| DM7’s Quarterly Business Results for 2022-2025 |

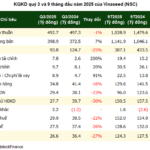

Dệt May 7, a company majority-owned by Dong Hai LLC with 51% equity, has recorded its worst quarterly performance in history. Following a meager Q2 2025 profit of less than 2 billion VND, Q3 profits plummeted further to 825 million VND—a 97% year-over-year decline and below the 1 billion VND threshold.

Quarterly net revenue dropped sharply by 71% to under 106 billion VND, pushing gross margins below 8%, the lowest in three years. DM7 narrowly avoided losses by slashing selling expenses by 37% and administrative costs by 41%. Meanwhile, other income plunged from over 10.5 billion VND year-over-year to less than 300 million VND this quarter.

|

Lowest Nine-Month Results Since Inception

For the first nine months of 2025, DM7 reported revenues of 395 billion VND, down 31% year-over-year, while net profit fell 68% to under 15 billion VND. The company achieved only 53% of its revenue target and 25% of its annual profit goal.

Management attributed the Q3 2025 challenges to ongoing order shortages in the textile industry, compounded by natural disasters and flooding that dampened consumer demand. Despite mitigation efforts, profits declined year-over-year. Earlier in 2025, DM7 noted increased costs and margin pressure due to smaller, more diverse orders.

| DM7’s Nine-Month Business Results by Year |

Improved Financial Structure Amid Surging Inventory

The Q3 2025 financial report highlights DM7’s debt-free status and a 66% reduction in total liabilities to 86 billion VND year-to-date. Short-term customer prepayments fell 94% to under 8 billion VND. However, cash reserves dwindled 95% to less than 5 billion VND. Inventory rose 58% to 161 billion VND, with finished goods accounting for 74%.

On the UPCoM exchange, DM7 shares remain illiquid, trading flat at 24,000 VND/share over the past two months. While the stock is up 30% year-over-year, average daily volume is a mere 815 shares.

| DM7 Share Price Performance Over the Past Year |

– 16:48 28/10/2025

Fami Soy Milk Manufacturer Burns Hundreds of Billions on Promotions, Q3 Profits Drop 28%

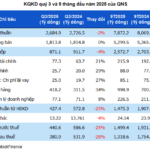

In Q3/2025, Quang Ngai Sugar JSC (UPCoM: QNS), the parent company of Fami soy milk, reported a significant decline in profits, reaching a 10-quarter low. This downturn was primarily driven by a sharp increase in sales and promotional expenses. Despite this, the company maintains a substantial cash reserve of nearly VND 7,700 billion, accounting for over 55% of its total assets.

Sài Gòn Beer Central Region Sets Profit Margin Peak, 9-Month Earnings Surpass 18% of Annual Plan

Revised Introduction:

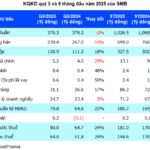

Saigon Beer Corporation – Central Region (HOSE: SMB) reported a record-breaking gross profit margin of 35.35% in Q3, the highest in its history, driving a 24% year-on-year surge in net profit. Over the first nine months, the company has already surpassed its full-year profit target by 18%.

Phú Bài Fiber Swings to Profit, Q3 Earnings Hit Record High

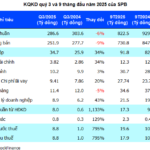

Despite a 6% decline in revenue, Phu Bai Fiber Joint Stock Company (UPCoM: SPB) reported its highest-ever quarterly profit in Q3/2025. This remarkable achievement was driven by improved gross margins and reduced production costs, enabling the company to officially eliminate accumulated losses as of September 2025.

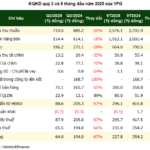

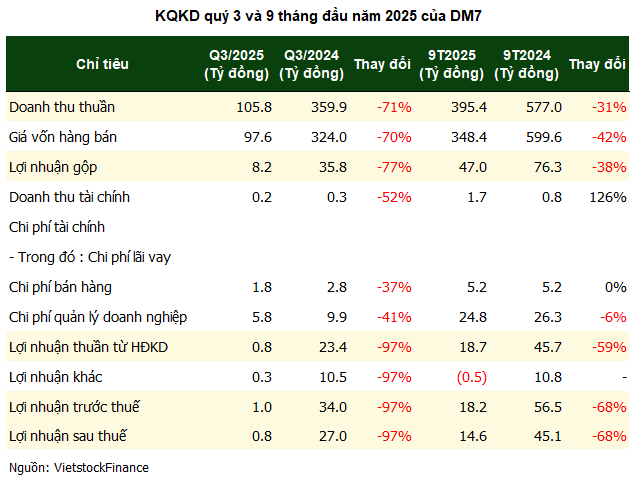

Vinaseed’s Gross Profit Hits Historic Low as Inventory Surges Past 1 Trillion VND

Amidst seasonal fluctuations and escalating financial costs, Vinaseed Group (HOSE: NSC) reported its weakest quarterly performance since 2020, with gross profit margins plummeting to a record low of 19%. Simultaneously, inventory levels surged past the 1,000 billion VND mark, exacerbating the company’s financial challenges.