The Securities Sector – A Highlight in the New IPO Cycle

VNDirect predicts that most IPOs in the second half of 2025 and the first half of 2026 will focus on the securities sector, an industry benefiting significantly from economic growth, low interest rates, and market upgrade news. Three major offerings from TCBS, VPBankS, and VPS are expected to raise approximately $1 billion for the market.

This comes as Vietnam has been upgraded to an emerging market by FTSE Russell, with the number of securities accounts surpassing 11 million, indicating a growing demand for investment and trading. According to VNDirect, large-scale capital raising will enable leading securities firms to strengthen their financial capabilities, expand margin lending, invest in technology, and enhance operational efficiency.

These high-profile IPOs also intensify competition within the industry, driving restructuring efforts. Currently, Vietnam’s securities market is led by two main groups: (1) companies within the banking ecosystem and (2) independent securities firms.

VNDirect observes a clear trend of banks expanding into the securities sector, aiming for a “financial conglomerate” model encompassing banking, securities, and insurance. Notable deals include SeaBank’s acquisition of ASEAN Securities, Sacombank’s investment of VND 1.5 trillion to own over 50% of a securities firm, and MSB’s planned acquisition of Stanley Brothers, highlighting the formation of securities firms within banking ecosystems.

From 2025 to 2030, VNDirect anticipates that companies like LPBS, ACBS, and HDBS may pursue IPOs to meet capital needs, reduce reliance on parent banks, and capitalize on potential MSCI upgrades. Backed by capital, financial costs, and a large customer base from parent banks, this group holds a distinct advantage, particularly in brokerage services.

However, independent securities firms retain unique strengths, such as experience across market cycles, flexible strategies, a network of domestic and international institutional clients, and deep expertise in investment banking (IB) and asset management. These areas hold significant potential as IPO activity increases and the middle class expands.

VNDirect believes that companies with strong capital foundations, substantial investments in technology, artificial intelligence (AI), and Open Finance models will maintain a competitive edge. Conversely, smaller firms with weak capital and market share may face elimination, potentially leading to M&A activity within the sector.

