Condominiums remain a hot topic across major urban centers, capturing the attention of investors. According to the Vietnam Association of Realtors (VARS), Q3/2025 recorded over 34,000 successful transactions, with an absorption rate of 66%, a 12% increase from the previous quarter. Apartments accounted for more than 66% of total transactions, achieving an impressive 81% absorption rate, significantly higher than low-rise housing.

In Hanoi’s condo market, apartment units dominate as absorption rates consistently hit record highs. Numerous projects in the eastern and western districts sold out immediately upon launch, fueling a vibrant trading environment. As the market peaked, investors began shifting their focus to other promising major markets. Among these, Ho Chi Minh City—where prices have stabilized and infrastructure near metro lines and ring roads is rapidly developing—has emerged as a prime destination for investors.

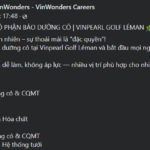

According to Batdongsan.com.vn, investment capital from the North is increasingly flowing into the South. In the first nine months of the year, the number of property buyers in HCMC from Hanoi-based investors surged by 28%.

Hanoi investors seeking HCMC apartments rise by 28%

Mr. Nguyen Thai Binh, CEO of Dong Tay Land, identifies three key drivers behind the northward capital shift. First, Hanoi property prices have soared since 2021, narrowing profit margins, while HCMC and its outskirts have seen minimal fluctuations over the past 3-4 years. Second, the southern supply has rebounded due to legal resolutions, with major developers re-entering the market. Third, areas surrounding HCMC offer lower prices and robust infrastructure, making them attractive for medium to long-term investments.

Echoing Mr. Binh’s sentiments, Mr. Nguyen Van Dinh, Vice Chairman of the HCMC Real Estate Association, notes that northern investors anticipate HCMC apartment prices to surge as rapidly as Hanoi’s did in 2023–2024. Beyond profitability, they prioritize sustainable rental income and the city’s improving infrastructure.

This capital shift between Vietnam’s two most dynamic real estate markets highlights investors’ adaptability: they are willing to exit peak-priced regions in search of higher returns in areas with untapped potential.

Observations reveal a clear diversification in northern buyers’ investment preferences. Long-term investors tend to follow major Hanoi-based developers launching projects in the South. Financially robust investors favor centrally located Eastern HCMC apartments with transparent legal frameworks, willing to pay premium prices for stable returns. Younger investors seek opportunities in land plots and apartments near metro lines, ring roads, and Long Thanh Airport, anticipating price appreciation.

The Global City, one of HCMC’s largest urban developments by Masterise Homes, targets young, successful professionals seeking both residence and investment. “Even before Masteri Park Place’s official launch, we received significant interest from Hanoi buyers,” a Masterise Homes representative revealed.

Spanning 117.4 hectares, The Global City is a rare large-scale development in central HCMC, featuring international-standard amenities such as a 123,000m² shopping center and Southeast Asia’s largest musical fountain canal. Previously, Masterise Homes launched high-rise zones like Masteri Grand View and Lumière Midtown, drawing attention for their exceptional amenities.

Experts emphasize that despite the growing southward trend, Hanoi investors remain cautious, prioritizing projects with clear legal status, reputable developers, and existing infrastructure. More importantly, they advocate for medium to long-term strategies, as sustainable property growth aligns with urbanization and genuine housing demand.

Hanoi Unveils 300 Trillion VND Red River Scenic Super Boulevard, Rallying Industry Titans Deo Ca, Van Phu Invest, MIK Group, and VPBank to Forge a Landmark Transformation

The Steering Committee, led by the Vice Chairman of Hanoi People’s Committee, oversees the implementation of tasks related to architectural planning and the development of the Red River Landscape Avenue investment project. With an estimated total investment of 300 trillion VND, this ambitious initiative involves the participation of several major industry leaders.

Abandoned Prime Land in the Heart of Ho Chi Minh City: An Aerial Perspective

Nestled in the heart of Thu Dau Mot Ward, Ho Chi Minh City, this 24-hectare prime development site is strategically positioned at the crossroads of four major thoroughfares: Binh Duong Avenue (National Highway 13), Yersin Street, Thich Quang Duc Street, and Duong Vo Thanh Long Street. Surrounded by a bustling urban landscape, the area boasts unparalleled accessibility and a wealth of amenities, making it an ideal location for both residential and commercial ventures.

Abandoned Student Housing in Hanoi Transformed into Affordable Social Housing

The long-abandoned student housing blocks in Pháp Vân – Tứ Hiệp (Yên Sở Ward, Hanoi), left as unfinished shells for over a decade, are finally being revitalized. These once-neglected structures are now being transformed into much-needed social housing, addressing a critical need while eliminating years of wasted potential.

Unlocking Côn Đảo’s Potential: 73 Investment Projects, Including Two Major Land Reclamation Zones

By 2030, the Con Dao Special Zone (Ho Chi Minh City) will simultaneously roll out 73 projects with an estimated investment of VND 21,348 billion; an additional 3 projects are planned for the post-2030 phase.