On the morning of October 26, domestic gold prices remained unchanged from the previous day’s closing level.

For gold bars, SJC and PNJ both listed their buying and selling prices at 147.2 – 149.2 million VND per tael. DOJI traded at 147.5 – 149.2 million VND per tael. Bao Tin Minh Chau listed their gold bar buying and selling prices at 148.2 – 149.2 million VND per tael.

For gold rings, SJC’s buying and selling prices were at 146.1 – 148.6 million VND per tael. PNJ listed their gold ring prices at 146.2 – 149.2 million VND per tael. DOJI traded at 146.5 – 149.1 million VND per tael. Bao Tin Minh Chau maintained their buying and selling prices at 150 – 153 million VND per tael.

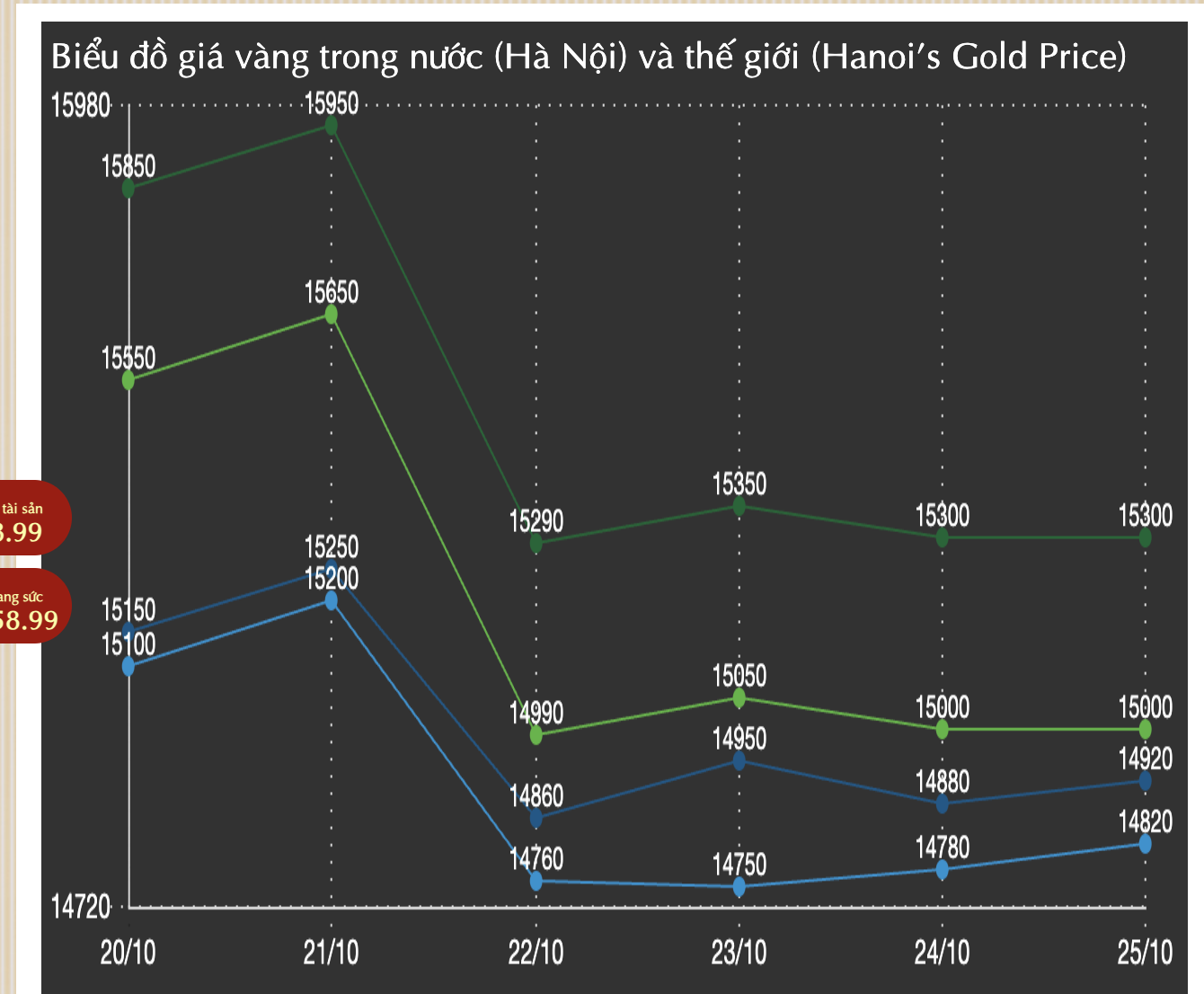

Earlier, domestic gold prices surged at the beginning of the week, reaching a record high of over 160 million VND per tael for gold rings and nearly 155 million VND per tael for gold bars during the October 21 trading session. However, prices have since declined sharply.

By the end of the week, gold bar prices were 1.8 – 2.3 million VND per tael lower than the previous week’s close, while gold ring prices dropped by 1.6 – 5.5 million VND per tael.

Among them, Bao Tin Minh Chau saw the most significant decrease, adjusting both buying and selling prices for gold rings by 5.5 million VND compared to the previous week’s close. Their gold bar prices also fell by 2.3 million VND per tael on the buying side and 1.8 million VND on the selling side. SJC, PNJ, and DOJI reduced their gold ring buying prices by 1.8 – 3 million VND per tael and their selling prices by 1.6 – 1.8 million VND per tael.

Bao Tin Minh Chau’s gold price fluctuations over the past week

In the global market, spot gold prices closed the week at $4,111.2 per ounce, down 3.29% from the previous week’s close.

Gold prices narrowed their decline on Friday after weaker-than-expected U.S. inflation data bolstered expectations that the Federal Reserve would cut interest rates the following week. However, the metal still recorded its first weekly decline after nine consecutive weeks of gains.

Data from the U.S. Department of Labor showed that the Consumer Price Index (CPI) for September rose 3.0% year-over-year, slightly below economists’ expectations of a 3.1% increase.

“Gold and silver surged as September’s core CPI came in below expectations, but it may not be enough to completely halt this week’s sell-off. Price action suggests gold needs another dip before stabilizing,” said Tai Wong, an independent metal trader.

Spot gold reached a record high of $4,381.21 on Monday (October 20) but then plummeted as investors took profits and easing U.S.-China trade tensions reduced safe-haven demand.

Meanwhile, the White House confirmed on Thursday that President Donald Trump would meet with Chinese President Xi Jinping the following week, ahead of the U.S. deadline to impose additional tariffs on Chinese imports on November 1.

“If (gold prices) fall below $4,000, we’ll likely see further declines in the market, potentially down to $3,850, the next major support level,” said Phillip Streible, chief market strategist at Blue Line Futures.

October 23: Gold Bars and Rings Surge by 900,000 VND per Tael

Global gold prices rebounded following a sharp decline during the sessions on October 21st and 22nd, with domestic gold prices also trending upward compared to yesterday’s closing levels.

Taxing Gold Transactions: PGS.TS Ngo Tri Long Advocates for Inclusion in Personal Income Tax

According to this expert, if the taxation on gold transactions is approved by the National Assembly, this regulation will restore gold trading to its true nature as a transparent financial investment activity. Simultaneously, it will help curb underground transactions, reduce foreign currency losses, and prevent tax revenue shortfalls.