Source: VietstockFinance

|

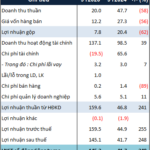

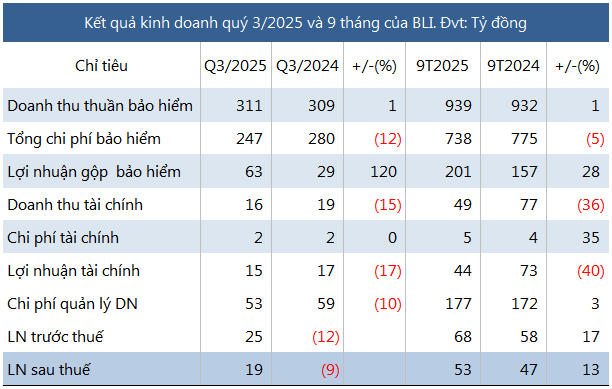

According to the Q3 2025 financial report, BLI recorded nearly VND 303 billion in gross insurance premiums and over VND 50 billion in reinsurance premiums, marking a 7% and 6% increase year-over-year, respectively. However, net insurance revenue remained flat at VND 311 billion due to a corresponding rise in reinsurance costs.

Despite stagnant revenue, insurance operations saw a 2.2x surge in profits compared to the same period last year, reaching VND 63 billion. BLI attributed this to a 12% reduction in total expenses to VND 247 billion, with claims expenses dropping significantly by 28% to VND 118 billion.

Thanks to improved core insurance performance and reduced management costs, BLI turned a net loss of VND 9 billion in Q3 2024 into a net profit of VND 19 billion, despite a 17% decline in financial profits to VND 15 billion.

For the first nine months, gross insurance profits rose 28% year-over-year to VND 201 billion, driven by cost reductions amid stable revenue. Conversely, financial activities underperformed, with gross profits falling 40% to VND 44 billion due to a 28% drop in deposit interest and the absence of VND 11 billion in investment securities gains from the previous year.

Despite lower financial profits and a 3% uptick in management costs to VND 177 billion, BLI achieved a 13% increase in net profit to VND 53 billion, fueled by its insurance segment.

For 2025, BLI targets pre-tax profits of over VND 56 billion, a 32% decrease from 2024. After nine months, the company has already surpassed its annual plan by 21%.

As of Q3, BLI‘s total assets reached nearly VND 2.7 trillion, up 3% year-to-date. Deposits accounted for 58% of total assets, totaling over VND 1,541 billion (up 8%).

Specifically, term deposits at the parent company, Saigon Commercial Bank (SCB), and major shareholder, Vietnam Export-Import Bank (Eximbank), stood at over VND 1.2 trillion and VND 23 billion, respectively, reflecting a 4% increase and a 47% decrease year-to-date. These deposits generated VND 31 billion (down 28%) and VND 1 billion (down 52%) in interest income for BLI over nine months.

BLI‘s total liabilities exceeded VND 1.7 trillion, primarily short-term. Short-term provisions dominated, totaling over VND 1.2 trillion (72% of liabilities), up 4% year-to-date.

– 12:01 27/10/2025

Real Estate Firm Sees 36x Profit Surge in Q3 Amid Bullish Stock Market

Financial revenue soared in Q3/2025 as CTCP Đầu tư Phát triển Nhà Đà Nẵng (HNX: NDN) capitalized on a buoyant stock market. The company reported consolidated revenue and after-tax profit of nearly VND 106 billion and VND 71 billion, respectively—a 2.1x and 36x surge compared to the same period last year. This marks NDN’s most profitable quarter since Q2/2023, with the VND 71 billion profit standing as a record high.

Sài Gòn Beer Central Region Sets Profit Margin Peak, 9-Month Earnings Surpass 18% of Annual Plan

Revised Introduction:

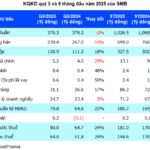

Saigon Beer Corporation – Central Region (HOSE: SMB) reported a record-breaking gross profit margin of 35.35% in Q3, the highest in its history, driving a 24% year-on-year surge in net profit. Over the first nine months, the company has already surpassed its full-year profit target by 18%.

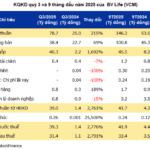

BV Life Q3 Profits Surge by Nearly 2,800%, Stock Hits Ceiling for 3 Sessions Before Cooling Down

The sale of the 5th-floor office space in Tower 25T1 propelled BV Life JSC (HNX: VCM) to a remarkable Q3 net profit of over 31 billion VND, a staggering 28.5-fold increase year-on-year. This stellar performance fueled a three-session ceiling rally in the company’s stock, before a modest 3% correction on October 24th.

Phú Bài Fiber Swings to Profit, Q3 Earnings Hit Record High

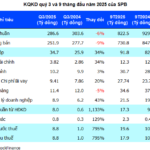

Despite a 6% decline in revenue, Phu Bai Fiber Joint Stock Company (UPCoM: SPB) reported its highest-ever quarterly profit in Q3/2025. This remarkable achievement was driven by improved gross margins and reduced production costs, enabling the company to officially eliminate accumulated losses as of September 2025.