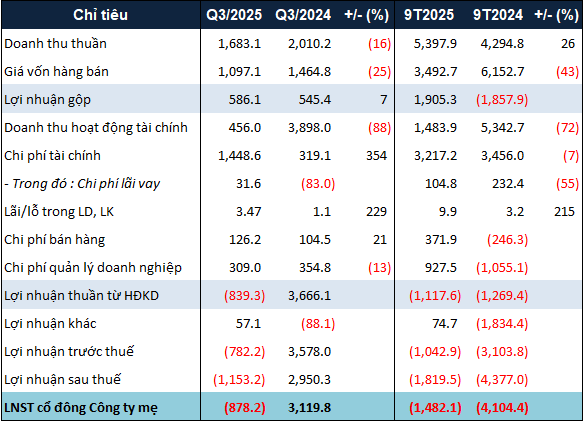

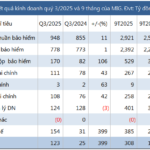

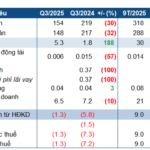

Specifically, in Q3/2025, NVL’s net revenue reached nearly VND 1.7 trillion, a 16% decline year-over-year. However, thanks to a 25% reduction in cost of goods sold, gross profit still rose by 7%, exceeding VND 586 billion.

Financial activities became a burden as revenue plummeted by 88%, generating only VND 456 billion. Meanwhile, financial expenses surged 4.5 times to over VND 1.4 trillion, driven by a VND 712 billion increase in foreign exchange losses compared to the same period last year.

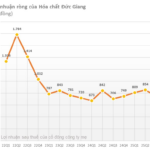

After accounting for additional expenses, NVL reported a net loss of over VND 878 billion in Q3, compared to a profit of VND 3.1 trillion in the same quarter last year. This result pushed the cumulative net loss for the first nine months to nearly VND 1.5 trillion.

A bright spot in the first nine months of 2025 for NVL was a 26% increase in net revenue, reaching nearly VND 5.4 trillion, attributed to handovers from projects such as NovaWorld Phan Thiet, NovaWorld Ho Tram, Aqua City, Sunrise Riverside, and Palm City.

|

Business results for the first nine months of 2025 of NVL. Unit: Billion VND

Source: VietstockFinance

|

According to the company, at NovaWorld Phan Thiet, the Golf Villas and Florida 3.7 sub-zones were handed over and operational in Q3. To date, 1,500 real estate products have been delivered at this project, including 750 fully furnished units now available for rent. At Aqua City, over 1,000 products have also been handed over.

Regarding land title issuance in 2025, NVL reported that as of September 30, 1,935 land titles had been issued across various projects. Notably, The Sun Avenue project has completed procedures for nearly 550 titles, with Novaland collaborating with residents to finalize registration and handover. The company is also accelerating title issuance for projects like Lucky Palace (commercial lots), Orchard Garden (Office-tel), Sunrise City North (Office-tel), and GardenGate.

As of September 30, 2025, NVL’s total assets stood at nearly VND 239.6 trillion, unchanged from the beginning of the year. Short-term cash holdings decreased by 16% to nearly VND 3.9 trillion. Short-term receivables fell by 18% to over VND 45 trillion, due to the absence of VND 5.1 trillion in receivables from equity transfers. Conversely, the company recorded VND 102 billion in long-term receivables from joint venture investments in project development.

Similar to total assets, total liabilities remained largely unchanged from the start of the year, at nearly VND 189 trillion. However, outstanding debt increased by 4% to nearly VND 64.3 trillion, driven by higher bank and third-party borrowings. Meanwhile, long-term payables from joint venture investments declined by 40% to VND 24.2 trillion.

– 13:16 28/10/2025

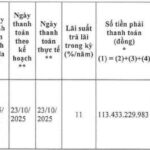

Novaland Delays Repayment of Nearly VND 113 Billion in Bond Principal

Novaland has delayed the repayment of over VND 112.8 billion in principal for the bond issuance NVLH2123007 due to insufficient payment arrangements.