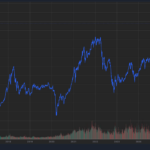

Last week, the stock market experienced dramatic volatility, marked by a historic plunge—shedding nearly 95 points (over 5%) with numerous stocks hitting their lower limits. Many investors are still reeling as months of accumulated gains were wiped out in a single week.

The VN-Index rebounded in the final sessions, closing at 1,683 points—a 2.77% weekly decline, retreating from the psychological 1,700-point threshold. Meanwhile, the VN30 index ended the week down 1.65% at 1,944 points.

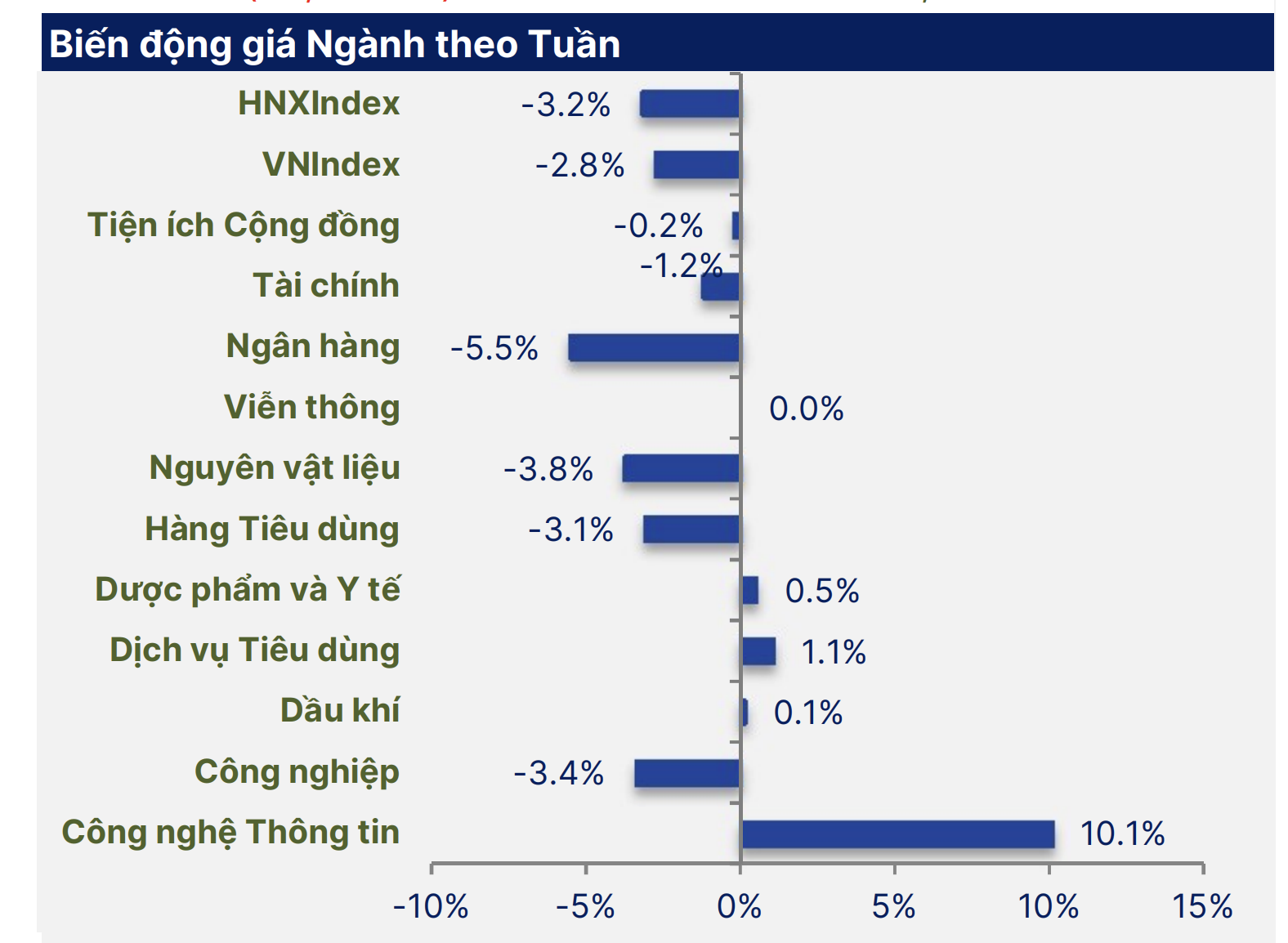

Capital Flow Shifts to Tech Stocks

Amid last week’s market correction, selling pressure spread across multiple sectors, leaving many investor portfolios in the red. Those who chased the rally near the VN-Index’s 1,790-point peak two weeks ago now face significant losses, with some fearing margin calls.

According to Người Lao Động reporters, capital is shifting from sectors that previously rallied—such as securities, banking, seafood, ports, and construction—to technology, telecom, and retail stocks. These sectors had corrected earlier and reported strong Q3 2025 earnings. Foreign investors extended their selling streak to 14 weeks, offloading over VND 4.3 trillion on HOSE.

Nguyễn Thái Học, an analyst at Pinetree Securities, noted that Vietnam’s stock market faced one of its most turbulent periods in months. Following the Government Inspectorate’s revelations of bond issuance violations by banks and firms, investor sentiment soured, triggering the VN-Index’s sharpest single-day drop in history—over 94 points.

Next week’s stock market is forecast to continue its recovery.

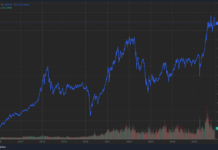

“A silver lining emerged as strong bottom-fishing demand resurfaced, propelling the VN-Index’s recovery. Buying focused on tech, real estate, and select stocks with unique catalysts. Notably, FPT surged after a prolonged correction, alongside Viettel’s VTP and CTR. Vingroup stocks also rallied, with VIC hitting an all-time high and VHM, VRE stabilizing,” Học added.

