Nui Pho Mining and Mineral Processing LLC has announced a resolution from its Board of Members regarding personnel changes.

The Board of Members has approved the appointment of new members, effective from October 24, 2025, to September 30, 2030.

Mr. Nguyen Thieu Nam has been appointed as Chairman of the Board of Members and a board member, representing a capital contribution of over VND 6,044 billion, equivalent to 56% of the company’s charter capital.

Mr. Nguyen Van Thang has been appointed as a board member, representing a capital contribution of nearly VND 2,159 billion, or 20% of the charter capital.

Mr. Ashley James McAleese (Australian nationality) has been appointed as a board member, representing a capital contribution of nearly VND 2,591 billion, or 24% of the charter capital.

Image: Masan High-Tech Materials

Nui Pho Mining and Mineral Processing LLC operates the Nui Pho mine, a polymetallic mine located in three communes (Hung Son, Ha Thuong, and Tan Linh) of Dai Tu district (formerly), Thai Nguyen province.

The company is a wholly-owned subsidiary of Masan High-Tech Materials, specializing in the exploration, mining, and processing of tungsten, fluorite, bismuth, and copper for export and domestic sales.

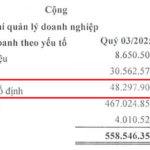

As of June 30, 2025, the company’s owner’s equity stood at nearly VND 9,318 billion, a decrease of VND 743 billion compared to the same period last year.

In the first half of 2025, the company reported a loss of over VND 166 million, an improvement from the loss of over VND 1 billion in the same period last year.

Consecutive losses have resulted in an undistributed after-tax profit deficit of nearly VND 1.5 billion.

Total liabilities as of the end of Q2/2025 were VND 13,286 billion, nearly half of the previous year’s figure. This includes bank loans of VND 3,528 billion and bond issuance debt of nearly VND 6,710 billion.

According to HNX, the company currently has 9 privately placed bond lots in the domestic market, with a total issuance value of VND 4,600 billion.

Additionally, the company has recorded nearly VND 2,121 billion in publicly offered bonds and nearly VND 3,049 billion in other payable debts.

Binh Minh Plastics to Distribute Over VND 532 Billion in Interim Dividends for 2025’s First Phase

Binh Minh Plastics is set to distribute over VND 532 billion in interim dividends for the first tranche of 2025, offering a payout ratio of 65%. The final registration date for eligibility is November 18, 2025, with payments expected to commence on December 8, 2025.

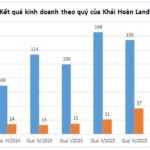

Explosive Revenue Growth: Khải Hoàn Land Achieves Remarkable Quarterly Performance

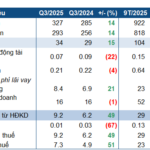

In Q3/2025, Khai Hoan Land Corporation (HSX: KHG) reported a significant surge in both revenue and profit compared to the same period last year, marking a robust financial performance.