|

Source: VietstockFinance

|

Buyers regained the upper hand with over 450 stocks rising compared to nearly 260 declining. This breadth indicates a market-wide bullish trend. Large-cap stocks, including VIC, VPB, VJC, FPT, TCB, VCB, MWG, HPG, STB, and BID, rebounded, contributing nearly 18 points to the VN-Index. Conversely, TCX weighed most heavily on the index, though it only deducted about 1 point. VPL and BSR followed suit.

The positive performance of large-cap stocks was reflected in the VN30-Index‘s nearly 50-point gain, reaching 1,949.28 points.

In the financial sector, several stocks saw significant gains: VPB rose 4%, SSI 3%, HDB 3.5%, VIX over 3%, HDB 3.5%, and SHS nearly 4%.

The industrial sector closed with numerous stocks hitting their upper limits. VJC maintained its impressive rise from the opening bell, continuing its recent strong performance. CTD and HAH surged toward the end of the session.

The information technology and telecommunications equipment sector led today’s gains, with VEC, DLG, POT, SMT, and FPT all rallying strongly.

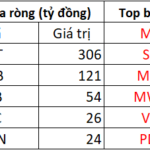

A notable highlight was the return of foreign capital, with net buying exceeding 1.4 trillion VND. Most of this inflow was concentrated in FPT. This indicates that foreign investors remain focused on technology stocks, and their capital is activated when prices are favorable.

| Foreign Net Buying/Selling Trends |

| Top 10 Stocks with Highest Foreign Net Buying/Selling on October 28, 2025 |

Morning Session: Spotlight on Information Technology

By the close of the morning session, the VN-Index settled near 1,630 points, down 23 points. Significant pressure from real estate stocks was the primary driver of this morning’s decline.

| Top 10 Stocks Impacting VN-Index in the Morning Session of October 28, 2025 (Point-Based) |

VHM, VRE, and VIC all dropped over 5%. NVL faced a similar decline. Additionally, CEO, NLG, and PDR exerted significant downward pressure on the index. With such heavy selling, the VN-Index struggled to gain traction, especially as selling dominated other sectors.

By the end of the morning, nearly 390 stocks declined, far outpacing the 230 gainers. Red dominated across sectors, suggesting the market was poised for further declines.

A rare bright spot was the information technology sector, with FPT, CMG, and ELC performing well.

Liquidity remained tight, reflecting investor caution amid a lack of positive sentiment. Morning trading volume reached 14.5 trillion VND. A positive note was foreign investors’ slight net buying, totaling over 200 billion VND.

| Top 10 Stocks with Highest Foreign Net Buying/Selling in the Morning Session of October 28, 2025 |

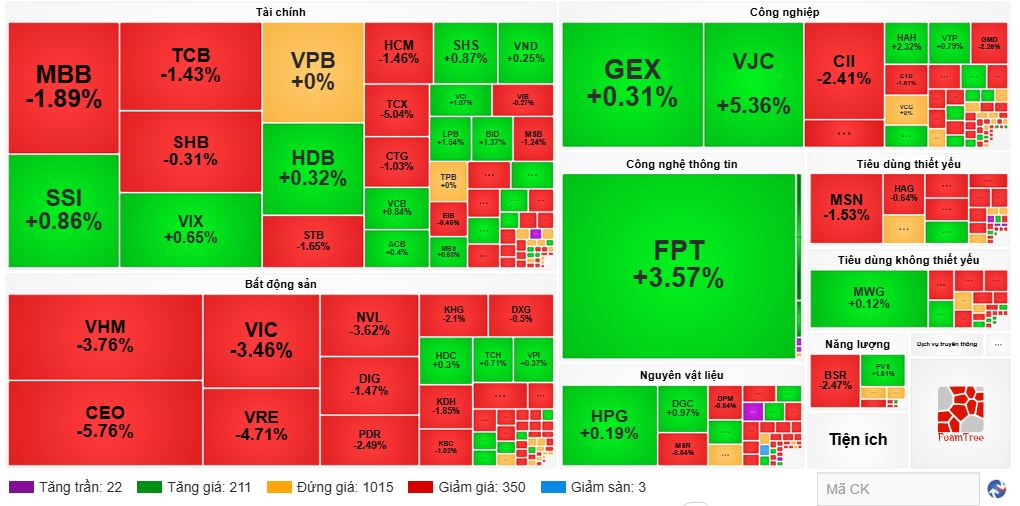

10:40 AM: Real Estate Pressure Mounts; Information Technology and Transportation Buck the Trend

By mid-session, market dynamics remained largely unchanged. As of 10:20 AM, the VN-Index was down slightly by nearly 4 points. Buying momentum edged ahead, with 300 decliners versus nearly 270 gainers.

Real estate stocks continued to weigh heavily on the index. Vingroup stocks declined sharply: VIC by 3.4%, VHM by nearly 3%, and VRE by 3.6%. Other notable decliners included CEO (down 5%), NVL (nearly 4%), and PDR (2%). VHM and VIC alone dragged the index down by over 10 points.

Not all real estate stocks were negative; some maintained gains, including DXG, HDC, VPI, and TCH.

The financial sector showed mixed performance. Decliners included MBB, TCB, SHB, VPB, HCM, STB, and TCX. Gainers were SSI, VIX, HDB, SHS, VND, and VCI.

Information technology stocks performed well in the morning session. FPT rose nearly 4%, CMG 1.4%, ELC nearly 2%, and VEC and SMT hit their upper limits.

Transportation stocks also held their ground, with gainers including ACV, VJC, HAH, PAP, PDN, VTP, DVP, VGR, CQN, and QNP.

However, compared to the opening, more sectors turned negative. Only 6 sectors gained, while 17 declined, indicating broadening selling pressure.

Market Heatmap as of 10:40 AM. Source: VietstockFinance

|

Opening: Real Estate Stocks Weigh Early

The market opened in the red, though buying and selling were relatively balanced. However, real estate stocks exerted significant downward pressure.

Real estate stocks dominated the early declines, with CEO, VHM, VIC, VRE, NVL, and NLG all dipping slightly.

By 9:25 AM, market breadth favored buyers, with 233 gainers versus 165 decliners. Positive sentiment was evident in sectors like information technology, non-essential consumer goods, and industrials. Leading stocks in these sectors posted strong gains, including VJC (up over 3%) and FPT (up 2%).

The financial sector leaned positive, though some stocks remained in the red. Gainers included SSI, VIX, SHS, MBS, FTS, VCI, and VCB. Decliners were HDB, TCB, HCM, and TCX.

– 15:35 28/10/2025

Vietstock Daily 29/10/2025: Surging Powerfully from Previous Lows

The VN-Index staged an impressive rebound after successfully testing its August 2025 lows. Short-term prospects have improved as the index broke above its 50-day SMA, while the Stochastic Oscillator also signaled a buy. If trading volume surpasses its 20-day average in upcoming sessions, the upward momentum will be confirmed.

Mastering Stock Market Adjustments: A Comprehensive Guide to Navigating 100% Equity Shifts

Although the VN-Index has yet to breach the correction threshold, a notable divergence has emerged across the entire securities sector. This phenomenon highlights a disconnect between the broader index and the sentiment within this industry, traditionally regarded as a barometer of market dynamics.

Foreign Block Continues Net Selling Spree of VND 1,200 Billion Amid VN-Index’s Sharp Decline, Focusing on Heavy Selling of “Bank, Securities” Stock Duo

In the afternoon trading session, FPT shares were the most heavily accumulated by foreign investors across the market, with a total value of 306 billion VND. Similarly, VPB also saw significant net buying activity, exceeding hundreds of billions of VND.