The third quarter of 2025 marked an unprecedented surge in Vietnam’s stock market, with average trading liquidity on HoSE reaching nearly VND 37 trillion per session. Amid this vibrant backdrop, brokerage activities of securities companies (SCs) flourished, achieving a record-high total revenue of approximately VND 7 trillion.

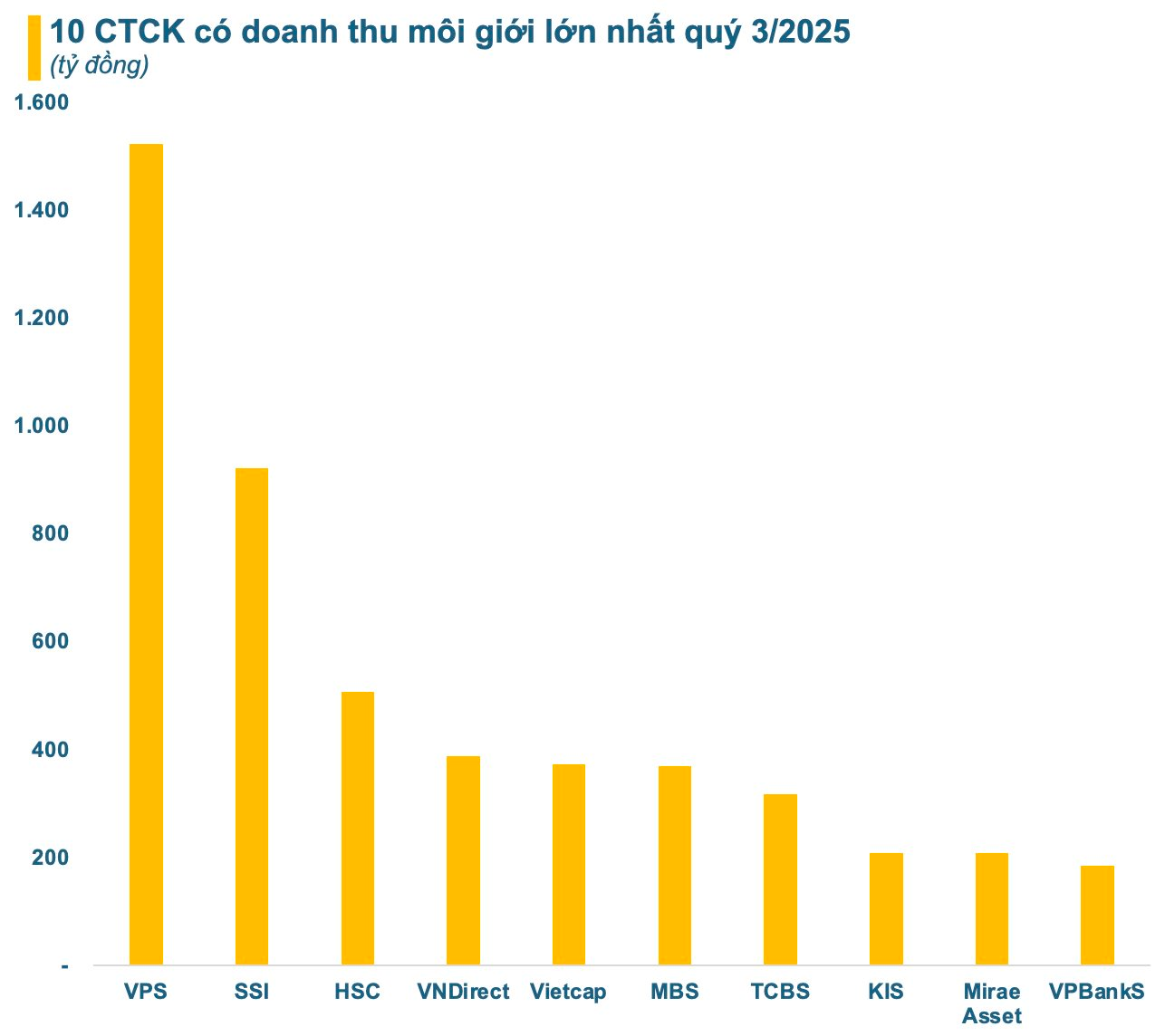

Most leading SCs reported all-time high brokerage revenues. The top 10 SCs by brokerage revenue in Q3/2025 were VPS, SSI, HSC, VNDirect, Vietcap, MBS, TCBS, KIS, Mirae Asset, and VPBankS. Collectively, they generated VND 5 trillion in brokerage revenue, accounting for over 70% of the industry’s total.