New Valuation Standards for Securities Stocks

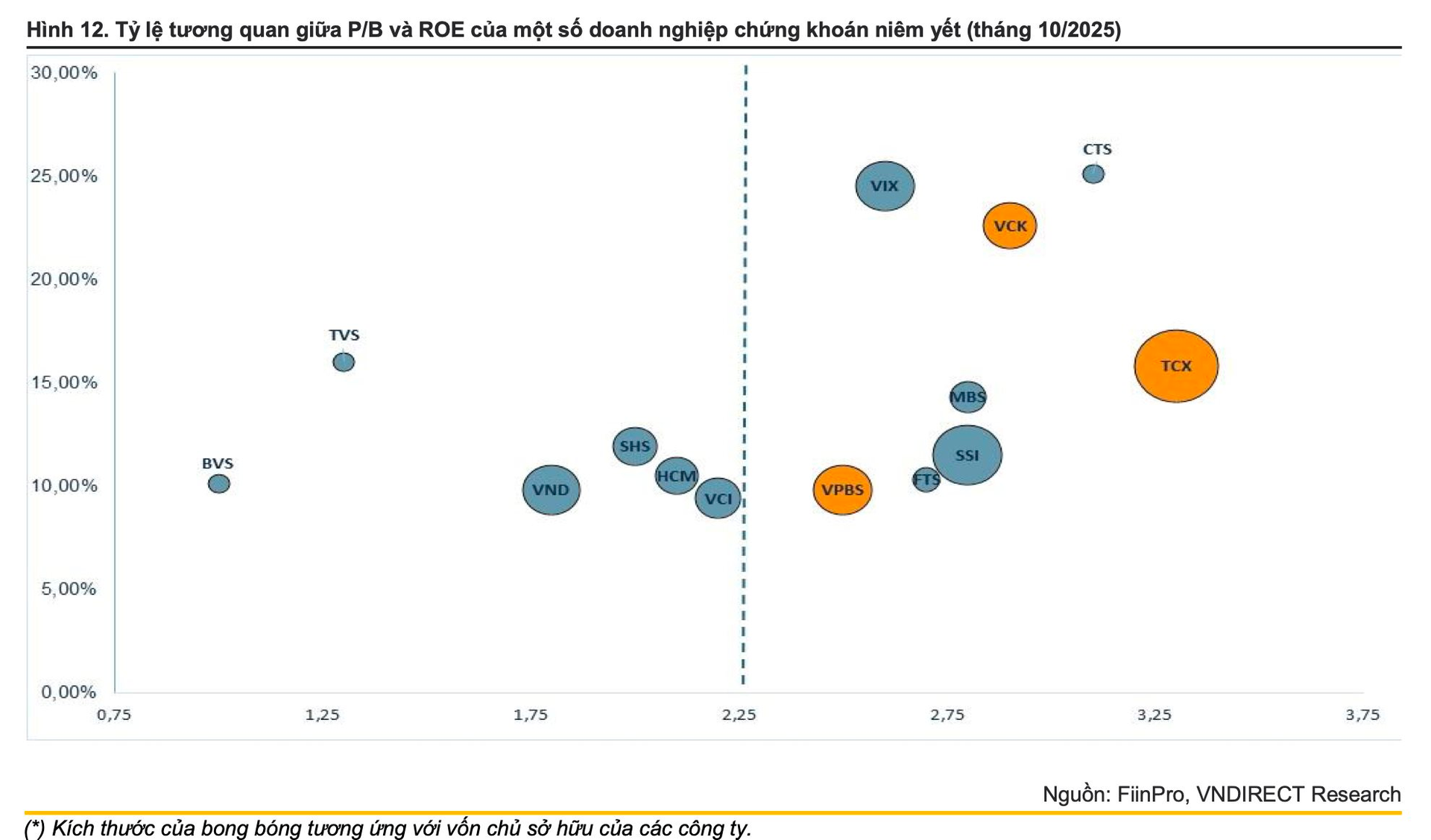

VNDirect suggests that the major IPOs of TCBS, VPBankS, and VPS will act as a “catalyst for industry-wide revaluation.” Despite initial P/B valuations higher than the industry average of 2.2x, these offerings have seen strong demand from institutional investors.

For instance, TCBS’s IPO at a P/B of 3.3x was oversubscribed by 2.5 times, while VPBankS received registrations totaling VND 6 trillion, equivalent to 50% of the offering value, from major funds like Dragon Capital and VIX.

According to VNDirect, these high valuations are justified given the robust growth of Vietnam’s securities market. Following the FTSE Russell upgrade and anticipated MSCI upgrade in 2027–2028, liquidity and investor numbers are expected to surge, supporting sustainable profit growth for securities firms.

Historically, during favorable periods like 2021, when interest rates were low, the industry’s average ROE reached a record high, pushing the sector’s P/B to 3.2x. With a similarly positive macroeconomic environment today, VNDirect expects leading firms to maintain an ROE of 15–20% in the coming years, a key factor for market acceptance of higher valuations.

Additionally, IPO-bound securities firms boast large capital bases, leading market shares, and advantages from their banking ecosystems. Their leadership in digital technology, digital brokerage models, and WealthTech solutions, coupled with cost optimization and high profitability, make them attractive to long-term investors.

