At a recent real estate seminar, Mr. Nguyễn Quốc Anh, Deputy General Director of Batdongsan.com.vn, highlighted growing concerns about speculative investments. “We’ve observed that during the recovery phase, investors have shown a heightened interest in asset types that prioritize cash flow rather than speculative gains,” Mr. Quốc Anh noted.

When macroeconomic, political, and policy factors create a sense of stability, investors gradually shift their focus toward speculative assets like land or vacation properties. Over the past two years, markets such as Hanoi, Da Nang, and now Ho Chi Minh City have rebounded, primarily driven by apartment and house sales. However, land prices experienced only one significant surge—during the merger rumors late last year and early this year.

Comparing September last year to April this year, all property types have recovered, except for land, which saw a 22% nationwide decline. This trend underscores that despite widespread concerns about speculation, the most speculative asset—land—is currently underperforming.

Mr. Nguyễn Quốc Anh, Deputy General Director of Batdongsan.com.vn.

“This cycle appears to defy traditional economic patterns. Typically, during credit expansion, riskier assets surge more rapidly. However, in the current cycle, gold has risen sharply alongside real estate and stocks. This suggests investors, despite seeing growth, still feel uncertain about market stability.

They remain cautious, diversifying into gold while favoring assets with stronger cash flow over purely speculative ones,” Mr. Quốc Anh explained.

In its Q2 and Q3 reports, Batdongsan.com.vn will focus on the polarization in investor preferences, emphasizing cash flow-driven assets. “We often view speculation negatively, but every market requires a balance between investors and speculators. A market dominated solely by investors lacks short-term liquidity, while one driven purely by speculation becomes unsustainable,” he added.

Mr. Quốc Anh advocates for a balanced approach, with a higher proportion of investors over speculators. He also cautions against labeling speculation as inherently harmful.

Drawing on international examples, he suggests implementing progressive capital gains taxes on real estate transactions. In Japan, for instance, selling a property within five years incurs a 39% tax, while sales after five years are taxed at 19%.

Vietnam could adopt a similar model, taxing sales within 3–5 years at 15% and reducing it to 5–7% for longer holdings. Such policies could reshape consumer behavior in real estate asset retention.

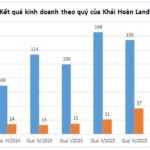

Explosive Revenue Growth: Khải Hoàn Land Achieves Remarkable Quarterly Performance

In Q3/2025, Khai Hoan Land Corporation (HSX: KHG) reported a significant surge in both revenue and profit compared to the same period last year, marking a robust financial performance.

₫6.8 Trillion in Real Estate Bonds Maturing in October, Led by Vinhomes, Phu My Hung, and Cen Land

According to FiinRatings, in October 2025, real estate companies are set to face a significant bond maturity milestone, with approximately VND 6.8 trillion in bonds due. This substantial figure is predominantly concentrated among industry leaders such as Vinhomes, Phu My Hung, and Cen Land.