Experts highlight a notable capital shift: blue-chip and banking stocks cooled, while speculative funds moved to tech, Viettel, real estate, and chemical sectors following the week’s steep decline.

“I’ve noticed the shift to tech stocks, but my portfolio remains heavy in real estate and securities. With many holdings underwater, I can’t reallocate yet,” said Nam Hoàng, an investor in Ho Chi Minh City.

What Should Investors Do After Chasing the Peak?

For investors caught chasing the peak, Nguyễn Thành Trung, CEO of FinSuccess Investment, views the current downturn as a temporary technical correction (under 10%). Short-term losses are possible amid rapid intraday volatility.

“Investors shouldn’t try to time peaks or bottoms. Maintain a risk-aligned portfolio. I keep stocks at 80%+ and cash at 20% max, even in bearish markets. Focus on fundamentally strong stocks benefiting from sector trends and macro policies for sustainable returns,” Trung advised.

Tech stocks unexpectedly surged last week. Source: SHS

SJE Cancels Sale of Nearly 2.3 Million Unsold Shares

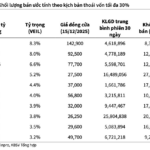

Song Da 11 JSC (HNX: SJE) has announced the results of its public offering of over 18.1 million shares. The company successfully distributed more than 15.8 million shares at a price of VND 13,000 per share, while approximately 2.3 million shares remained unsold and were subsequently canceled.

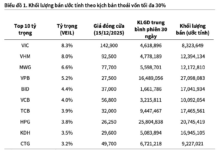

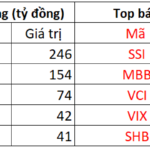

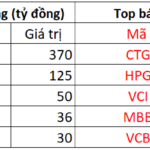

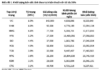

Surge in Brokerage Firm’s Proprietary Trading: One Stock Witnessed Unexpected Net Buying Spike on September 23rd

Proprietary trading firms recorded a net purchase of VND 61 billion on the Ho Chi Minh City Stock Exchange (HOSE), signaling a significant shift in market dynamics. This substantial investment underscores growing confidence in the bourse’s potential, as traders capitalize on emerging opportunities within Vietnam’s vibrant financial landscape.