The free market US dollar exchange rate has surged dramatically. Illustrative image.

|

Concerns Over Unusual Market Behavior

The foreign exchange market has recently been stirred by a series of new developments. Last weekend, the State Bank of Vietnam (SBV) issued a document to the Ministry of Public Security, Ministry of Industry and Trade, and the Government Inspectorate regarding coordinated management of foreign exchange market activities.

Subsequent actions include inspections, monitoring, and oversight of foreign exchange activities by organizations and individuals, particularly focusing on illegal currency trading and operations in the unofficial foreign exchange market.

This move comes as policymakers observe that “the exchange rate between the Vietnamese dong and the US dollar in the unofficial market shows signs of volatility and a widening gap compared to rates within the banking system.”

In Ho Chi Minh City, the nation’s largest remittance recipient, efforts to control the market continue. Recently, the SBV’s Zone 2 branch issued a directive requiring economic entities engaged in foreign exchange activities in HCMC and Dong Nai Province to strictly adhere to legal regulations on foreign exchange management, anti-money laundering, terrorism financing, and related laws. Any suspected violations must be reported immediately. These measures aim to “significantly stabilize foreign exchange rates and the market.”

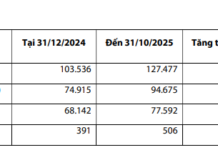

Recent data reveals a substantial widening of the gap between official and free market exchange rates. While the official rate at Vietcombank stands at 26,349 VND/USD, down 0.3% since early October, the disparity is notable.

According to Maybank Securities Vietnam (MSVN), the free market rate has climbed 7.5% year-to-date as of October 24, compared to a 3.5% increase in the official rate. This gap has particularly widened in October, with the free market rate rising 4.2% since the month’s start, while the official rate dipped 0.4%.

Yuanta Securities Vietnam’s currency report highlights contrasting domestic exchange rate trends. While the central rate hovers around 25,098 and commercial banks’ selling rate at 26,352 (slightly down from the previous week), the free market rate reached 27,650 VND/USD, a 1.52% weekly increase.

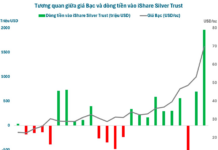

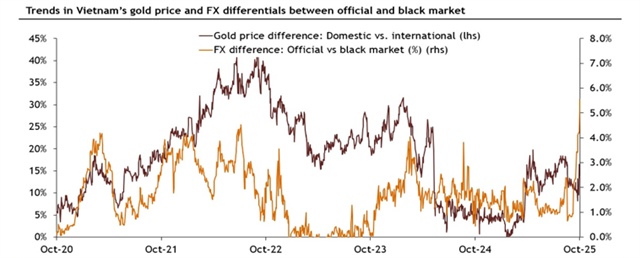

Trends in gold prices and exchange rate disparities between official and free markets in Vietnam. Source: MSVN |

Expectations for Easing Pressure

Yuanta Securities Vietnam analysts attribute the persistent high disparity between bank and free market rates to heightened year-end dollar demand and limited cash dollar supply in the free market.

MSVN analysts link the dual-market rate gap to recent gold price surges and the growing differential between domestic and international gold prices. As gold price gaps widen, free market dollar demand rises for gold imports and speculation, further expanding the exchange rate disparity. “These pressures are non-fundamental, reflecting gold market distortions rather than weaknesses in Vietnam’s international balance of payments,” MSVN notes.

Beyond administrative controls, the SBV’s latest intervention involved selling approximately $1.5 billion in forward contracts on October 22 to banks with negative foreign exchange positions, as reported by Yuanta Vietnam. This marks the third such intervention in nearly two months to support the market.

Despite short-term challenges, experts remain optimistic for year-end prospects. Pressure is expected to ease as the US dollar continues its rate-cutting trajectory. The Federal Reserve is projected to cut rates by 25 basis points on October 30 with 98% probability. Other macroeconomic factors like international trade, FDI, and remittances are also anticipated to remain positive.

Among these variables, international trade and gold prices remain unpredictable. While the trade war shows positive signs with recent US agreements with Vietnam and other nations, and progress with China, gold prices remain volatile despite recent declines.

Domestically, issues in the unofficial foreign exchange and gold markets persist. Prolonged high disparities in the unofficial market risk shifting capital away from commercial banks.

D. Nguyễn

– 13:00 28/10/2025

Is the Sharp Rise in Black Market USD Rates a Cause for Concern?

The black market USD price is inching closer to 28,000 VND per USD, surpassing the official market rate by over 1,000 VND. Experts suggest that while the unofficial market is rising, it’s unlikely to significantly impact the broader economy, as the State Bank continues to intervene to stabilize USD rates within the banking sector.

Ho Chi Minh City: Only 3 Social Housing Projects Receive Over VND 280 Billion in Disbursements

As of the end of October, the social housing loan program, worker housing, and old apartment renovation initiative had disbursed over 280 billion VND to three projects in Ho Chi Minh City.