VPS became the first SC in history to surpass VND 1.5 trillion in quarterly brokerage revenue. SSI’s brokerage revenue also soared above VND 900 billion, positioning it as a strong contender to become the second SC to reach the trillion-dong milestone. These two firms significantly outpaced their competitors, with most other top 10 SCs recording brokerage revenues below VND 400 billion.

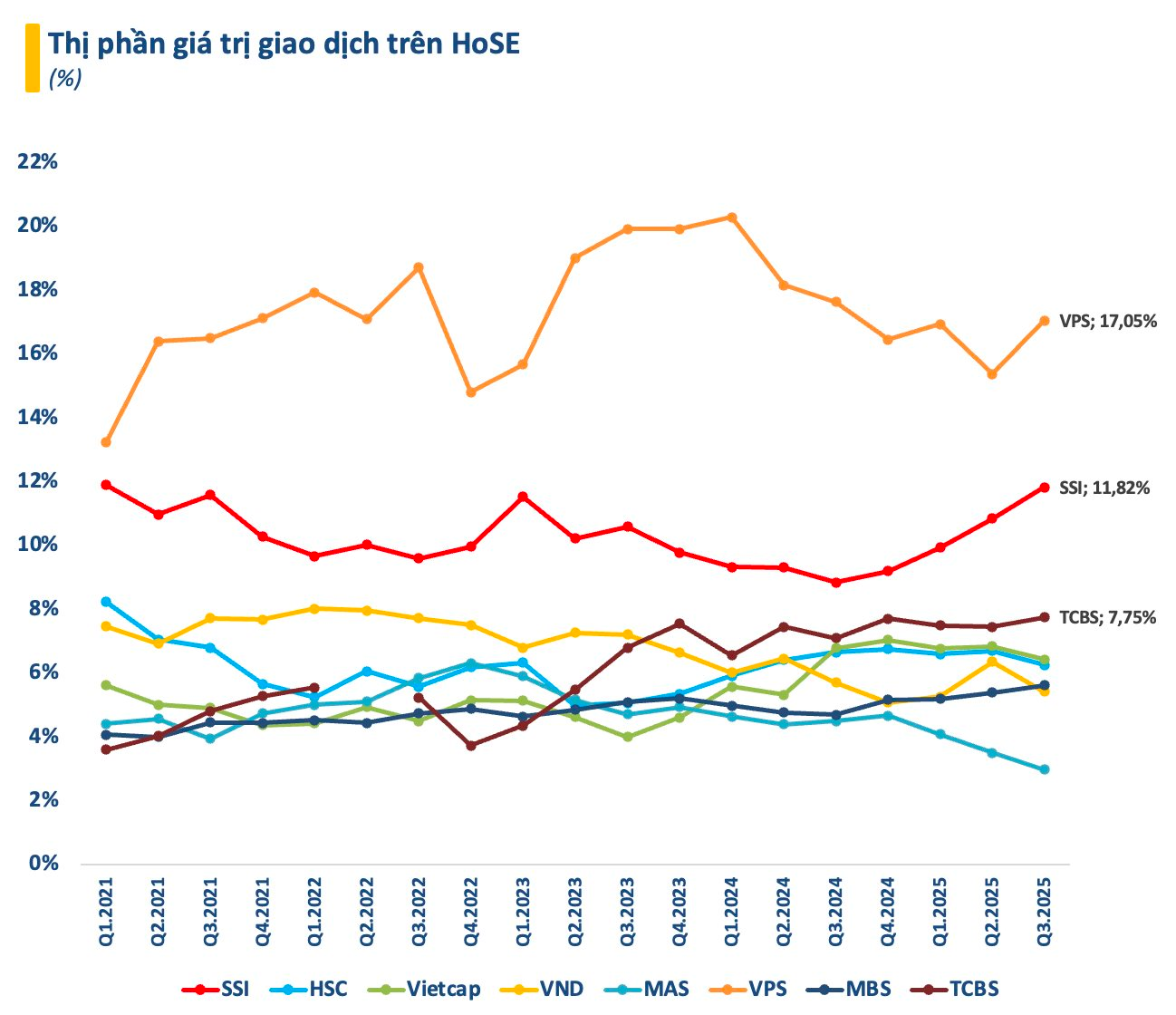

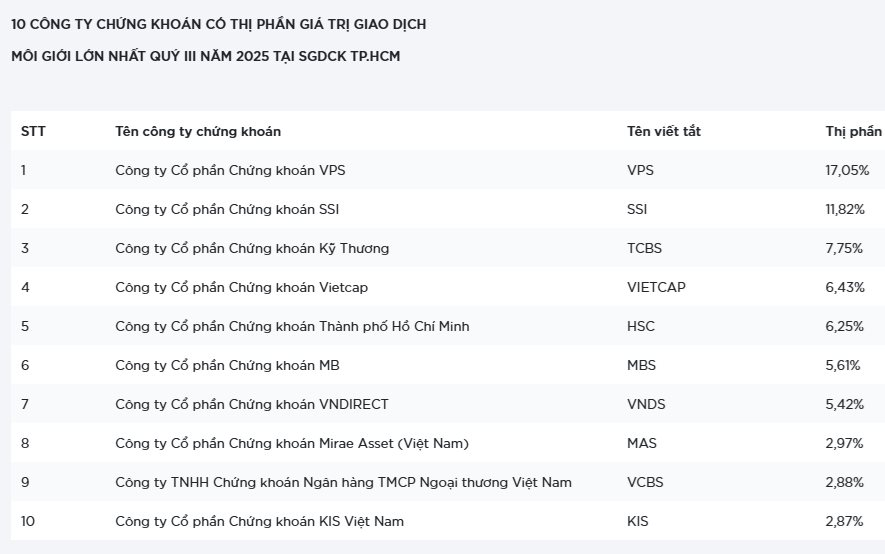

Theoretically, the top 10 SCs by brokerage revenue should align closely with the market share rankings by trading value. However, notable discrepancies emerged. For instance, TCBS, despite holding the third-largest market share (7.75%), ranked only seventh in brokerage revenue for Q3.

This disparity can be attributed to TCBS’s “Zero Fee” policy, which sacrifices brokerage revenue in exchange for a broader customer base, enabling cross-selling of other services like investment advisory and margin lending. SCs adopting Zero Fee policies often exhibit a mismatch between market share and brokerage revenue.

Conversely, VNDirect, despite ranking seventh in market share, secured the fourth position in brokerage revenue. Similarly, HSC, with the fifth-largest market share, trailed only SSI and VPS in revenue. VPBankS, though outside the top 10 in market share, ranked tenth in brokerage revenue. These SCs, largely absent from the Zero Fee race, often maintain higher transaction fees compared to industry averages.

Ultimately, the decision to compete on fees or not reflects each SC’s unique strategic direction, influenced by factors such as resources, strengths, and limitations. Nevertheless, the Zero Fee policy is increasingly prevalent among SCs, reshaping the securities industry and the brokerage profession.

Dragon Capital’s Top 3 Recommendations for Investors Amid Market Turbulence

Dragon Capital remains steadfast in its optimistic outlook, championing a long-term investment strategy.

VPBank Experts: Market Corrections Are Opportunities, Except for Overvaluation and Major Crashes

VPBankS experts assert that Vietnam’s stock market outlook remains robust in the medium term, with no significant concerns. This optimism is underpinned by the country’s sustained high economic growth rate, ranging between 8% and 10%, coupled with a manageable inflation rate of approximately 3%.