Binh Minh Plastic Joint Stock Company (Stock Code: BMP, HoSE) has announced a Board of Directors Resolution regarding the first dividend payment for shareholders in 2025.

Accordingly, Binh Minh Plastic will pay an interim dividend in cash at a rate of 65%, meaning shareholders holding one share will receive 6,500 VND. The final registration date for eligibility is November 18, 2025, with the payment scheduled for December 8, 2025.

With over 81.86 million BMP shares outstanding, it is estimated that Binh Minh Plastic will allocate more than 532 billion VND for this dividend payment.

As of September 30, 2025, the Thai shareholder Nawaplastic Industries Co., Ltd. holds over 45 million BMP shares and is expected to receive more than 292.6 billion VND in dividends from Binh Minh Plastic.

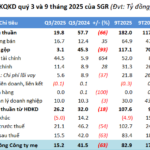

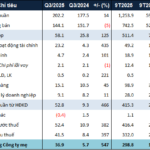

Regarding business performance, the consolidated financial report for Q3/2025 shows that Binh Minh Plastic recorded a net revenue of nearly 1,532.3 billion VND, an 8.9% increase compared to the same period last year. After deducting the cost of goods sold, gross profit reached nearly 734.2 billion VND, up 21.2%.

During the period, the company also generated nearly 26.6 billion VND in financial revenue, a 32.3% increase year-over-year. Meanwhile, financial expenses rose from 71.5 billion VND to 79.9 billion VND; selling expenses increased by 23.6% to 204.4 billion VND; and administrative expenses reached over 37.2 billion VND, a 6.3% increase.

As a result, after deducting taxes and fees, Binh Minh Plastic reported a net profit of nearly 350.6 billion VND, a 21.1% increase compared to the same period last year.

For the first nine months of 2025, Binh Minh Plastic achieved a net revenue of over 4,223.5 billion VND, an 18.6% increase compared to the same period in 2024; net profit after tax reached nearly 967.4 billion VND, up 27.3%.

In 2025, Binh Minh Plastic set a business plan with an expected net profit of 1,055 billion VND. Thus, by the end of the first two quarters, the company has completed 91.7% of its profit target.

As of the end of Q3/2025, Binh Minh Plastic’s total assets increased by 24.1% compared to the beginning of the year, reaching nearly 3,970.9 billion VND. Of this, term deposits amounted to 1,930 billion VND, accounting for 48.6% of total assets; inventory was nearly 407.6 billion VND, representing 10.3% of total assets.

On the liabilities side, total payables stood at over 822.6 billion VND, a 64.9% increase compared to the beginning of the year. Taxes and other payable amounts to the state were nearly 261.8 billion VND, accounting for 31.8% of total liabilities.

Bảo Long Insurance Escapes Q3 Loss Despite Stagnant Premium Revenue

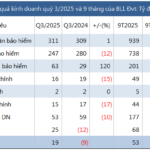

Baoviet Insurance Corporation (UPCoM: BLI) has reported a remarkable turnaround in its financial performance for Q3 2025. The company achieved a net profit of nearly VND 25 billion, a significant improvement from the VND 9 billion loss incurred during the same period last year, which was primarily attributed to the impact of natural disasters and severe flooding. This positive result is largely due to the reduction in overall operating expenses related to insurance business activities.

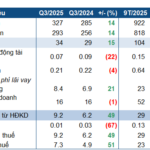

Vĩnh Long Water Narrows Profit Margins as Biwase Expands Ownership Stake

Vĩnh Long Water Supply Joint Stock Company (UPCoM: VLW) has released its Q3/2025 financial report, revealing a decline in profits due to rising costs. Despite this, major shareholder BWE has registered to purchase over 2.6 million shares through a negotiated transaction, aiming to increase its ownership stake.