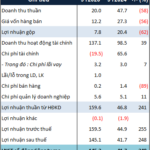

For the first nine months of the year, Danang Housing reported a net revenue of VND 20 billion, a 58% decline compared to the same period last year. After deducting the cost of goods sold, gross profit stood at VND 7.8 billion, down 61.7%.

Despite the weakening core business, a positive note is the 39% surge in financial revenue to VND 137 billion, with over VND 128 billion stemming from securities investment gains.

Additionally, NDN benefited from a reversal of over VND 53 billion in provisions for securities trading and investment depreciation, exceeding the total of other financial expenses combined.

As a result, Danang Housing posted a post-tax profit of more than VND 145 billion for the nine-month period, 3.5 times higher than the same period last year. This outcome significantly surpasses the annual profit target of VND 44.3 billion.

As of September 30, 2025, Danang Housing’s total assets reached VND 1,309 billion, a 2% increase from the beginning of the year.

Cash, cash equivalents, and bank deposits rose by 6% to VND 295 billion.

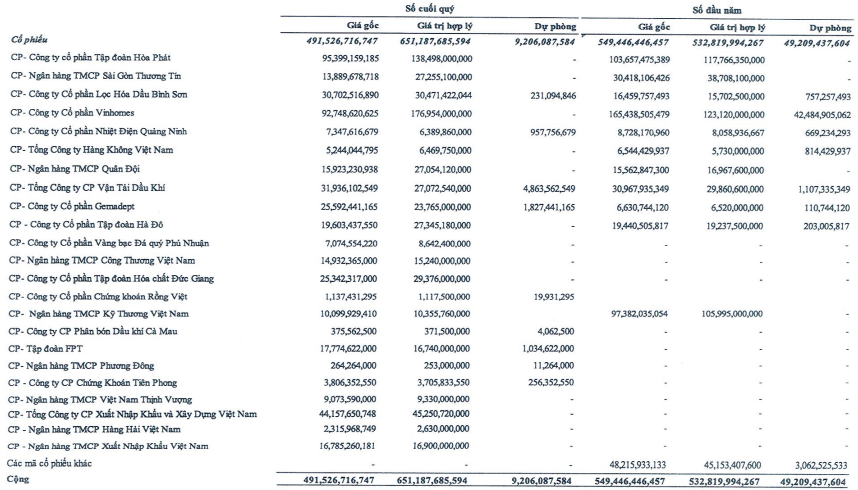

Investments in trading securities decreased by 11% to nearly VND 492 billion. Portfolio restructuring led to a significant reduction in provisions from VND 49 billion to VND 9 billion.

The portfolio reveals that Danang Housing is invested in over 23 stocks, with allocations ranging from a few hundred million to under VND 100 billion. Notable holdings include:

HPG, with a principal value of VND 95 billion, down 8% year-to-date, and a temporary gain of 45%. VHM, with a principal value of nearly VND 93 billion, down 43% year-to-date, and a temporary gain of 90%.

Stocks such as DGC, FPT, VPB, VCG, EIB, and CTG have newly entered the portfolio, whereas they were not recorded at the beginning of the year.

Danang Housing’s stock investment portfolio as of September 30, 2025

Regarding capital structure, total liabilities decreased by half compared to the beginning of the year, amounting to VND 94 billion. Short-term payables declined by 85% to nearly VND 18 billion, primarily due to the absence of a VND 43 billion maintenance fee payable for the Monarchy B apartment project.

Short-term customer advances and unearned revenue totaled approximately VND 15 billion. The company does not utilize financial leverage.

Company Profits Surge 36-Fold After Cashing in on Vinhomes Shares

This marks the highest result achieved in the past 10 quarters, surpassing all records since Q2 2023.

Real Estate Firm Sees 36x Profit Surge in Q3 Amid Bullish Stock Market

Financial revenue soared in Q3/2025 as CTCP Đầu tư Phát triển Nhà Đà Nẵng (HNX: NDN) capitalized on a buoyant stock market. The company reported consolidated revenue and after-tax profit of nearly VND 106 billion and VND 71 billion, respectively—a 2.1x and 36x surge compared to the same period last year. This marks NDN’s most profitable quarter since Q2/2023, with the VND 71 billion profit standing as a record high.

PNJ Surpasses 25 Trillion VND in 9 Months, Profit Growth Sustained Despite Weak Consumer Demand

Amidst a challenging market where jewelry demand has waned due to soaring gold prices, Phu Nhuan Jewelry Joint Stock Company (HOSE: PNJ) has impressively sustained its profit growth over the first nine months. This resilience is primarily attributed to its core retail jewelry segment, which continues to deliver robust profit margins.