What is the Potential of Tuan Huy Phu Tho?

Tuan Huy Phu Tho Joint Stock Company, originally established as Tuan Huy Limited Liability Company on March 8, 2010, specializes in residential construction.

According to the business registration update on April 2, 2013, the company increased its charter capital from 1 billion VND to 9.8 billion VND. At that time, Mr. Lai Anh Tuan (born in 1981) was the legal representative.

As of June 19, 2020, Mr. Lai Anh Tuan was the sole owner of Tuan Huy Phu Tho.

Following this date, the charter capital was raised to 20 billion VND, though the ownership details were not disclosed.

Rendering of Cam Khe Central Park Project

By August 17, 2021, the charter capital was further increased to 45 billion VND, with three founding shareholders: Mr. Lai Anh Tuan contributed 43 billion VND (95.556% ownership), and Ms. Tran Thi Hong Hanh and Ms. Bui Thi Thanh Xuan each contributed 1 billion VND (2.222% ownership).

As of the latest update in August 2022, the charter capital has been raised to 200 billion VND. The legal representatives are Mr. Lai Anh Tuan, Chairman of the Board and CEO, and Mr. Duong Ngoc Truong, Deputy CEO.

Mr. Duong Ngoc Truong (born in 1981) also serves as the Director and Legal Representative of Dat Moi Investment and Construction Joint Stock Company.

Tuan Huy Phu Tho is known as the developer of the Urban Housing and Cultural-Sports Complex project in Cam Khe town, Cam Khe district (now Cam Khe commune, Phu Tho province), commercially named Cam Khe Central Park.

The 20.57-hectare project includes 72 villas, 323 shophouses and townhouses, and a nearly 3-hectare lake, with a population of 1,604. The total investment exceeds 1.078 trillion VND, with 1.026 trillion VND for project execution and 52 billion VND for land clearance.

According to sources, on September 24, 2024, Tuan Huy Phu Tho pledged all asset rights related to Cam Khe Central Park – Phase 1 as collateral at VietinBank’s Thanh An branch.

Just one day later, on September 25, 2024, the company also pledged its entire asset rights and those of CMH Group arising from the investment cooperation contract for Cam Khe Central Park – Phase 1 at the same bank branch.

What Role Does CMH Group Play in Cam Khe Central Park?

CMH Group is the developer of Cam Khe Central Park. Established in 2007 as Vietnam Construction and Manpower Joint Stock Company, it now focuses on trade, services, and construction.

Approximately 25.5 million shares of the company are listed on HNX under the code CMS.

Illustrative Image

In CMH Group’s 2025 mid-year consolidated financial report, the investment cooperation contract with Tuan Huy Phu Tho (No. 16/2024/HĐHTĐT/CMH-THPT, dated June 1, 2024) outlines joint investment in Cam Khe Central Park’s first land parcel of over 13.8 hectares. The total investment is projected at 527.9 billion VND, with Tuan Huy Phu Tho contributing 97 billion VND (18.38%) and CMH Group 430.9 billion VND (81.62%).

As of June 30, 2025, CMH Group recorded short-term and long-term receivables from Tuan Huy Phu Tho totaling nearly 30.5 billion VND, under the EPC contract for design, material supply, and construction at Cam Khe Central Park.

Additionally, CMH Group holds other short-term receivables of over 376.7 billion VND from Tuan Huy Phu Tho, including 230 billion VND borrowed from a bank to pay land use fees for the 13.8-hectare plot, as per the Phu Tho Tax Department’s notice on December 31, 2024.

CMH Group also recorded inventory of nearly 40.6 billion VND from the EPC contract (1102-1/2022) with Tuan Huy Phu Tho. The contract value is 450.04 billion VND, with 164.8 billion VND already approved, and completion expected in Q4/2026.

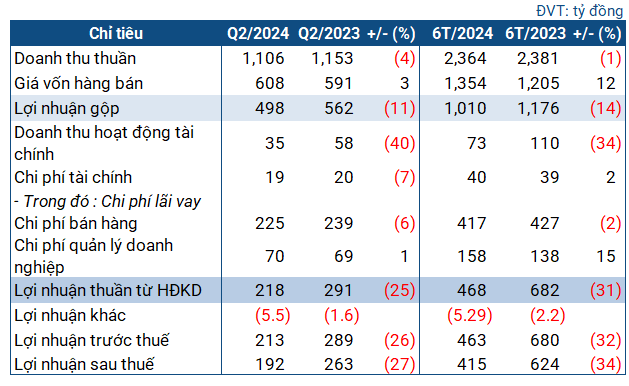

Steel Tycoon to Liquidate 10 Million Hòa Bình Construction Shares (HBC), VND 100 Billion in Deposits, Real Estate, and Machinery to Settle Bank Debts

As of June 30, 2025, SMC Trading and Investment’s outstanding loans have surged to over 2.3 trillion VND, quadrupling its equity capital. This includes nearly 2.15 trillion VND in short-term debt and approximately 180 billion VND in long-term debt.