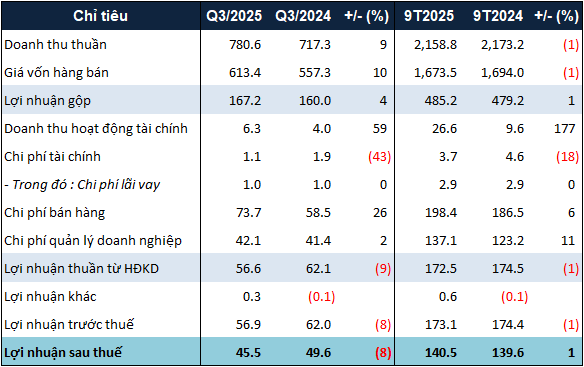

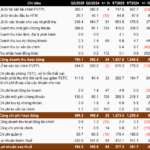

Specifically, in Q3, LIX’s net revenue reached nearly VND 781 billion, a 9% increase year-over-year. Financial revenue also rose by 59%, though its share in total revenue remained insignificant at just over VND 6 billion.

Meanwhile, both cost of goods sold and selling expenses saw notable increases, climbing 10% and 26% respectively to over VND 613 billion and nearly VND 74 billion. Administrative expenses edged up slightly by 2%, reaching more than VND 42 billion.

As a result, LIX posted an after-tax profit of nearly VND 46 billion in Q3, an 8% decline. Combined with the first half’s earnings, the company’s nine-month after-tax profit stood at nearly VND 141 billion, flat compared to the same period last year.

Against the 2025 pre-tax profit target of VND 242 billion, LIX’s nine-month performance equates to 71% completion.

|

Nine-month business results of LIX in 2025. Unit: Billion VND

Source: VietstockFinance

|

Following the release of Q3 and nine-month results, LIX’s Board of Directors announced its Q4 2025 targets. The company aims to achieve VND 915 billion in net revenue and VND 37 billion in pre-tax profit, representing a 30% revenue increase but a nearly 54% profit decline compared to Q4 2024.

Based on these Q4 targets, LIX projects full-year 2025 net revenue of VND 3,074 billion and pre-tax profit of VND 210 billion. Compared to the annual shareholders’ meeting plan, this exceeds the revenue target by 1% but falls short of the profit goal, with expected completion at approximately 87%.

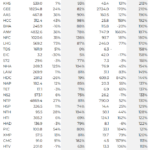

Returning to LIX’s Q3 financial statements, as of September 30, 2025, total assets stood at nearly VND 1.5 trillion, a 6% increase year-to-date. Key components such as short-term cash holdings and inventory rose significantly by 14% and 19% respectively, reaching over VND 427 billion and nearly VND 275 billion.

Total liabilities also increased by 9% to over VND 503 billion. Outstanding loans remained unchanged at VND 55 billion. However, customer prepayments and short-term payables plummeted by 62% and 86%, to nearly VND 12 billion and VND 7 billion, respectively, due to the absence of nearly VND 16 billion in dividend payables. Conversely, short-term accrued expenses surged to over VND 69 billion, five times the year-start figure.

– 11:35 27/10/2025

Long Giang Reports Return to Loss in Q3

After two consecutive profitable quarters, Long Giang Investment and Urban Development Corporation (HOSE: LGL) has reported a loss in Q3 2025.

KIS Reports 84% Surge in Q3 Net Profit, Rebounding from First-Half Slump

KIS Vietnam Securities Corporation (KIS Vietnam) reported a remarkable net profit of over VND 194 billion in Q3, surging 84% year-over-year. This impressive growth was driven by strong performance across key business segments, including proprietary trading, brokerage, and lending. The stellar Q3 results helped offset the company’s lackluster performance in the first half of the year.