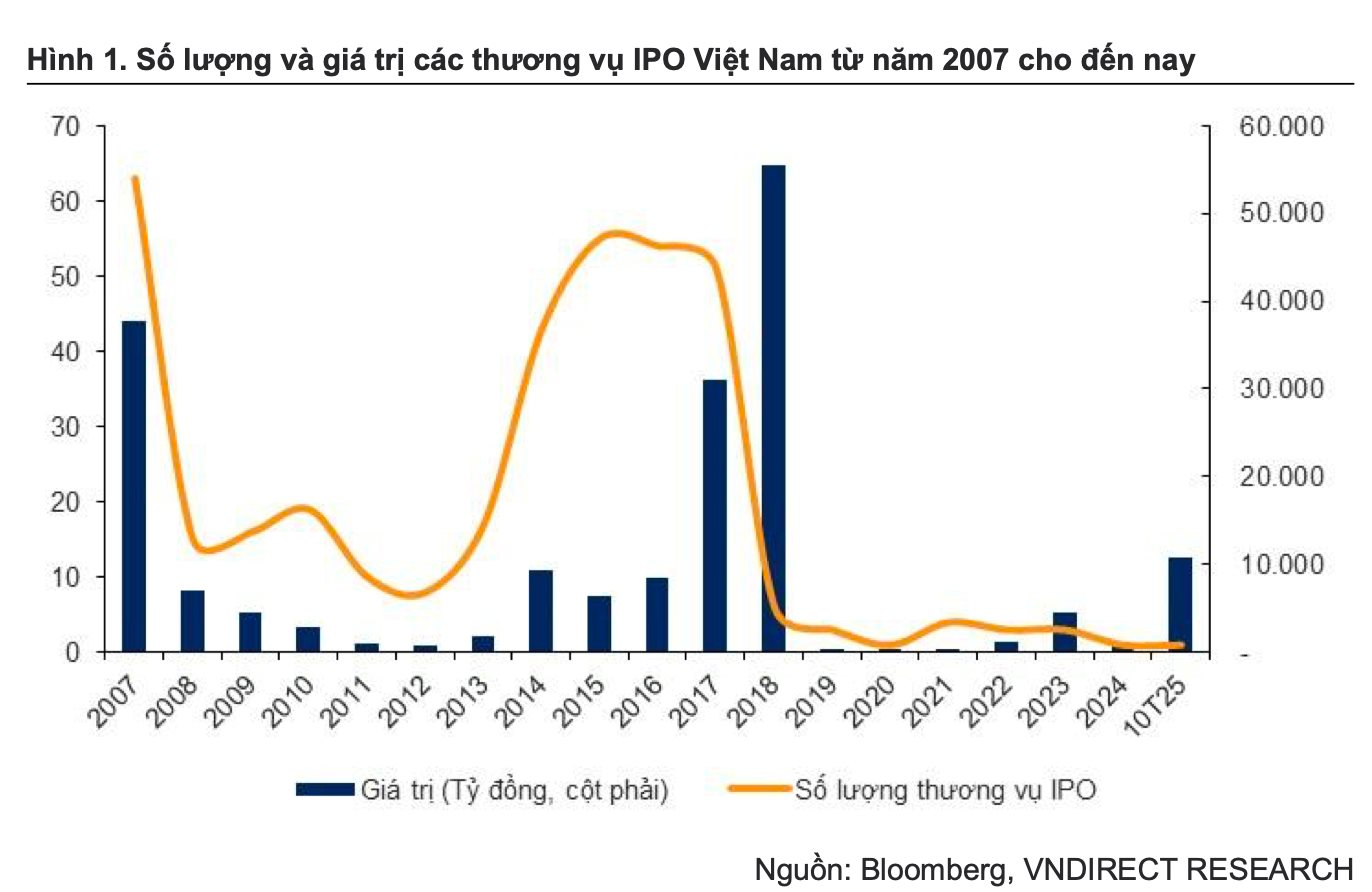

According to a recent report by VNDirect Securities, Vietnam’s stock market has witnessed two notable IPO booms in the past and is now gearing up for a new wave expected to flourish from 2025 onward.

The first IPO wave occurred in 2007, marking a peak in the number of listed companies with 63 enterprises going public, totaling $2.55 billion. This period also represented the early development phase of Vietnam’s stock market, where corporate governance, information disclosure, and investor protection policies were still rudimentary and not given adequate attention. IPO activities at that time primarily focused on transforming state-owned enterprises into joint-stock companies.

Notable transactions during this phase included Vietcombank (VCB), Vietnam Insurance Corporation (BVH), Phu My Fertilizer (DPM), and PetroVietnam Finance Corporation (PVI).

The second IPO wave took place between 2017 and 2018, considered the golden era of IPOs in Vietnam, characterized by a surge in both scale and quantity.

Growth was driven by two key factors: first, the continued divestment from large state-owned enterprises such as PetroVietnam Power Corporation (POW), PetroVietnam Oil Corporation (OIL), and Binh Son Refining and Petrochemical Company (BSR); and second, the rise of leading private conglomerates like Vinhomes, Vincom Retail (VRE), Techcombank, and HDBank.