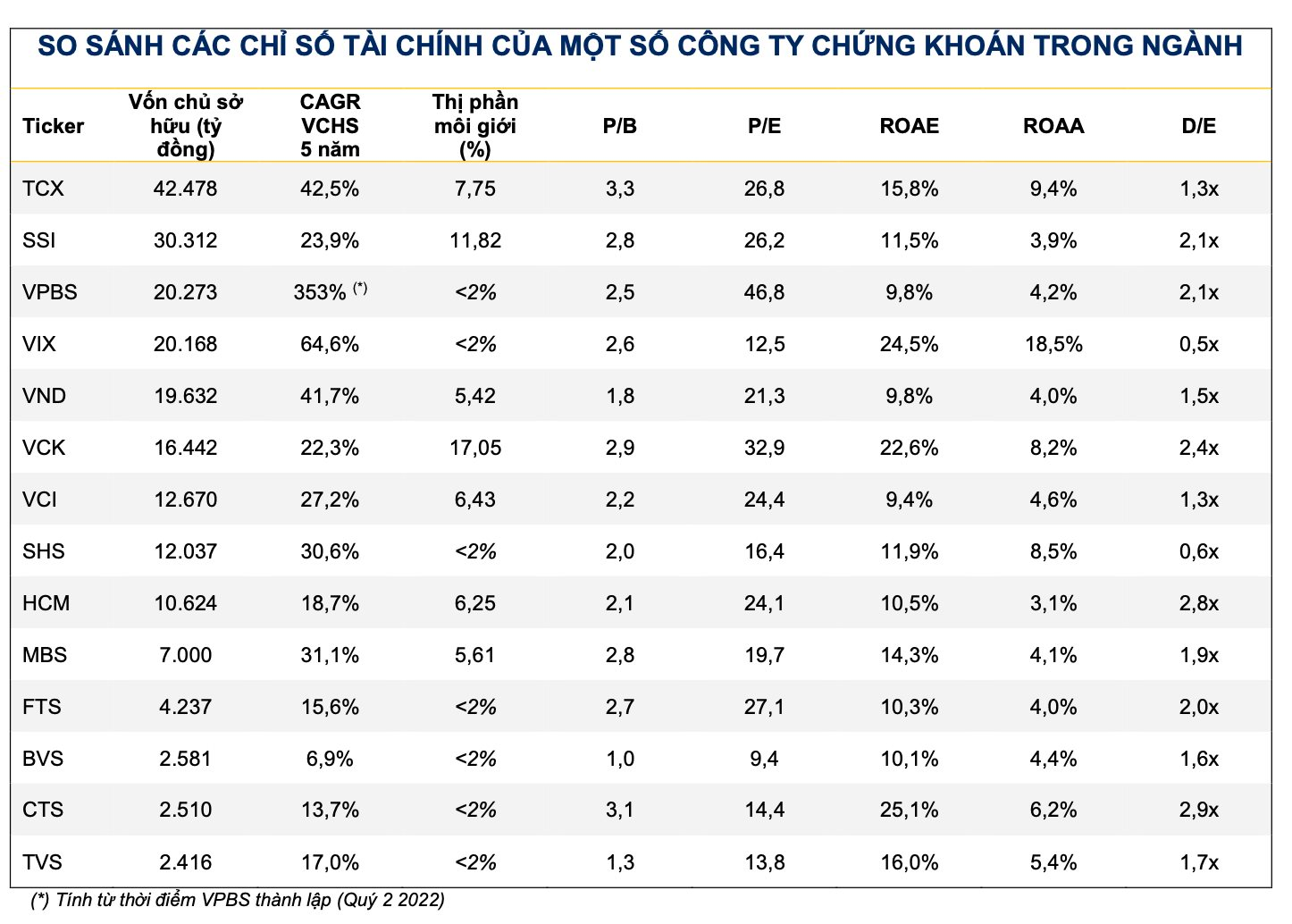

VNDirect predicts that once TCBS, VPBankS, and VPS list at high P/B ratios, the market may establish a “new price benchmark,” pushing the industry’s average P/B from 2.2x to around 2.5x. However, this revaluation will lead to significant differentiation.

Specifically, VNDirect believes that listed companies with large equity, high capital growth rates (linked to margin lending and bond investment expansion), strong customer market shares, effective digital and AI strategies, cost optimization, and P/B ratios below 3.0x with stable ROE (e.g., SSI, VND, HCM, VCI) may be revalued more favorably.

In contrast, firms with weak capital, low ROE, and insufficient market share may lag behind. This revaluation process will accelerate, especially as new capital, particularly foreign investment following market upgrades, seeks assets with strong market positions, robust strategies, large equity bases, and attractive valuations.

MSN Tops ETF Buy List in Q4 Rally

According to SSI Research, during the Q4/2025 portfolio rebalancing, Masan (HOSE: MSN) is forecasted to rank among the Top 3 stocks with the strongest net buying by ETFs. Additionally, it is expected to enter the Top 10 of the STOXX Vietnam Total Market Liquid Index, a benchmark widely replicated by international investment funds.

Where Does the Massive Capital from High-Profile IPOs Ultimately Flow?

The stock market is entering an unprecedentedly vibrant phase following a period of scarcity, as numerous companies, particularly in the securities sector, are launching initial public offerings (IPOs) worth trillions of dong. With such massive capital influx post-IPO, the question arises: how will these funds be utilized, and will the securities industry’s cash flow face dilution amid the recent surge in IPO activities?