I. FUTURE CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

On October 27, 2025, all VN30 futures contracts experienced declines. Specifically, 41I1FB000 (I1FB000) dropped by 2.37% to 1,891.5 points; VN30F2512 (F2512) fell by 1.95% to 1,900 points; 41I1G3000 (G3000) decreased by 1.62% to 1,889.8 points; and 41I1G6000 (I1G6000) declined by 2.08% to 1,889.9 points. The underlying index, VN30-Index, closed at 1,900.76 points.

Additionally, all VN100 futures contracts also saw declines on the same day. Notably, 41I2FB000 (I2FB000) fell by 2.11% to 1,810.1 points; 41I2FC000 (I2FC000) dropped by 1.46% to 1,810.3 points; 41I2G3000 (I2G3000) decreased by 1.03% to 1,817.1 points; and 41I2G6000 (I2G6000) declined by 0.75% to 1,814 points. The underlying index, VN100-Index, closed at 1,810.65 points.

During the October 27, 2025 session, 41I1FB000 initially surged during the ATO session but buyers gradually lost momentum as selling pressure intensified, causing the contract to reverse and weaken. In the afternoon session, although Long positions attempted to support a recovery, sellers remained dominant, pushing 41I1FB000 to its session low and closing at 1,891.5 points, down 45.9 points.

Intraday Chart of 41I1FB000

Source: https://stockchart.vietstock.vn/

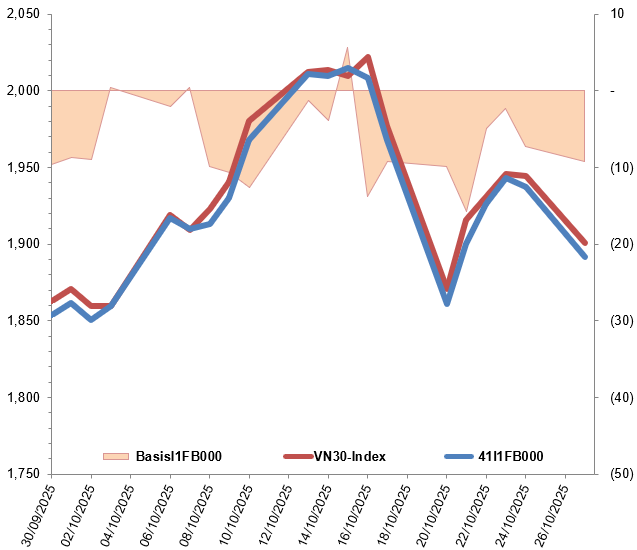

At the close, the basis of the 41I1FB000 contract widened compared to the previous session, reaching -9.26 points. This indicates a more pessimistic sentiment among investors.

Fluctuations of 41I1FB000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN30-Index

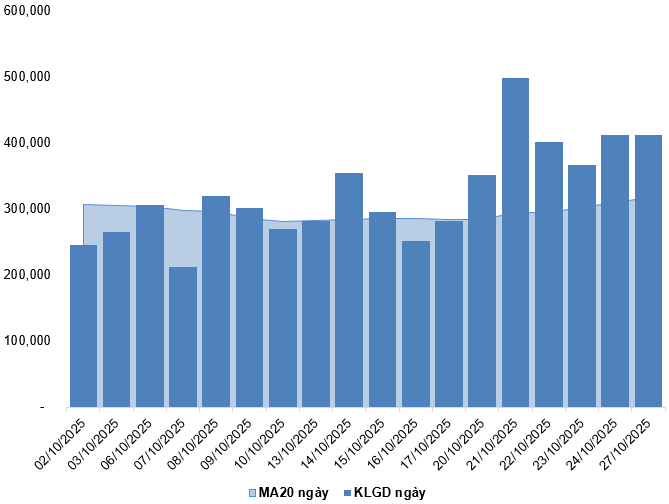

Trading volume and value in the derivatives market increased by 0.31% and decreased by 0.01%, respectively, compared to the session on October 24, 2025. Specifically, the trading volume of I1FB000 rose by 0.2% with 411,302 matched contracts. The trading volume of I2FB000 reached 159 contracts, up 12.77%.

Foreign investors returned to net buying, with a total net buying volume of 646 contracts on October 27, 2025.

Daily Trading Volume Fluctuations in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

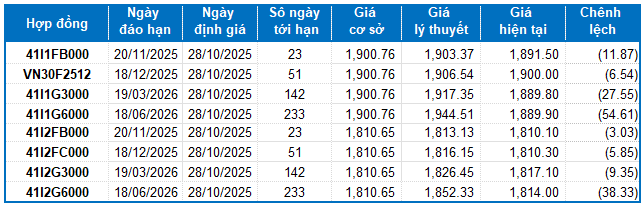

I.2. Futures Contract Valuation

Based on the fair pricing method as of October 28, 2025, the fair price range for futures contracts currently trading in the market is as follows:

Summary Table of Derivatives Valuation for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with term adjustments suitable for each futures contract.

I.3. Technical Analysis of VN30-Index

On October 27, 2025, the VN30-Index declined, accompanied by a Bearish Engulfing candlestick pattern, indicating less optimistic investor sentiment.

Additionally, the MACD indicator continued to widen its gap with the Signal line after giving a sell signal, while the index fell below the Middle line of the Bollinger Bands. This suggests that short-term recovery prospects remain challenging.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

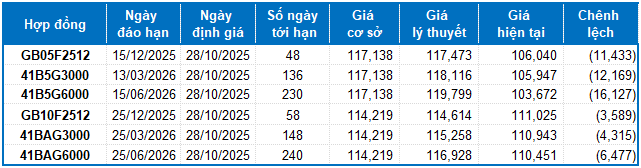

II. FUTURE CONTRACTS OF THE BOND MARKET

Based on the fair pricing method as of October 28, 2025, the fair price range for futures contracts currently trading in the market is as follows:

Summary Table of Government Bond Futures Valuation

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with term adjustments suitable for each futures contract.

According to the above valuation, contracts GB05F2512, 41B5G3000, 41B5G6000, GB10F2512, 41BAG3000, and 41BAG6000 are currently attractively priced. Investors may focus on and consider buying these futures contracts in the near future, as they present a favorable opportunity in the market.

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 18:28 27/10/2025

Vietstock Weekly 27-31/10/2025: Will Market Volatility Persist?

The VN-Index extended its correction into the second consecutive week, accompanied by trading volumes dipping below the 20-session average. While the decline has somewhat narrowed, a cautious sentiment persists, with demand largely exploratory and lacking the breadth required for a sustained rebound. Against a backdrop where the Stochastic Oscillator has signaled a sell and the MACD is gradually converging with the Signal Line, continued volatility is likely in the near term.

Derivatives Market on October 24, 2025: Uncertainty Takes Hold

On October 23, 2025, both the VN30 and VN100 futures contracts rallied during the trading session. The VN30-Index edged higher, forming a Spinning Top candlestick pattern, while trading volume continued to decline, remaining below the 20-session average. This suggests a sense of investor hesitation in the market.

Technical Analysis for the Afternoon Session of October 21: Continued Adjustment

The VN-Index persists in its corrective phase, testing the August 2025 lows. Meanwhile, the HNX-Index is trending downward, clinging to the Lower Band of the Bollinger Bands.