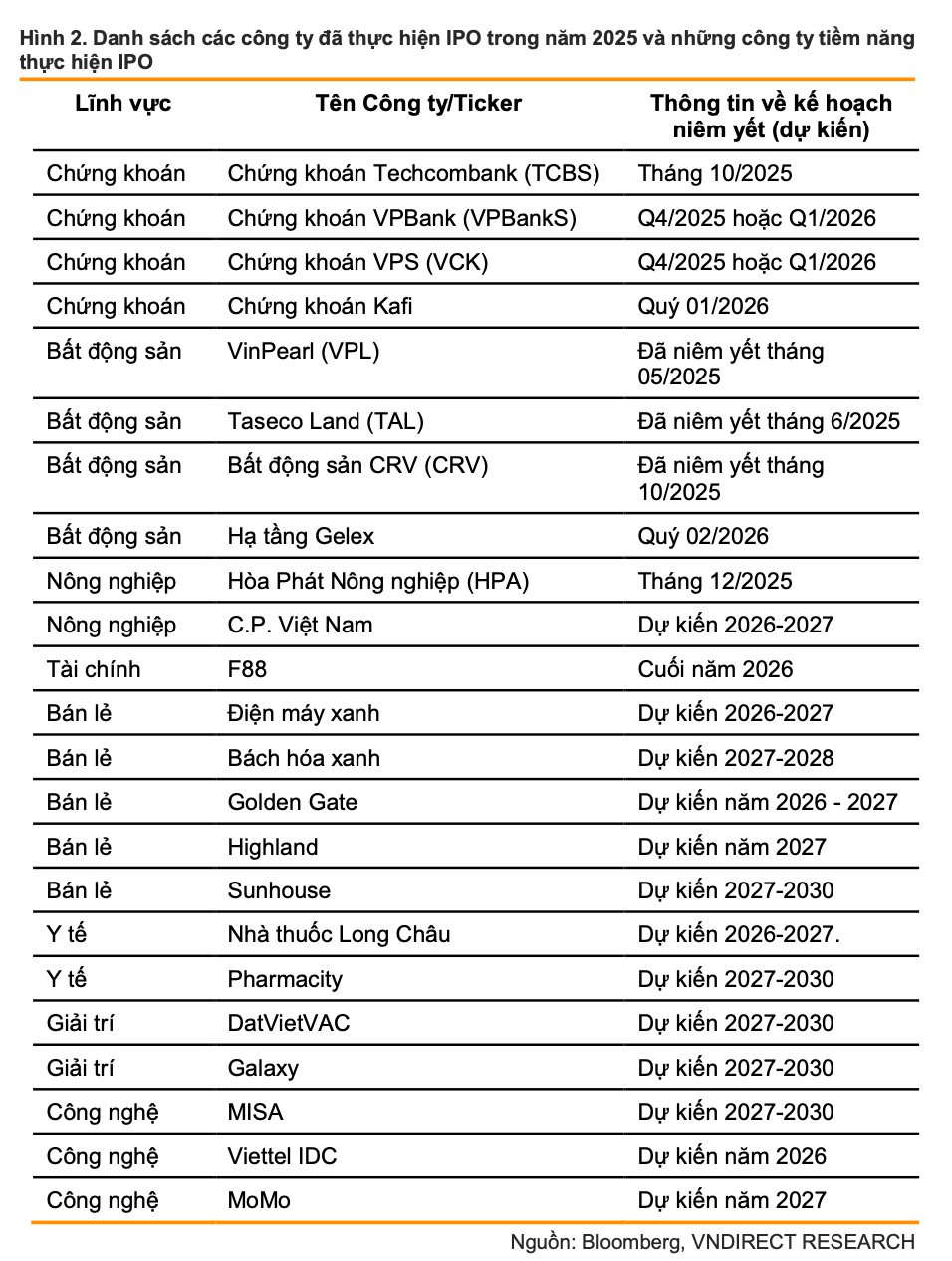

As we approach 2025, a stable macroeconomic foundation coupled with converging catalysts is paving the way for a new IPO wave. After a prolonged lull, IPO activity is projected to rebound strongly, initiating a fresh cycle with a diverse portfolio of potential deals across various sectors. Notable enterprises include consumer sector leaders like Highlands and Golden Gate; financial services players such as TCBS, VPBankS, VPS, and F88; entertainment companies like DatvietVAC; technology firms including Misa and VNLife; and real estate developers such as VPL, TAL, and Viettel IDC.

Drivers of the IPO Wave

VNDirect identifies seven key drivers propelling the resurgence of IPOs in 2025. First, a stable macroeconomic environment coupled with accommodative monetary policies both domestically and internationally. Second, Vietnam’s upgrade to “secondary emerging market” status by FTSE Russell, unlocking significant foreign capital inflows.

Third, an increasingly robust policy framework enabling better corporate governance pre-listing. Fourth, more flexible regulations on foreign ownership limits and free-float ratios. Fifth, continued divestment mandates for state-owned enterprises, supplying high-quality stocks to the market.

Sixth, streamlined administrative procedures for IPOs alongside enhanced post-IPO investor protection measures. Lastly, the readiness of technical infrastructure, particularly the implementation of the new KRX trading system, ensuring more efficient and transparent market operations.

Vietnam’s Stock Market Post-Upgrade: New Opportunities, New Challenges

Following its official upgrade by FTSE Russell, Vietnam’s stock market is entering a transformative phase, marked by heightened expectations for foreign capital inflows, improved asset quality, and enhanced trading infrastructure. However, this evolution also brings new demands for transparency and governance capabilities.

Vietnam’s Securities Regulator Outlines Market Development Roadmap Post-Upgrade

On October 16, 2025, the State Securities Commission (SSC) of Vietnam, in collaboration with the JICA Project, hosted a conference in Ho Chi Minh City titled “Dissemination of Amendments and Supplements to the Securities Law and Detailed Implementing Regulations” for the Southern region. During the event, a key question emerged regarding the policy direction for market development following FTSE’s upgrade of Vietnam’s market classification.