As of late October 28th, SJC gold bar prices continued to plummet. SJC and DOJI companies are currently listing SJC gold bars at VND 143.1 – 145.1 million per tael, a decrease of VND 3.8 million on the buying side and VND 3.3 million on the selling side compared to the end of October 27th. Bao Tin Minh Chau also significantly reduced gold bar prices, now listed at VND 143.5 – 145.1 million per tael, down by VND 4.4 million on the buying side and VND 3.3 million on the selling side compared to the previous day’s close.

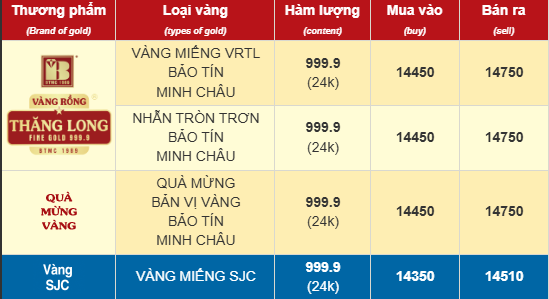

Gold ring prices at Bao Tin Minh Chau dropped sharply by VND 4.5 million per tael on both buying and selling sides, now listed at VND 144.5 – 147.5 million per tael. SJC further reduced gold ring prices by VND 3.8 million per tael (compared to the previous day), down to VND 141.2 – 143.7 million per tael. DOJI, Phu Quy, and PNJ are listing gold ring prices at VND 142 – 145 million per tael.

Thus, gold bar and ring prices at some gold retailers have dropped by over VND 10 million compared to their historical peaks.

As of 1:00 PM, DOJI’s gold bar prices fell by an additional VND 600,000 per tael on both buying and selling sides, now listed at VND 145.1 – 146.6 million per tael.

Gold ring prices at Bao Tin Minh Chau continued to drop sharply on both buying and selling sides (VND 2.3 million down on the buying side, VND 1.49 million down on the selling side), now at VND 145.6 – 148.6 million per tael. DOJI and Phu Quy also reduced gold ring prices by VND 500,000 and VND 600,000 per tael respectively on both buying and selling sides.

As of 10:45 AM, Bao Tin Minh Chau, SJC, PNJ, and Mi Hong further reduced SJC gold bar prices by VND 600,000 per tael on both buying and selling sides. Currently, Bao Tin Minh Chau lists SJC gold bars at VND 145.6 – 146.6 million per tael, while SJC lists them at VND 145.1 – 146.6 million per tael.

Gold ring prices at SJC also dropped by VND 600,000 per tael on both buying and selling sides compared to the opening price, down to VND 143.4 – 145.9 million per tael. PNJ reduced gold ring prices to VND 143.5 – 146.5 million (a decrease of VND 500,000 per tael).

Updated at 9:00 AM, gold retailers significantly reduced SJC gold bar buying prices by VND 1.7 million per tael. SJC Company adjusted gold bar prices to VND 145.7 – 147.23 million per tael. Bao Tin Minh Chau reduced gold bar prices to VND 146.2 – 147.2 million per tael, and DOJI to VND 145.7 – 147.2 million per tael.

Gold ring prices also dropped sharply by approximately VND 1.2 million per tael. Buying and selling prices at SJC Company are at VND 144 – 146.5 million per tael. DOJI lists them at VND 144 – 147 million per tael. Gold ring prices at Bao Tin Minh Chau decreased by VND 1.1 – 1.9 million on both buying and selling sides, down to VND 147.9 – 150.09 million per tael.

Global gold prices are currently fluctuating around USD 4,000 per ounce (equivalent to VND 128 million per tael based on Vietcombank’s exchange rate, excluding taxes and fees), approximately VND 20 – 21 million per tael lower than domestic gold prices.

——————–

Upon opening on October 28th, some gold retailers reduced SJC gold bar and gold ring prices by VND 1 million per tael.

Previously, on October 27th, SJC gold prices had dropped by approximately VND 700,000 per tael, and plain gold rings by VND 1 – 1.5 million per tael.

Currently, SJC, PNJ, and DOJI companies are listing SJC gold bar buying and selling prices at VND 146.9 – 148.4 million per tael. Meanwhile, Bao Tin Minh Chau lists gold bars at VND 147.9 – 148.4 million per tael.

For gold rings, buying and selling prices at SJC Company are at VND 145 – 147.5 million per tael. DOJI lists them at VND 145.8 – 148.3 million per tael, and PNJ at VND 145.4 – 148.3 million per tael. Gold ring prices at Bao Tin Minh Chau are at VND 149 – 152 million per tael.

Global spot gold prices recorded at 7:00 AM (Vietnam time) were USD 3,997 per ounce, unable to return above the USD 4,000 mark after dropping more than USD 120 per ounce and losing this critical level on the evening of October 28th.

According to Kitco News, following last week’s sharp sell-off, the gold market continues to face technical selling pressure, with prices falling below USD 4,000 per ounce. While the long-term trend remains bullish, experts warn that gold prices could decline further in the short term.

According to some analysts, gold is facing additional selling pressure after the U.S. and China announced a framework agreement on trade negotiations, easing geopolitical tensions.

Fawad Razaqzada, market analyst at City Index and FOREX.com, noted: “The decline in gold prices coincides with renewed optimism surrounding U.S.-China trade negotiations. As risk sentiment improves and the S&P 500 sets records, safe-haven assets like gold become less attractive,” he said in a report.

Razaqzada believes that gold falling below USD 4,000 is not surprising, and given last week’s developments, this breach was almost inevitable. However, he emphasizes that USD 4,000 remains a critical psychological level.

“Sellers will seek a decisive break — meaning gold prices remain below this level for a sufficiently long period, not just a few days. If this occurs, it could trigger another wave of selling, especially from speculative long positions. Conversely, if gold prices stabilize around USD 4,000, it could attract ‘bottom-fishing’ investors, particularly those who missed the previous rally,” he observed.

Ole Hansen, Head of Commodity Strategy at Saxo Bank, suggests that investors may need to prepare for a new accumulation phase for gold.

“Recent price movements indicate a high likelihood that this year’s peak has been set. If a deeper correction occurs, the market may need considerable time to recover, given increasing investor caution and strengthening equities,” he said. “The reasons to hold gold haven’t disappeared — the question is whether they justify a 50% increase since the year’s start. In my view, gold’s next rally will likely be a 2026 story, especially as the recent accumulation phase starting in April has lasted four months.”

In the latest report, Chantelle Schieven, Head of Research at Capitalight, stressed that from a broader perspective, gold’s downside is limited, and this is merely a technical correction rather than a structural downtrend. “We maintain a positive long-term outlook for gold, based on persistent macroeconomic and policy risks,” she said.

SJC Gold Bar Prices Plummet by 15 Million VND in Just 2 Days

In just two days, the price of SJC gold bars in the free market plummeted by a staggering 15 million VND from its peak.

Gold Price Predicted to Drop After Hitting $5,000/oz, Experts Forecast

Our analysis team suggests that many investors will remain in the gold market even after the rally subsides, not solely due to price appreciation expectations, but because of gold’s diversification value and its role as a ‘safe haven’. This marks a distinct difference from other historical price surges.

Unlocking Gold Trading Floors to Stabilize the Market

Many economists believe that establishing a national gold trading platform is a key solution to stabilizing the gold market.